Before I start off on any analysis in this segment, even at the cost of a repetitive bore I will put forth this disclaimer. All fund schemes are taken as direct. However, even if you are a direct investor, hire a financial advisor that you trust who can guide with investments. Pay for your advice.

Fund category definition: Funds with minimum 80{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} portfolio allocation to Large Cap (top 100 by market cap size) stocks

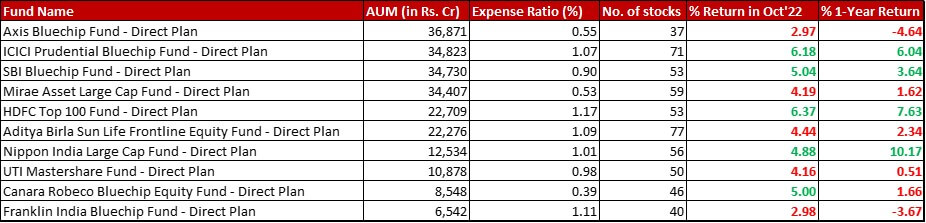

Benchmark: BSE 100 TRI or Nifty 100 TRI with latter changing by 4.72{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in October 2022 and a 1-year change of 3.40{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}

Data as on: 31st October, 2022

Summary

For long the battle for AUM rankings has been very intense in the second to fourth spot between SBI, Mirae and ICICI. This month, ICICI has moved from the fourth right on to the second while the other two have pushed back one spot each.

Three funds have slightly noteworthy change in expense ratios – Mirae and Franklin India have increased their expense ratios by 3 basis points each while UTI has reduced it’s expense ratio by the same magnitude of 3 basis points.

The month’s score card is perfectly balanced with five funds in the red and five in the green. In terms of one year return, Canara Robeco is the only fund to be green for last month but red for the past year.

The only perceptible movement in number of stocks is noticeable in Franklin where the holdings have increased by 3.

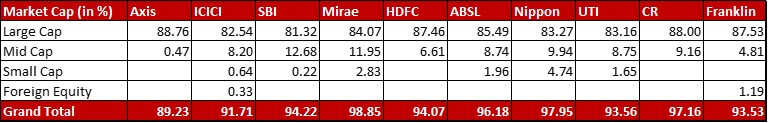

Market Cap Allocation

Nippon has increased it’s Large cap allocation by about 2{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}, trimming a bit of Mid and Small caps and increasing overall allocation slightly.

UTI too has gone ahead and increased it’s Large Cap allocation by 3.14{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} which mostly reflects in an increased equity exposure.

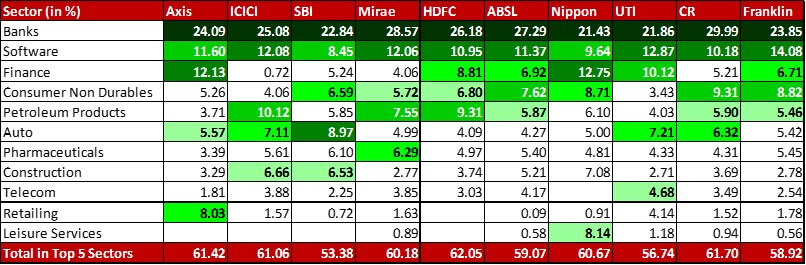

Top 5 Sectors

There is an organic switch between Consumer Non Durables and Auto in Axis, with the latter replacing the former in the Top 5 Sectors.

With minor magnitude of trim in Cipla and doubling of allocation in DLF, Construction has overthrown Pharma for the sectoral spot in the ICICI fund.

Mirae sees an organic swap between Consumer Durables and Consumer Non Durables, with the latter making the cut this month.

UTI has completely exited it’s 0.53{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} allocation to Dr. Reddy’s which has resultantly led to Pharma being replaced by Telecom in the top 5 sectors.

Franklin has a few changes up it’s sleeve. Pharma and Petroleum products have had an organic switch with the latter sneaking in. There seem to be more intentional changes in Finance and Insurance. In Finance, the fund has increased it’s allocation to HDFC Limited by a whopping 1.71{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} taking it up to 4.62{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}, as well as added on a new 0.33{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in Cholamandlam Investment and Finance. On the other hand, while it has added a 0.40{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in ICICI Lombard, overall Insurance allocation is down with a 0.92{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} trim in SBI Life Insurance. Hence, Finance edges it’s way into the Top 5 Sectors beyond Insurance.

