Before I start off on any analysis in this segment, even at the cost of a repetitive bore I will put forth this disclaimer. All fund schemes are taken as direct. However, even if you are a direct investor, hire a financial advisor that you trust who can guide with investments. Pay for your advice.

Fund category definition: Funds with minimum 80{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} portfolio allocation to Large Cap (top 100 by market cap size) stocks

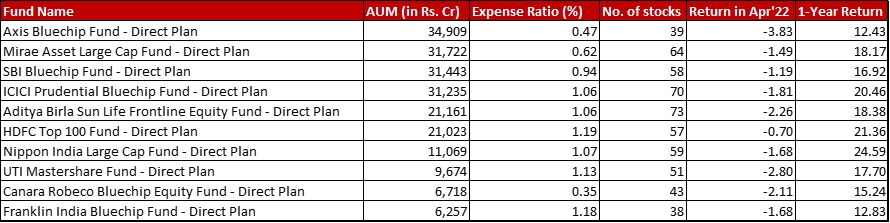

Benchmark: BSE 100 TRI or Nifty 100 TRI with latter changing by -1.11{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in April 2022 and giving a 1-year return of 19.37{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}

Data as on: 29th April, 2022

Summary

HDFC was the sole fund that fell lesser than the benchmark index of Nifty 100 TRI. However, the silver lining is that six of these funds fell less than the more popular Nifty 50, while that number went up to eight in comparison to Sensex.

For the one year performance, three funds (ICICI, HDFC and Nippon) gave higher returns than the Nifty 100 TRI. Three more funds (Mirae, Aditya Birla and UTI) join the rank of outperformers when the benchmark compared to Sensex.

In terms of AUM, Mirae and SBI continue their dance for the second and third places. Mirae has won that battle this month bagging the second spot.

Market Cap Allocation

Officially the most unchanging or crawlingly changing section of the analysis. A major change is that Axis has cut down it’s equity exposure by almost 3{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}, sitting on even more cash. Mirae had increased it’s allocation a bit last month, which is now back in the market.

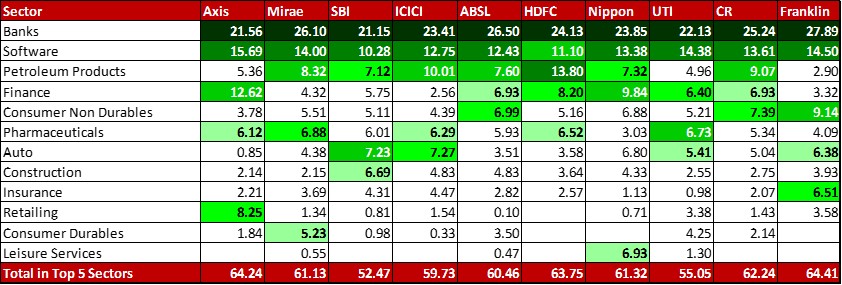

Top 5 sectors

There is a reduction in Software allocation for most of the mutual funds.

In UTI, there is a minor organic swap with auto taking the fifth position in place of telecom.

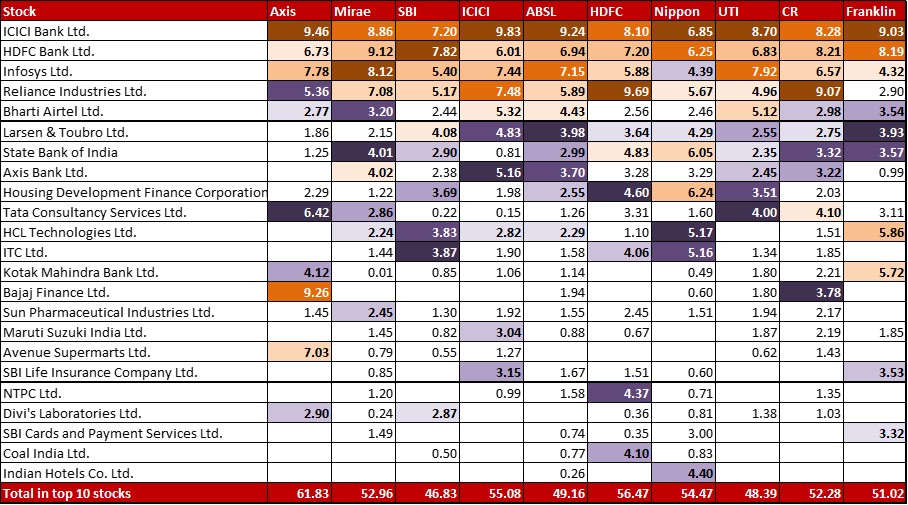

Top 10 stocks & Movements

To make things easier, let me mention the bigger drops of Infosys seen across portfolios. We see that in Axis (1.99{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Mirae (1.60{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), SBI (1.07{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Aditya Birla (1.34{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), HDFC (1.22{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), UTI (1.54{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Canara Robeco (2.51{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Franklin (0.72{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

On the other hand, it has increased it’s allocation to Reliance Industries by a big 1.69{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to bring it up to 5.36{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. HDFC Bank and Wipro both see a trim of 0.73{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} as well. In the case of Wipro, that brings down it’s allocation almost to half.

Mirae has increased it’s allocation in HDFC Bank by 1{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} and in HUL by 1.03{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} (this is an almost 50{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} hike for the stock’s allocation in the portfolio). One of the biggest development though is the 0.86{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} increase in Gland Pharma which effectively zooms it’s allocation from 0.18{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} all the way up almost 6x to 1.04{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}!

ICICI doesn’t seem too enthused about the HDFC merger as the twins see big reductions in allocation – 1.59{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} chopped off from HDFC bank bringing it down to 6.01{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} and a very big 3.21{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} reduction to bring HDFC Limited to almost 40{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} of it’s last months’ 5.19{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. It’s now a mere 1.98{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in the portfolio. The fund has also slightly increased allocation to Reliance Industries by 0.77{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

Aditya Birla sees a new 0.75{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in Gland Pharma.

Nippon has a strange reaction to the HDFC merger – 1.36{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} reduction in HDFC Bank and a 1.55{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} increase in HDFC Limited. Axis Bank sees a 0.79{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} reduction while TCS gets a chunky trim, down from 2.61{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} t0 1.60{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. The fund has also made a complete exit from it’s 0.81{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in Max Financial.

In Canara Robeco, Reliance Industries has been buffed up by 1.03{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} and Cholamandlam Investment & Finance by 0.83{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} boosting it’s allocation by more than 2.5x! The fund also has a new 1.35{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} allocation to NTPC.

In Franklin, ACC sees it’s allocation exactly halved from 1.98{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to 0.99{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. Mphasis also sees a drop of 0.86{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. On the other hand, ICICI Bank gets a boost of 0.85{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} while the fund has a new allocation of 0.89{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to HUL.

Check out the other categories and what the funds there were up to:

Leave a Reply