Before I start off on any analysis in this segment, even at the cost of a repetitive bore I will put forth this disclaimer. All fund schemes are taken as direct. However, even if you are a direct investor, hire a financial advisor that you trust who can guide with investments. Pay for your advice.

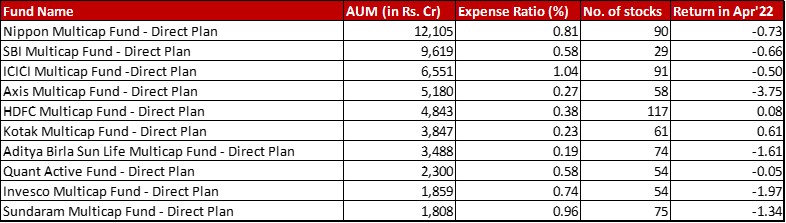

Fund category definition: Funds with minimum 25{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} each in Large, Mid and Small cap stocks

Benchmark: Nifty 500 50:25:25 TRI with change of -0.23{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in April 2022 and a one-year return of 23.70{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}

Data as on: 29th April, 2022

Summary

I love the idea of this fund because it just gives quite a balanced exposure to all market caps. In my view, especially for beginners who do not want too many funds, this can fulfil so many needs like growth as well as stability.

Since it is still a recent category, funds are of two types – either those that changed the stripes of existing funds or new launches in the past few months or a year. Hence, for the next few months I won’t include a 1-year performance for the funds in this category.

There isn’t any change in the AUM ranking as compared to the last month. Neither have any of the expense ratios changed in a way that merits any mention.

In terms of the April performance, HDFC, Kotak and Quant are the only three funds to have fallen less than the 0.23{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} of the index.

As for the number of stocks, SBI which is still in it’s infancy went for 7 chunky purchases. Axis and Quant matched the number adding 7 stocks each to their portfolios too although the magnitude of those buys would have been smaller.

Market Cap Allocation

In it’s first full month in the market, SBI went from 48{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to 71{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}, a big jump of 23{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} while the stock tally increased only by 7. Axis has also gradually increased it’s equity exposure by about 8{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} with an increase in number of stocks by 7. Quant has also increased it’s allocation by 5-6{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} with 7 additional stocks to go up to 99{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}+.

Also, while the linked index is Nifty 500 50:25:25, Axis, HDFC and Quant are closest to the 50{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} mark in Large Cap allocation.

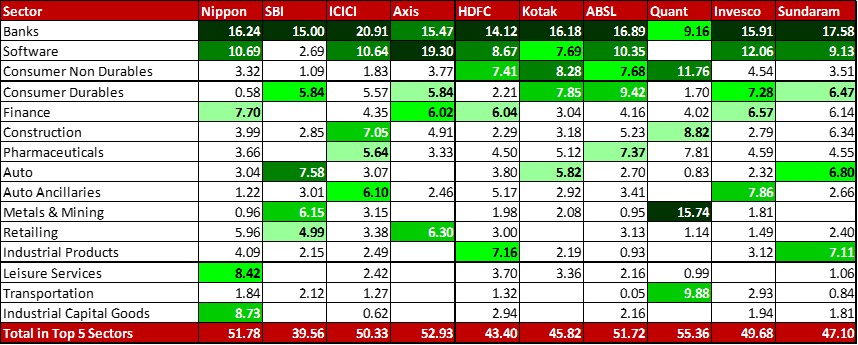

Top 5 sectors

There is a swap in Nippon whereby Finance with a 0.98{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} increase has routed out Chemicals (thanks to a 0.87{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} reduction in Linde India).

SBI is all out of whack with the big strides it made. Might be better for me to tackle it in the stocks section.

While not much happened in Construction, Consumer Durables has edged it out in the Axis portfolio with some increases in all 5 stocks (Voltas, Crompton Greaves Consumer Electricals, Blue Star, Titan and Orient Electric). In fact, Blue star has gone up to 4x from 0.35{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to 1.05{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

In HDFC, organically Finance and Chemicals have swapped in and out of the top 5 sectors in the portfolio.

Quant remains the outlier with Metals & Mining being their highest sector with a new 0.74{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} allocation to JSW Steel.

In Sundaram, organically Auto has edged out Construction for the fourth spot.

