Before I start off on any analysis in this segment, even at the cost of a repetitive bore I will put forth this disclaimer. All fund schemes are taken as direct. However, even if you are a direct investor, hire a financial advisor that you trust who can guide with investments. Pay for your advice.

Fund category definition: Funds with minimum 35{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} portfolio allocation to Large Cap (top 100 by market cap size) stocks and 35{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} allocation to Mid Cap (101-250 by market cap size) stocks. Remaining 30{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} is as per fund management.

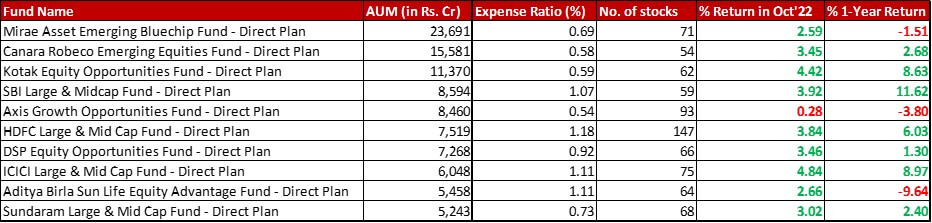

Benchmark: Nifty LargeMid Cap 250 TRI with a change of 3.27{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in October 2022 and a one-year return of 4.41{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

All data as on: 31st October, 2022

Summary

In terms of ranking, SBI has beaten back Axis to go up to the fourth spot. The latter might be taking a beating thanks to it’s foreign equity portfolio.

While most funds have kept it under the 3 additional stock mark, DSP has increased its portfolio by 4 stocks to go up to 66.

As for performance, Axis remains the only one in red for last month. When it comes to 1-year performance, this month only 3 funds are in the red unlike the six last month – Mirae, Axis and Aditya Birla.

Market Cap Allocation

Kotak has increased it’s allocation to Large Cap stocks by about 2.06{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}, taking the overall equity exposure up to 96.44{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

SBI has substantially increased it’s total equity exposure with a 3.91{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} increase in Large Cap and more than doubling its’ foreign equity exposure to 3.30{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

ICICI is another fund to have increased it’s Large Cap allocation (by 2.12{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and overall equity allocation.

Aditya Birla follows suit with a 2.63{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} increase in it’s Large Cap allocation, resultantly increasing it’s total equity exposure.

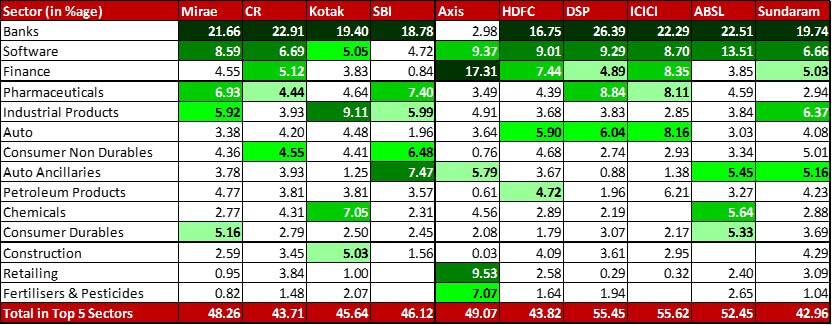

Top 5 Sectors

In Canara Robeco, there is an organic swap between Chemicals and Pharma, with the latter making it to the top 5 sectors.

Kotak sees an organic swap between Construction and Industrial Capital Goods, with the latter making it’s way back to the Top 5 Sectors this month.

While there is no additional stock, SBI has increased it’s allocation to Banks by a whopping 4.47{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}, making it an even stronger top sector in the fund.

The ping pong between Consumer Non Durables and Petroleum products in HDFC continues, with the latter making it’s way in this month.

With a 0.96{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} increase in the Maruti Suzuki allocation, Auto sees a substantial increase in ICICI to edge out Telecom.