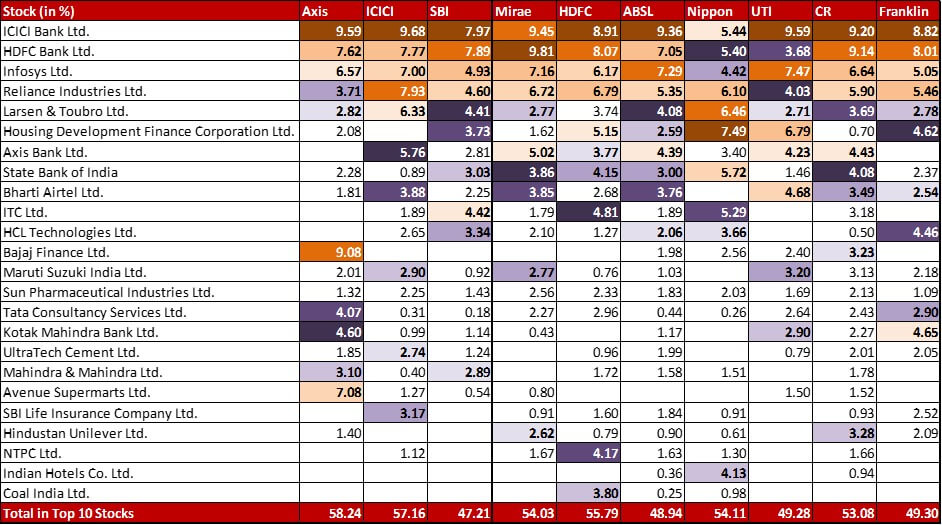

Top 10 Stocks & Movements

Thanks to the 23{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} stock price increase, the Axis Bank allocation in ICICI fund is up by a substantial 0.81{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to now be at 5.76{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. The fund has three exits as well – NMDC (0.18{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), US stock Conoco Phillips (0.14{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Gland Pharma (0.09{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) after a short one month stint. To balance it out, there are four new entrants – HPCL (0.12{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Zee Entertainment (0.11{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), MphasiS (0.09{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and NMDC Steel (0.03{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). I suspect the last one is more by accident whereby the fund still had some remnant of the parent company on the day of the demerger recording.

SBI has exited Coal India (0.55{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

HDFC has substantially trimmed Coal India by 0.88{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} (now down to 3.80{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). The fund has also exited Dr. Reddy’s Labs (0.27{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and IOCL (0.14{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). The fund has added a new 0.38{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position to SRF.

Aditya Birla has an increased allocation to Infosys by 0.86{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}, now up to 7.29{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. This fund too has exited IOCL (0.27{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) while adding a minute position in Mindtree (0.06{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

Nippon has exited two of it’s positions – Triveni Turbine (0.28{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Sapphire Foods (0.25{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), the latter after a mere three months.

UTI has made two changes in it’s banking allocation – increased it’s Axis Bank position beyond the price increase by 0.97{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} (to go up to 4.23{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) while simultaneously cutting down the SBI position by 0.79{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} (bringing it down to 1.46{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). Maruti Suzuki also sees a beefed up allocation by 0.83{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to touch 3.20{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. The fund has two exits – Dr. Reddy’s Lab (0.53{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and ITC (0.98{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). Two new stocks have made their way to the portfolio – Ultratech Cement (0.79{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Mindtree (0.77{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

It’s a quieter month for Canara Robeco. The fund too has increased it’s allocation in Axis Bank beyond the racy stock price, by 1.03{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}, taking it up to 4.43{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

Franklin probably has the maximum changes this month. Beyond the changes mentioned above, two more stocks each see meaningful turns in their allocation. L&T has been beefed up by 1.62{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} (now at 2.78{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Bharti Airtel is up by 0.91{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} (now at 2.54{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). The fund has trimmed it’s position in HDFC Bank by 1.10{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} (down to 8.01{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and in TCS by 0.99{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} (down to 2.90{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). There is just one exit, that of 0.89{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} from HDFC AMC after a 5-month stay. Beyond the two new stocks mentioned above, the fund has also added Jubilant Foodworks (0.56{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

Check out the other categories and what the funds there were up to:

Flexi Cap Funds – October 2022

Multi Cap Funds – October 2022

Leave a Reply