Before I start off on any analysis in this segment, even at the cost of a repetitive bore I will put forth this disclaimer. All fund schemes are taken as direct. However, even if you are a direct investor, hire a financial advisor that you trust who can guide with investments. Pay for your advice.

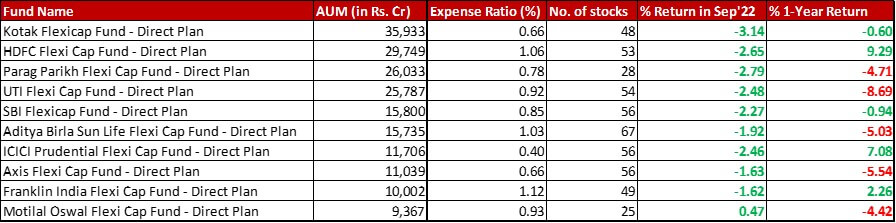

Fund category definition: Funds with no restriction on market cap allocation or number of stocks

Benchmark: Nifty 500 TRI with a change of -3.21{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in September 2022 and a 1-year change of -0.22{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}

Data as on: 30th September, 2022

Summary

Once a fund starts piquing investor imagination, then there is really no looking back for quite a length of time. This shows very clearly in the case or Parag Parikh Flexi Cap fund which this month inched up to becoming the third biggest in the category.

Two funds have also increased their expense ratio – ICICI by 5 bps to reach 0.40{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} while Aditya Birla has taken a bigger increase of 12 bps to breach the 1{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} mark and settle in at 1.03{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

Motilal Oswal has also used it’s trimming scissors to take the number of stocks from 29 to 25, making it an even more concentrated bet.

September turned out to be a month of unilaterally beating the benchmark, although that number drops to 50{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} funds in case of the 1-year performance.

Market Cap Allocation

Parag Parikh shows a reduced allocation to Foreign Equity by almost 2{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to go below the 20{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} mark.

ICICI and Motilal Oswal have both reduced their Large Cap allocation by about 2{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. While ICICI has redistributed it within Small and Mid cap, Motilal Oswal has mostly kept it to the latter.

Top 5 Sectors

There are very few changes in the sectoral allocation yet again.

In Franklin, Telecom and Cement continue to organically keep playing for a place in the top 5 sectors with the former finding a spot this month.

Motilal Oswal has heftily raised the allocation of Bajaj Finance from 2.70{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to 7.40{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}, which shows in Finance allocation moving up from 8.98{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to 13.14{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

