Before I start off on any analysis in this segment, even at the cost of a repetitive bore I will put forth this disclaimer. All fund schemes are taken as direct. However, even if you are a direct investor, hire a financial advisor that you trust who can guide with investments. Pay for your advice.

Fund category definition: Funds with no restriction on market cap allocation or number of stocks

Benchmark: Nifty 500 TRI with return of 2.42{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in December 2021

Data as on: December 31, 2021

Summary

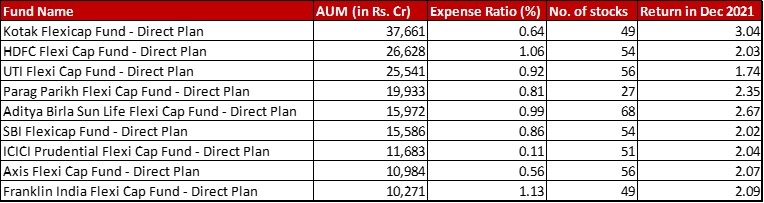

Flexi cap funds remain a highly varied category, although this month the returns were mostly in a narrow range. As for AUM wise ranking, there’s no change. However, since I have been unable to see the portfolio disclosure on Motilal Oswal site, I have simply eliminated the fund from the review this month.

Most funds under performed the index yet again, with the only two exceptions being Aditya Birla and Kotak. Although it is crucial to remember that Axis, UTI, Parag Parikh and ICICI fell lesser than the benchmarks’ tumble of -2.83{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} last month. Since the fall was lesser, overall it’s not a big issue that they did not rise or in fact cover up for that loss, as much as the benchmark did.

In three cases, the expense ratio has seen a reduction – 0.06{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} for HDFC, 0.08{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} for UTI and who thought even a low expense ratio like 0.16{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} for ICICI could be slashed further to 0.11{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}! That is in fact lower than quite a few index funds as well.

As for the number of stocks, there is barely any noticeable change.

Market Cap Allocation

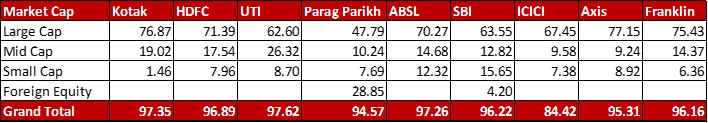

The major change in the market cap allocation is in Kotak Flexi cap where Large cap allocation has moved up from 69.72{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to 76.82{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}! In terms of stocks that make up this category for the fund, Lupin has been shown the door while Bharat Electronics and SRF have been added.

Within equity exposure also, there is barely any shift. This includes even for ICICI Prudential Flexi Cap which hasn’t moved up much to stay at 84.42{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

Top 5 sectors

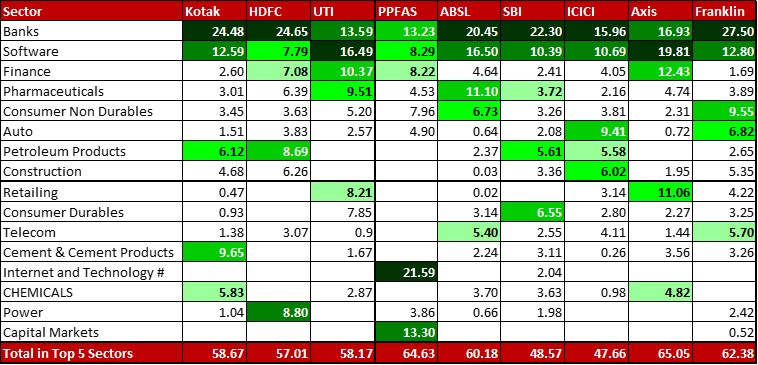

Banking continues to dominate the sectors. However, in Axis the small gap between Banks and Software has been bridged making the latter the dominant sector. This has been aided amply by the super high valuations of the sector and addition of Mphasis and Rategain Travel Technologies.

With respect to Finance, SBI has a big change with a complete exit of their 1.43{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} allocation in SBI Cards and Payments. Now, that’s quite a change.

Within petroleum products, while Axis used to hold a 1.83{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} allocation in Reliance, that is a position that’s been completely exited.

There is another change in terms of composition for Axis. The fifth largest sector is now Chemicals although the margin still remains wafer thin between this and Auto ancilliaries. Within chemicals, the allocation to Pidilite has increased by 0.32{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} and there is a tiny tiny addition with Privi Specialty Chemicals.

They have also brought down their allocation in Cement substantially by completely exiting their 1.14{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in JK Laxmi cement.

Top 10 stocks

ICICI Bank and HDFC Bank remain the most popular stocks featuring in the top 10 list of nine funds each. There is not much of any earth-shattering movement in terms of the top 10 stocks in Flexi cap funds.

Leave a Reply