The tables turned slightly in November 2022 with FIIs being in the green (showing Rs. 22,546 Crore net purchase) and DIIs being in the red (having a cumulative show of Rs. 6,301 Crore). This shows in all the market cap based indices gleaming in green.

However, it has been an intensely polarised rally. The funds either have it or they don’t. The it here being the stocks that led the charge on the rally. In fact, most funds ended up lagging the benchmark and red was the favoured colour for performance metrics this time.

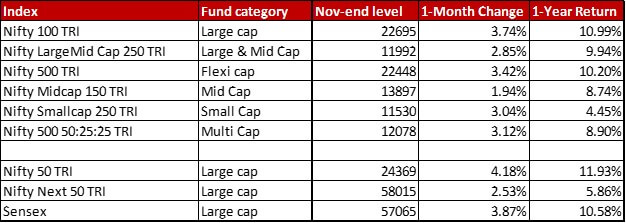

This month yet again, Large Caps are leading from the front with the biggest gains reflecting in Nifty 50. Check out the movement of market cap based indices last month. While all other indices are in TRI or Total Returns Index mode (meaning stock dividends add to the returns), Sensex is plain jane Sensex.

Some points that popped out as I was working on the analysis.

One, there are two big mergers which reflect in many portfolios although the resultant entities are yet to be listed. With L&T Infotech acquiring MindTree, the latter’s shares have been merged with the former. The Shriram Finance consolidation can also be seen with the shares of Shriram City Union Finance and Shriram Capital merging with that of Shriram Transport Finance.

Two, a plethora of IPOs listed on the bourses last month. Some were already a part of funds as unlisted stocks for the last one or two months. Many bought them in this period. The most popular of these stocks were Global Health, Archean Chemical Industries, Fusion Micro Finance, Kaynes Technology and Bikaji Foods.

Three, this is the month that the L&T mutual funds merged into HSBC India. This shows in the HSBC India fund coming up from 11th to 9th in Mid Cap and moving one spot up in Small Cap categories.

Check out how the portfolios of the top 10-by-AUM funds in different categories stack up against each other.

In case, you are curious what brought about this segment on the blog or how is this analysis even being done, then check out the introduction post where I go into all those details.

You could also check out all the other previous months of analyses – October 2022, September 2022, August 2022, July 2022, June 2022, May 2022, April 2022, March 2022, February 2022, January 2022, December 2021, November 2021 and October 2021.

Leave a Reply