Before I start off on any analysis in this segment, even at the cost of a repetitive bore I will put forth this disclaimer. All fund schemes are taken as direct. However, even if you are a direct investor, hire a financial advisor that you trust who can guide with investments. Pay for your advice.

Summary

This is personally one of my favourite fund categories. I have often been caught saying like an ad salesperson – stability of large cap, growth potential of mid caps.

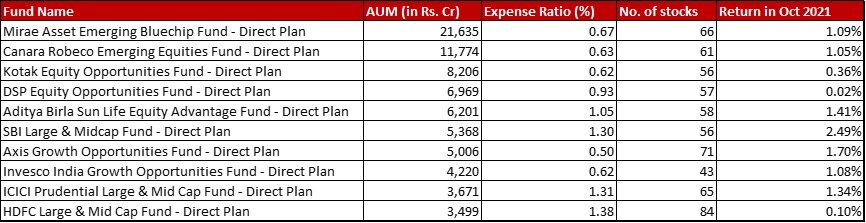

But, when you look at the AUMs, you will see it’s not much of a favourite of investors apart from Mirae. In fact, it really is Mirae Emerging Bluechip which first got the AMC much popularity Even now investors with high value SIP refuse to let go of it, concentration risk be damned.

The one AUM movement that has happened is that HDFC Large & Mid Cap fund has now come into the Top 10, edging out Nippon Growth fund.

The benchmark Nifty LargeMid Cap 250 TRI grew by 0.29{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in October 2021. Of the top 10 funds, only DSP and HDFC failed to match it while other funds did better.

Market Cap Allocation

For me, Axis remains a surprise here. In my understanding, the Large & Mid Cap funds are mandated to have a minimum 35{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} allocation to Large Caps and Mid Caps. I have always understood this to mean domestic stocks. However, for the second consecutive month I see the Large Cap number surprisingly low at 18.33{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

Within the other funds, SBI Large & Mid almost acts as a multicap with a 20{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} allocation to small caps.

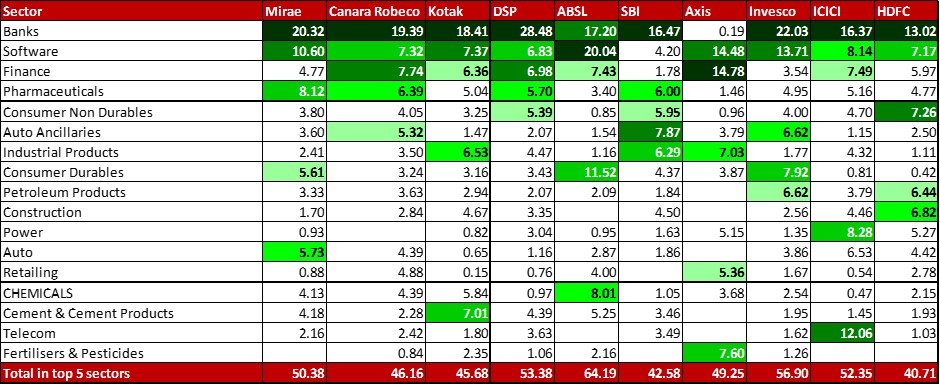

Top 5 sectors

Banks and Software remain the two favourites for the fund category. However, Axis doesn’t really seem to favour banks that much. They have thrown in more of their weight to NBFCs mostly via Bajaj Finance.

In the second biggest sector, the story is even more interesting. For SBI it is auto ancilliaries while for ICICI it is Telecom with the top stock being Bharti Airtel and some allocation in Tata Communications. In fact, for ICICI the third sector is power through NTPC and CESC.

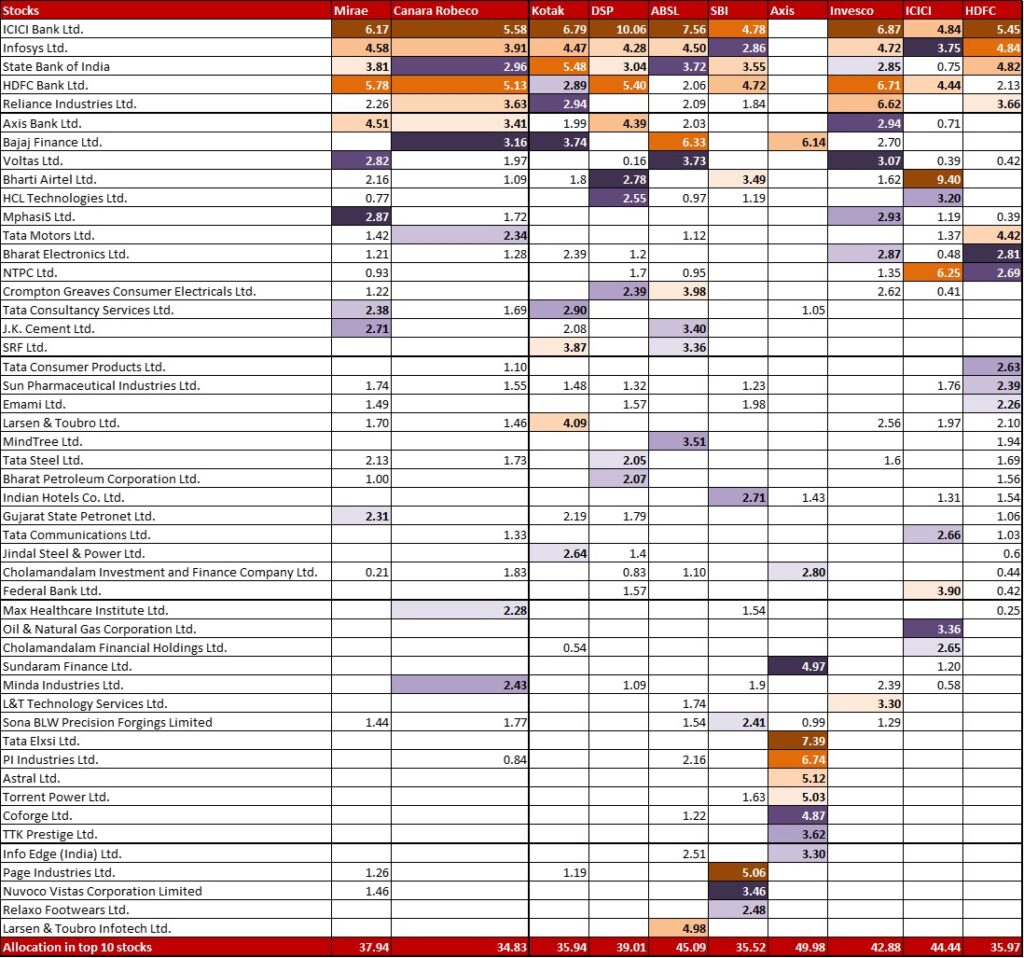

Top 10 stocks

If you are looking for uniqueness, then Axis has to be right up there in this category. Apart from Bajaj Finance in it’s kitty, most of the other top 10 stocks don’t seem to find much favour with other funds.

Most of the clustering remains prevalent in the usual suspects – ICICI Bank, Infosys, SBI, HDFC, Reliance, Axis Bank and Bajaj Finance. These stocks make their way in the top 10 for four or more of the funds.

Leave a Reply