October 2022 was a month of almost balanced FII activity. Starting the month with a shopping spree of about $905 million and ending the month with a sell-off of $904 million. Literally feels like one of those MBA balance sheet questions where things have to be equated on both ends of the spectrum.

Jokes aside, it is interesting to note that even in a month when overall the FIIs haven’t really added much to the investments all indices show an upswing. It’s now a much-abused point of chest beating pride that domestic investors are finally stepping up into the game, but so far it does seem that they have a stabilising effect on the market.

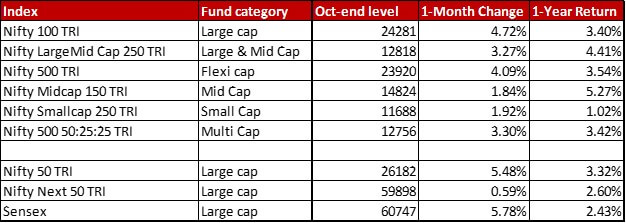

This month though, Large Caps have led the charge with bigger strides although Mid and Small Cap haven’t lost on any gains either. Check out the movement of market cap based indices last month. While all other indices are in TRI or Total Returns Index mode (meaning stock dividends add to the returns), Sensex is plain jane Sensex.

Some points that popped out as I was working on the analysis.

One, unlike last month where active funds seemed to really have their moment in the sun, this month is yet another mixed bag. In each category, the tug between the benchmark and the active funds is almost in balance.

Two, Axis Bank has been a standout stock with 23{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} gains last month on the back of a stellar quarterly result. This has resulted in the stock allocation going substantially up in quite a few funds, often less and sometimes even more than just the price movement.

Three, last month saw two demergers which again reflect in quite a few portfolios. NMDC Steel was split from NMDC Limited while Aarti Pharmalabs came out of Aarti Industries. Hence, many funds now sport these new ISIN’s.

Four, apart from these Mindtree figured quite a bit in new stock allocations while Dr. Reddy’s featured a little higher on the exit side.

Check out how the portfolios of the top 10-by-AUM funds in different categories stack up against each other.

In case, you are curious what brought about this segment on the blog or how is this analysis even being done, then check out the introduction post where I go into all those details.

You could also check out all the other previous months of analyses – September 2022, August 2022, July 2022, June 2022, May 2022, April 2022, March 2022, February 2022, January 2022, December 2021, November 2021 and October 2021.

Leave a Reply