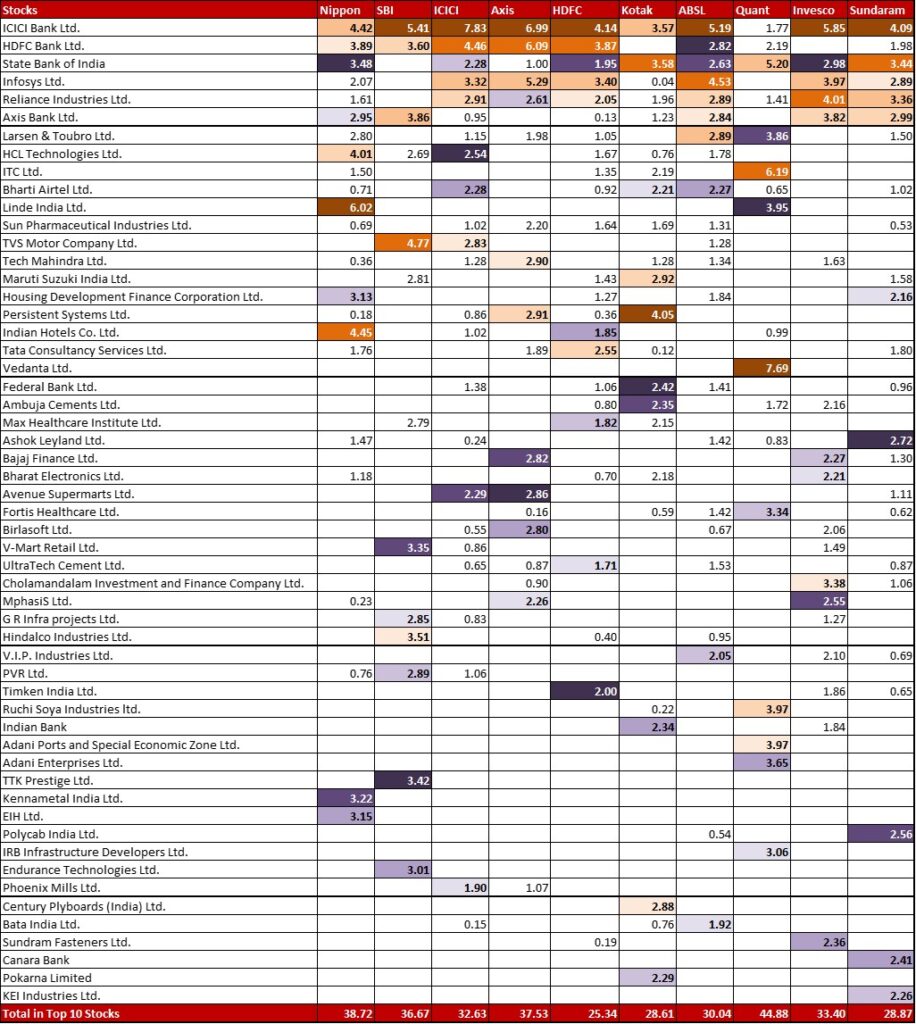

Top 10 stocks & Movements

Some of the funds see substantial drops in Infosys, worth mentioning – ICICI (0.71{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Axis (0.96{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), HDFC (0.81{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Aditya Birla (0.74{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Sundaram (1.19{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

As mentioned above, in Nippon Linde India allocation is shaved off by 0.87{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} but still retains numero uno position. The allocation to Mahindra & Mahindra sees an increase of 0.89{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} which takes it to almost 3.5x of it’s March position. Bharti Airtel has also been shaved off by 0.97{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to get to a less than half position.

SBI is really where the action is this month. Four stocks see big increases in allocation – ICICI Bank (up by 1.35{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Axis Bank (up by 1.23{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Hindalco (up by 1.61{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and PVR (up by 2.23{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). With this, PVR is now at more than 4x of March levels. There are also many new positions worth a mention – TVS Motor Co (4.77{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Endurance Technologies (3.01{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Deepak Nitrite (2.17{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Bandhan Bank (2.13{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Page Industries (1.90{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Navin Fluorine (1.68{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Mrs. Bectors (1.09{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

ICICI sees a new position in Barbeque Nations of 1.08{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

In Axis there is a reduced allocation in two of its’ IT stocks – Infosys and L&T Infotech by 1.29{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} (which indicates that some of the position has been cut down by the fund too and it’s not merely organic). Reliance Industries has gotten the biggest boost of 1.44{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to go up to 2.61{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} while HDFC Bank increased by 1.07{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} and Galaxy Surfactants by 0.83{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. There’s also a new allocation of 0.88{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to Bandhan Bank.

Infosys story is repeated in HDFC with a drop of 0.81{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

In Aditya Birla, the fund has made a complete exit from it’s 1.28{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in Escorts. There is also a 0.81{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} increase in Reliance Industries and 0.82{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} allocation hike in Bandhan Bank (this has resulted in a more than double allocation).

Quant is another fund that saw a lot of action this month. Complete exits from Sunteck Realty (1.35{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and ICICI Securities (1.21{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). Piramal Enterprises is now four times it’s allocation than last month, sitting pretty at 2.33{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. Plus there is a whole host of new positions – HDFC Bank (2.19{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Zee Entertainment (1.68{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Dr. Reddy’s (1.45{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Reliance Industries (1.41{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Grasim Industries (1.13{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

Invesco sees trimming in two stocks – Axis Bank (0.81{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Mphasis (0.98{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). Plus there are two substantial new positions – a very big one in Reliance of 4.01{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} and a tinier one in Sumitomo Chemical India of 0.83{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

In Sundaram, there is a 1.61{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} reduction in HDFC Bank while HDFC Limited is boosted by 0.80{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. There is also a new 0.96{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in Federal Bank.

Check out the other categories and what the funds there were up to:

Leave a Reply