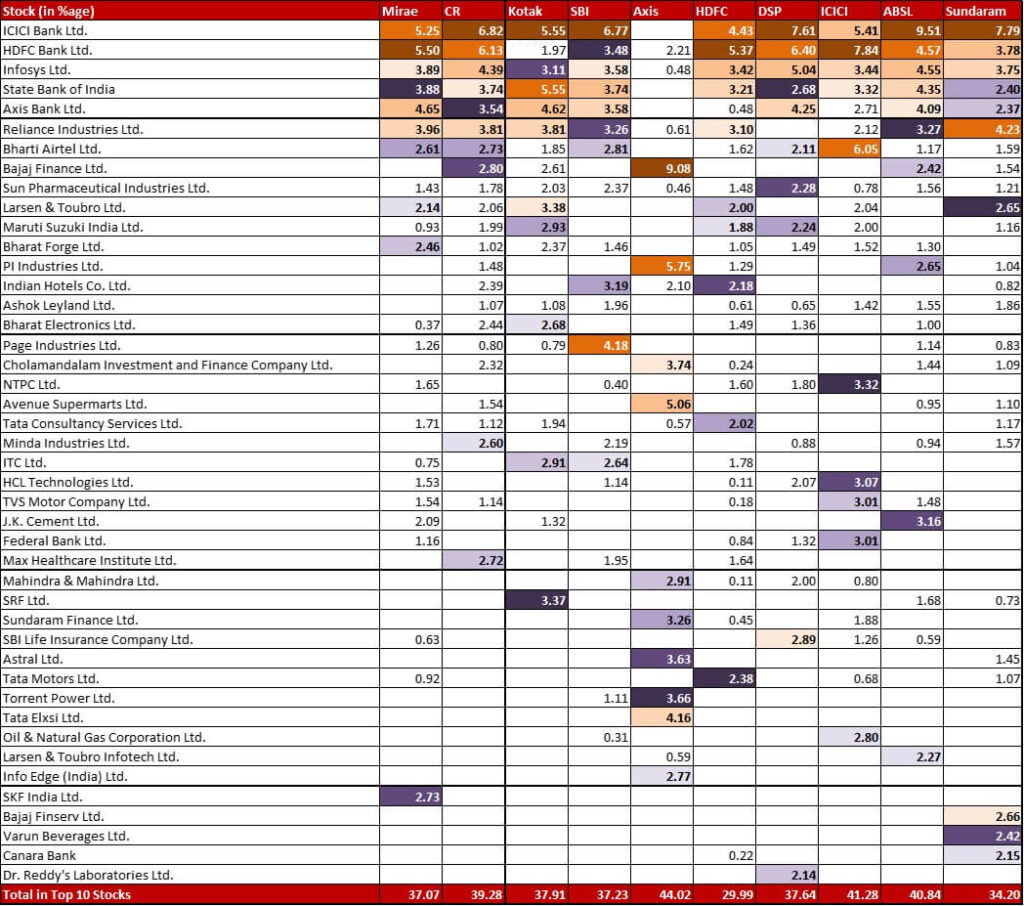

Top 10 Stocks & Movement

Mirae has exited from it’s 0.24{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in BPCL. Additionally, it has a new 0.51{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in Mindtree.

Kotak sees a big jump of 1.14{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in it’s Axis Bank allocation, which is more than the 23{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} stock price increase as well. The fund has two new additions – Tata Chemicals (1.20{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and BEML Land Assets (0.08{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

As mentioned in the sectoral changes, SBI has increased it’s allocation to Banking substantially. There is a massive increase in it’s allocation to Axis Bank, more than tripling it from 1.10{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to 3.58{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}! The parent bank SBI sees a 1.23{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} increase in allocation (up to 3.74{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and ICICI Bank is also up by 0.97{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} (now at 6.77{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). The fund also boasts of three new additions – Invesco QQQ Trust Series 1 (1.46{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) which is a mutual fund investing in Nasdaq 100 and responsible for doubling the fund’s foreign equity allocation, ACC (0.81{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and NMDC Steel (0.33{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

Axis has hacked off 1.00{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} from an erstwhile favourite stock Tata Elxsi, bringing it down to 4.16{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

HDFC has increased it’s allocation to the parent bank HDFC Bank by 0.92{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} taking it up to 5.37{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. The fund also has three new additions – DCX Systems (0.66{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Aarti Pharmalabs (0.02{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Ajanta Pharmaceuticals (0.02{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

DSP has four new additions – Kotak Mahindra Bank (1.06{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Century Plyboards (0.60{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Pfizer (0.35{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Ambuja Cements (0.12{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

It’s a quieter month for ICICI, which has exited from it’s 0.20{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in Karur Vysya Bank. The fund also has three new additions – SAIL (0.31{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Hero Motocorp (0.25{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Delhivery (0.17{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

Aditya Birla has fortified it’s allocations in Infosys by 1.39{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} (zooming up to 4.55{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and to Axis Bank by 0.90{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} (now at 4.09{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). The fund has trimmed it’s position in Crompton Greaves Consumer Electricals by 1.09{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} (down to 1.37{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). There are three exits this month – ICICI Lombard (0.48{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Whirlpool (0.23{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Syngene International (0.07{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). There are also three new additions – Bharat Forge (1.30{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Aarti Pharmalabs (0.12{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Devyani International (0.01{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

Sundaram has just one exit this month – Gland Pharma (0.68{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). The fund also has three new additions – Indian Hotels (0.82{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), United Breweries (0.76{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Triveni Turbine (0.28{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

Check out the other categories and what the funds there were up to:

Large Cap Funds – October 2022

Flexi Cap Funds – October 2022

Leave a Reply