Before I start off on any analysis in this segment, even at the cost of a repetitive bore I will put forth this disclaimer. All fund schemes are taken as direct. However, even if you are a direct investor, hire a financial advisor that you trust who can guide with investments. Pay for your advice.

Fund category definition: Funds with minimum 65{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} portfolio allocation to Small Cap (251 and beyond by market cap size) stocks

Benchmark: Nifty Small Cap 250 TRI with a change of 0.57{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in April 2022 and a 1-year return of 31.74{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}

All data as on: 29th April, 2022

Summary

It’s a mixed score card this month with exactly half the funds beating benchmark and half of them not. The good news is that when looking at the one-year performance the benchmark beating number goes up to 8.

There is no change in the AUM ranking.

In terms of Total Expense Ratio, Axis has raised it by quite a bit from 0.35 to 0.46. Franklin also sees a hike from 1.05 to 1.10.

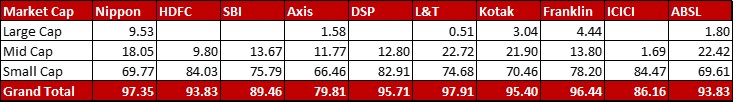

Market Cap Allocation

Axis goes one step further to increase it’s cash by cutting down equity exposure with a further 2-odd{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} trim. Now, it is in the sub-80{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} level of equity, touching 79.81{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

ICICI is another cash lover with a more than 6{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} shave-off (mostly in Small cap) to go down to 86.16{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. This follows a 5{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} cut in equity exposure last month itself.

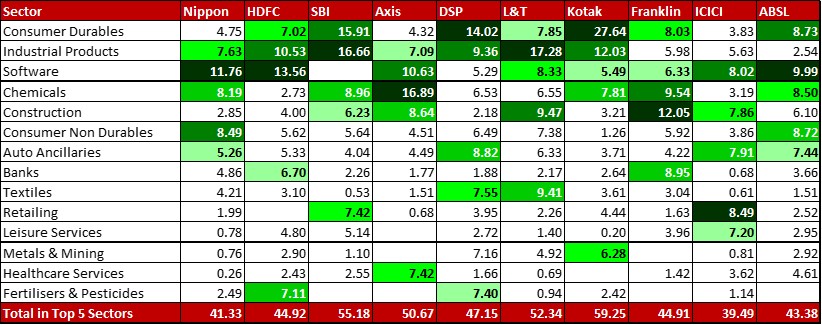

Top 5 sectors

Software has seen a reduction in most funds, especially Axis and ICICI where reduction is more than 2{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

In Nippon, Auto ancillaries has edged out Industrial Capital Goods mostly organically led by a 14{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} price increase in Tube Investments of India.

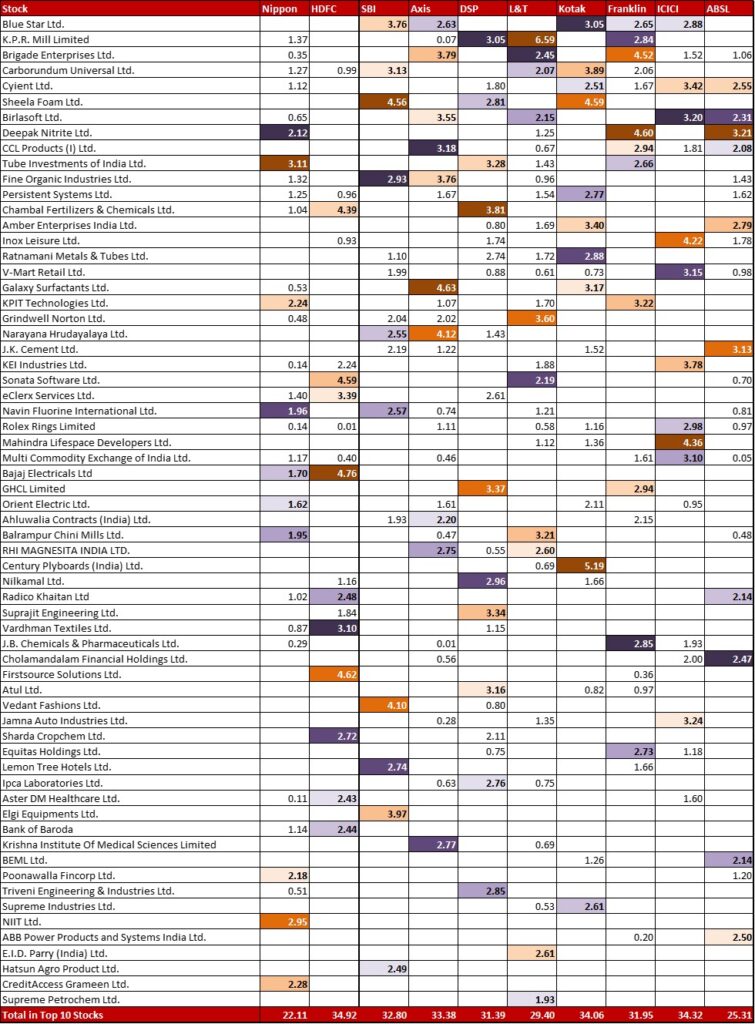

Top 10 Stocks & Movement

Nippon, despite being a Small Cap fund, has a new 1.19{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} allocation to HDFC Bank.

HDFC has cut down it’s exposure to Persistent Systems to less than half by trimming it 1.46{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

Axis seems to have booked some profits from it’s allocation in Tata Elxsi, which sees a reduction of 2.28{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}, taking it down to 1.90{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

Franklin has reduced it’s allocation to Brigade Enterprises by 0.80{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} making it slip from the first to the second spot with 4.52{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

In a bid to increase it’s cash levels, there are quite a few changes to note in ICICI. A 1.05{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} reduction in V-Mart Retail making it slip from the fourth to the seventh spot and complete exits from Persistent Systems (1.65{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Metropolis Healthcare (1.45{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

Adiyta Birla sees a 0.95{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} cut in it’s allocation to Cyient, leaving it at 2.55{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

Check out the other categories and what the funds there were up to:

Leave a Reply