I am now beginning to sound like the Mad Hatter with the whole I’m Late, I’m late refrain. Yes, there were some logistical challenges at my end but here’s hoping that I tend to do better with the timing next month onwards.

If January 2022 was a sure shot red for most funds, February 2022 was an even more intense version of that trend. On February 24th, the broader indices of Sensex and Nifty saw a drop of almost 5{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}, in one day! While the expiring futures had a little to do with it, the uncertainty around the Russia-Ukraine war seems to have eased off a little by now. Not just that. Despite FIIs pulling quite a bit of money out, domestic investors seem to have wisened up as 24th Feb was also the day when Zerodha saw the highest stock buying!

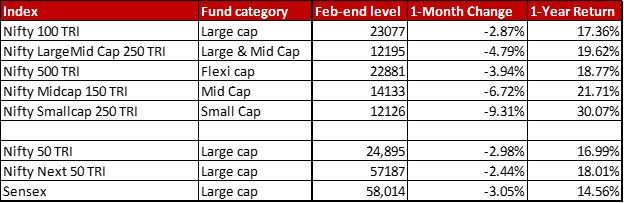

Check out how all the major indices moved last month. By the way, while all other indices are in TRI or Total Returns Index mode (meaning stock dividends add to the returns), Sensex is plain jane Sensex.

As you can see, with the indices some of the 1-year returns are coming back closer down to earth. One major market basic is also visible to the naked eye right here. When there is uncertainty and volatility, it is the large cap, mid cap and small cap that get hit with increasing intensities. So, look at Mid Cap and Small Cap as compared to the total Large Cap index.

There’s another interesting aspect that I would want to mention here, which came about to me during a discussion with a friend about what the future of the market looks like. Almost any mature investor knows that we have had a surreal run especially in the 12-14 months from about September 2020 to October 2021. When you think of the way ahead, one way to see it is to remember that returns will finally revert to their long term mean, where the technical term of reference is mean reversion.

This can happen in two ways – stock correction or time correction. So, with stock correction, prices of individual shares which might have raced up much further than warranted will finally make a hard landing. On the other hand, with time correction, the entire market essentially goes about in a stupor for a longish time. Since there is a time value of money, that too brings down the returns over time. In my view, I think the moment is ripe for a time correction and we will see more of a yo-yo pendulum like market for some time.

One change I would like to mention here in my analyses of the funds. Instead of just restricting myself to a discussion of the top 10 stocks, I am now trying to see a wider view even though the visual analysis will be restricted to the Top 10 stocks to give an idea of the overlap between funds. However, in the text I will talk about substantial changes, which are atleast 0.80{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in size in either direction up or down (or in it’s whereabouts). For Small Cap since that is quite a high parameter, I have brought it down to 0.50{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}

Check out how the portfolios of the top 10-by-AUM funds in different categories stack up against each other.

In case, you are curious what brought about this segment on the blog or how is this analysis even being done, then check out the introduction post where I go into all those details.

Leave a Reply