Oh what a month April has been. If you are in the habit of reading financial newspapers, you would have noticed the doom and gloom all around. We are staring at high inflation, lower growth prospects and continued supply chain issues thanks to the still ongoing Russia-Ukraine war. FIIs have been making a beeline out of India, preferring safer havens of developed markets or even debt now that the yields are rising. How is it then that our markets haven’t come truly crashing down like the London Bridge?

Well, one of the most heartening aspects has been that domestic investors are finally stepping up. India is still at a paltry level when it comes to investing in financial assets. We are still a country of real estate and gold huggers, liquidity be damned. But, mostly we are now beginning to transition our way to financial markets, especially equities.

Within this development, there is an even more interesting trend. Earlier, at the mere hint of the lightest shade of red for the index most investors would flee with their money. Now, with every dip, I have had investors call and ask – aur daalun kya ya abhi rukun kyunki market aur girega? (should I invest more or do I wait for it to fall further?). So, here’s to the maturing Indian investor.

The road is bound to remain rocky for the next 12-18 months. In case you are wondering what can you as an investor do, just remember this quote by Warren Buffet:

Be fearful when others are greedy and greedy when others are fearful

If you don’t see the need for money arising in the next 3-5 years, this is the time to look beyond the fear all around and keep building on your position to bear fruit in the next bull run.

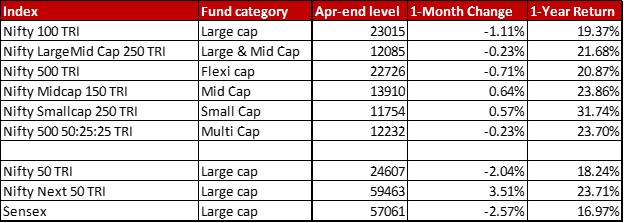

Check out how all the major indices moved last month. By the way, while all other indices are in TRI or Total Returns Index mode (meaning stock dividends add to the returns), Sensex is plain jane Sensex.

If you notice, only three of the indices are in the green – Mid Cap, Small Cap and Nifty Next 50. One of the reasons for Mid and Small Cap indices to remain more stable is that they are less dependent on FII flows. As for Nifty Next 50, 15{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} is made up of Adani companies and another 5-odd{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} is Vedanta. Considering commodities are having their time in the sun, Next 50 has outranked them all this month.

A few observations that I came across while working on these portfolios.

One, IT has been the favourite whipping boy for the month. Stocks across the spectrum were in deep shades of red. Concerns ranged from falling margins, high attrition rates, FII sell-offs and the US tech meltdown. The drop in value within April for some of the favourites can be seen: L&T Infotech fell by 21{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}, Infosys fell by 17{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}, Tech Mahindra by 16{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}, Wipro by 14{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}, HCL Tech by 7{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} and TCS by 5{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. This reflected in a lowered sector allocation to Software (not necessarily a drop in position) and a reduction in allocation the favourite – Infosys across most funds.

Two, it’s not been a good month for Axis Mutual Funds. No, I am not talking about the change of fund managers or the alleged front running scam which happened in the early part of this month. However, many of the key funds have substantially under performed the benchmark. The saving grace has been Axis Growth Opportunities, surprisingly thanks to the foreign equity allocation. Considering I was an employee of the parent company and still hold a favourable bias, I would off course say the funds remain a viable option for wealth creation. Plus one month here or there does not define them anyway.

Three, there are some stocks which seem to suddenly be in favour of quite a few mutual funds. Some of them off the top of my mind include Gland Pharma, NTPC, Jindal Steel, Hindustan Aeronautics, Mahindra & Mahindra and Zee Entertainment. The last one is possibly in approval of Invesco dropping it’s case against Zee which should clear the path for the Sony-Zee merger. Reliance Industries is another one which sees an increased allocation in a few portfolios. On the other hand, the HDFC merger has seen fairly mixed reactions in portfolios. Two stocks which seem to have gone somewhat out of favour are Escorts and Mphasis.

Check out how the portfolios of the top 10-by-AUM funds in different categories stack up against each other.

In case, you are curious what brought about this segment on the blog or how is this analysis even being done, then check out the introduction post where I go into all those details.

You could also check out all the other previous months of analyses – October 2021, November 2021, December 2021, January 2022, February 2022 and March 2022.

Leave a Reply