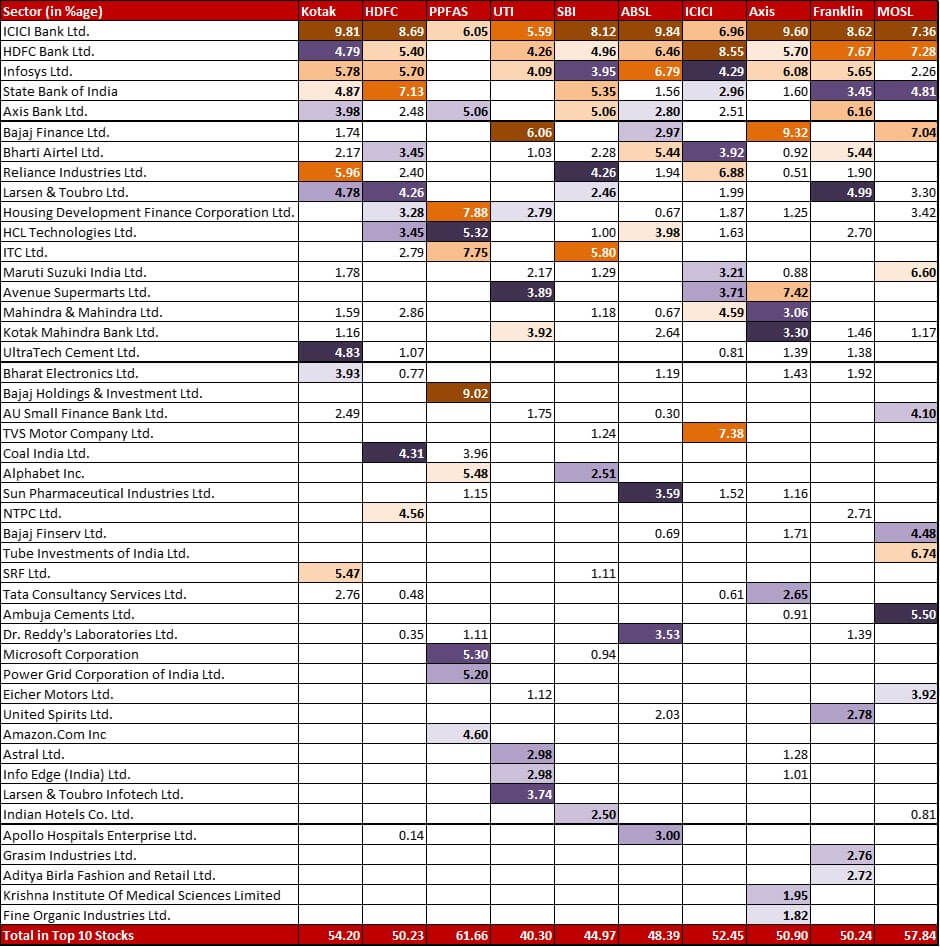

Top 10 Stocks & Movements

HDFC continues with it’s strategy of sweeping changes. There is a substantial allocation increase in four stocks – Mahindra & Mahindra (by 1.46{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), SBI Life Insurance (by 1.33{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), ICICI Bank (by 0.82{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and HCL Tech (by 0.82{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). Three stocks have also seen a substantial drop – ITC (by 1.81{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), TCS (by 1.69{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Power Finance Corp (by 0.86{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). HDFC has also added 4 new stocks to it’s fray – Tech Mahindra (1.45), Dr. Reddy’s Lab (0.35{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Apollo Hospitals (0.14{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and BEML Land Assets (0.16{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). While Sun Pharma (0.84{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Aurobindo Pharma (0.37{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Power Grid (0.32{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) find themselves out.

Parag Parikh Flexi Cap has increased it’s position in Bajaj Holdings & investments by 1.29{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} taking it up to 9.02{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to be the largest stock.

SBI has fortified it’s position in Axis Bank, increasing allocation by 2.05{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to take it up to 5.06{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. On the other hand, Cholamandlam Investment and Finance has been cut down to it’s mere shadow with a trim of 1.14{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}, landing at a measly 0.18{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. The fund has taken a new 1.01{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in GR Infra Projects, while exiting Tata Steel (1.11{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) in a mere two months.

Aditya Birla has added four new stocks – Mahindra & Mahindra (0.69{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Bajaj Finserv (0.67{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Bandhan Bank (0.23{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Fortis Healthcare (0.15{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). On the other hand, there is a string of exits – Bajaj Finserv (0.68{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), LIC (0.33{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) after four months of listing, L&T (0.26{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) in five months, ACC (0.20{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Dishman Carbogen Amcis (0.14{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

ICICI has yet again trimmed it’s position in Mahindra & Mahindra, this time by 2.59{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to bring it down to 4.59{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}, from fifth highest to third highest stock. The fund has two new tiny allocations – HDFC Life Insurance (0.27{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Zomato (0.21{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

Axis has minor changes. There are two exits – Motherson Sumi (0.28{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Coforge (0.29{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) while adding a new stock of RHI Magnesita (0.15{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

Franklin has exited it’s 0.17{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in Karur Vysya bank.

If you thought all the changes mentioned above seemed small and inconsequential, then you have come to the right fund. Motilal Oswal seems to have been in full turbo mode last month. Apart from the big increase in Bajaj Finance mentioned in the sectoral analysis, they have also raised their position in Ambuja Cements (by 3.99{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Bajaj Finserv (by 2.69{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Tube Investments (by 1.37{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). However, it is the list of hefty exits that is truly astounding – Reliance (5.21{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Ultratech Cement (3.17{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), ICICI Lombard (1.36{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Voltas (0.29{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). Personally, I find these many changes in a fund in one month truly disconcerting. Almost makes me feel like the fund management doesn’t have faith in it’s own choices. For some investors though, this also signals more of a nimble fund. The jury of course remains out.

Check out the other categories and what the funds there were up to:

Large Cap Funds – September 2022

Multi Cap Funds – September 2022

Large & Mid Cap Funds – September 2022

Leave a Reply