Before I start off on any analysis in this segment, even at the cost of a repetitive bore I will put forth this disclaimer. All fund schemes are taken as direct. However, even if you are a direct investor, hire a financial advisor that you trust who can guide with investments. Pay for your advice.

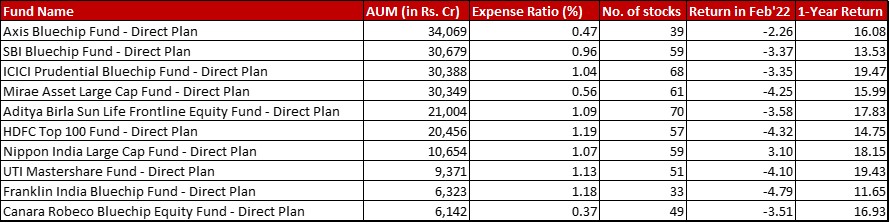

Fund category definition: Funds with minimum 80{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} portfolio allocation to Large Cap (top 100 by market cap size) stocks

Benchmark: BSE 100 TRI or Nifty 100 TRI with latter changing by -2.87{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in January 2022 and giving a 1-year return of 17.36{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}

Data as on: 28th February, 2022

Summary

It was a month of miniscule redemption for Axis Bluechip as it was the only fund in question that fell less than the benchmark.

The contest among the top 4 remains as hot as ever, with Mirae and ICICI constantly jostling for the third spot.

In the number of stocks, Nippon is the only one with some visible change having increased by 4 to go up to 59.

Market Cap Allocation

This section remains as always boring with very little to report. If I was to be really pushed, then Franklin has reduced it’s Mid Cap allocation from 3.39 to 2.07{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. As for the rest, really unchanged.

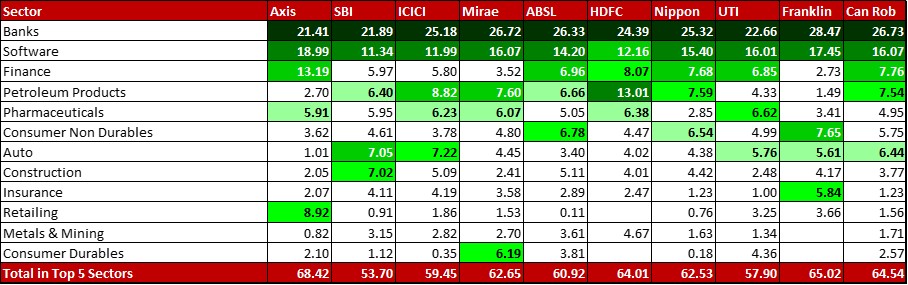

Top 5 sectors

Banks and Software remain the two favourites for the fund category, despite some bit of market lashing the two sectors seem to be at the end of.

There are two significant sectoral shifts that I can see. With UTI, there is a complete exit from the 1.55{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} allocation to HUL, leading to a 1.39{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} reduction in Consumer Non Durables. Thus, Auto moves on to the fifth spot.

In Franklin, there is a new chunky 1.41{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in Ashok Leyland leading to Auto replacing Construction for the No. 5 spot in sectors.

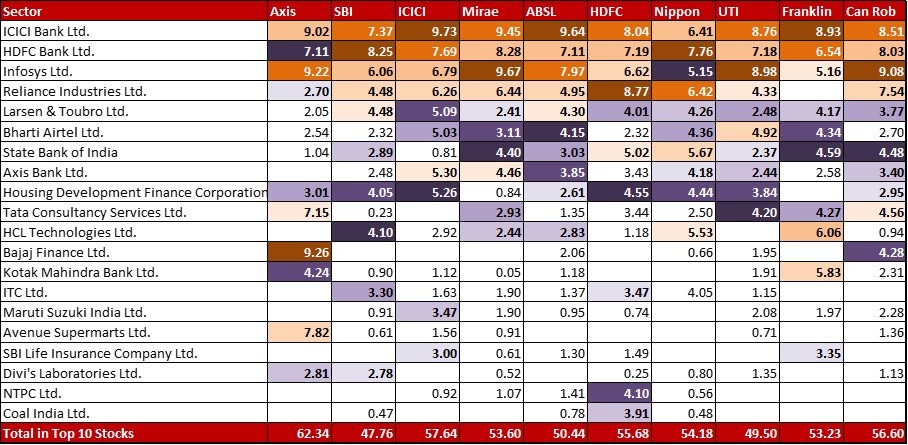

Top 10 stocks & Movements

Nippon sees some movement. They seem to have bought HDFC Limited a bit on the dips to increase it from 3.61{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to 4.44{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. There are also three significant reductions – Bharti Airtel (by 1.45{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}!), NTPC (by 0.97{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and a complete exit of the 0.85{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in Nestle.

As for UTI, one big change already mentioned is the exit of 1.55{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position from HUL. Simultaneously, there is a substantial new position of 1.04{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in Havells India.

For Franklin, one of the bigger changes mentioned above is a higher allocation to Auto with the new 1.41{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in Ashok Leyland. But, an even bigger move is a whole new 1.97{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in the software firm Mphasis. On the other hand, L&T sees 1.30{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} shaved off while Axis Bank also gets a 0.91{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} trim.

As for Canara Robeco, there’s been a complete exit from the 0.91{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in Muthoot Finance replaced by a 1.01{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} adding of United Spirits.

Check out the other categories and what the funds there were up to:

Leave a Reply