Before I start off on any analysis in this segment, even at the cost of a repetitive bore I will put forth this disclaimer. All fund schemes are taken as direct. However, even if you are a direct investor, hire a financial advisor that you trust who can guide with investments. Pay for your advice.

Fund category definition: Funds with minimum 35{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} portfolio allocation to Large Cap (top 100 by market cap size) stocks and 35{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} allocation to Mid Cap (101-250 by market cap size) stocks. Remaining 30{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} is as per fund management.

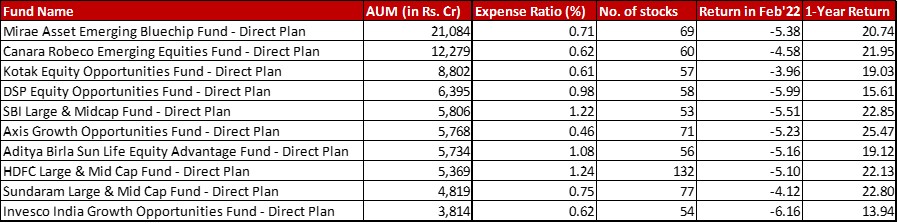

Benchmark: Nifty LargeMid Cap 250 TRI with a change of -4.79{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in February 2022 and a one-year return of 19.62{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}

All data as on: 28th February, 2022

Summary

This is personally one of my favourite fund categories. I have often been caught saying like an ad salesperson – stability of large cap, growth potential of mid caps.

But, when you look at the AUMs, you will see it’s not much of a favourite of investors apart from Mirae. In fact, it really is Mirae Emerging Bluechip which first got the AMC much popularity. Even now investors with high value SIP refuse to let go of it, concentration risk in the portfolio be damned.

When it comes to performance, it’s been a dismal month with only Canara Robeco, Kotak and Sundaram faring better than the index.

As for the AUM, Aditya Birla Sun Life has taken a leap back to go behind SBI and Axis and nestle itself in the seventh spot.

Market Cap Allocation

The biggest market cap change can be seen in HDFC with a 6.57{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} reduction in Large Cap and 7.63{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} increase in Mid Cap. Considering it was a bit in the opposite direction last month, it looks like with the merging of the other funds they are having a Goldilocks moment – an increase, a decrease here till the time it feels just right.

Top 5 sectors

There is very little in terms of sector shift this month.

In Mirae, finance has edged out Insurance but since the numbers are so close it seems to be more of an organic shift.

Within Canara Robeco, auto ancilliaries is edged out by Chemicals although within auto ancilliaries it’s just a slight allocation reduction in the same 3 stocks.

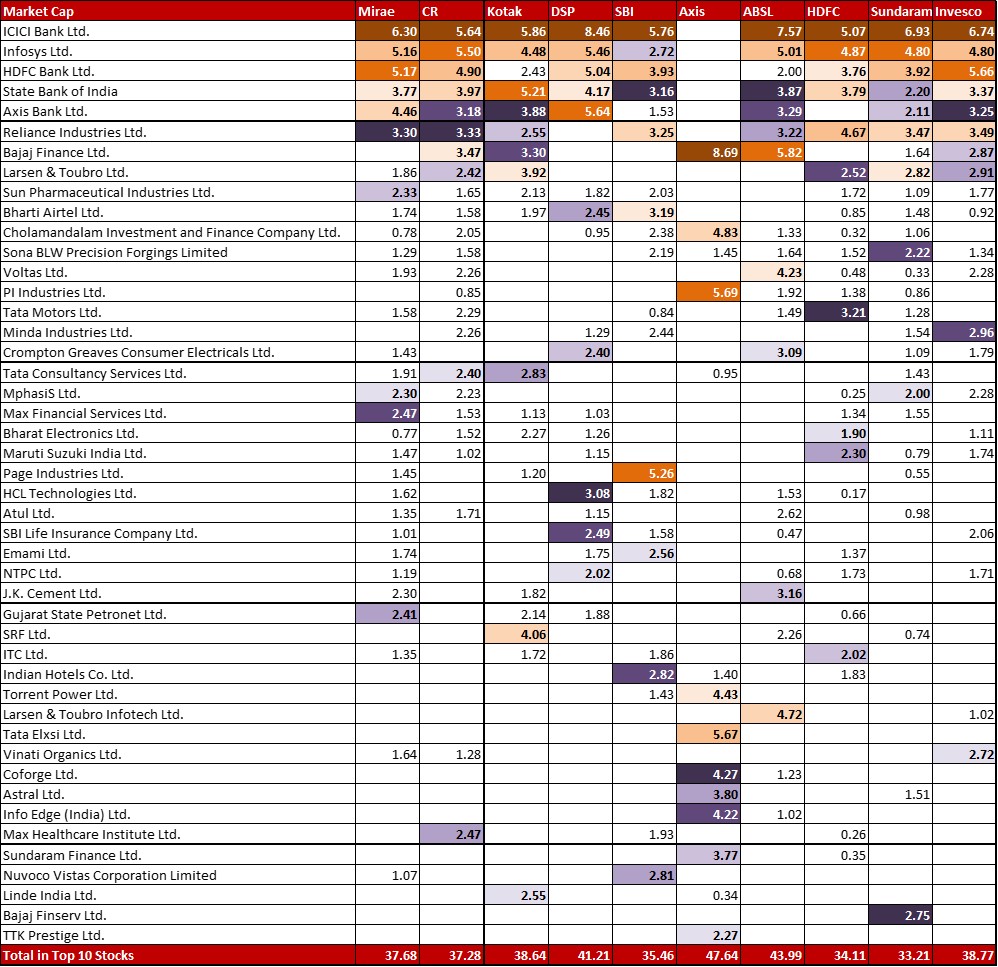

Top 10 stocks

Canara Robeco has slashed the Mahindra & Mahindra allocation by a whopping 0.85{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to bring it down to a miniscule 0.14{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} while completely exiting it’s 0.87{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in Muthoot Finance. On the other hand, they have a brand new 1.02{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in Maruti Suzuki.

Kotak has taken a 0.80{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in the newly listed Vedant fashion which is well known for it’s wedding wear brand Manyavar.

In Aditya Birla, SRF gets a slashing of 1.41{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} while Reliance and Axis Bank both see a boost of 0.74{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} each. The fund has also taken a new 0.99{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in Divi’s Laboratory.

SBI has done a simple swap with a complete 0.99{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} exit in Muthoot Finance and a 1.00{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} new entry in Equitas Small Finance Bank.

In Axis, the darling of the fund Tata Elxsi sees another 0.80{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} trim while Cholamandalam gets a 0.79{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} increase.

With Sundaram there is just one major movement with a complete exit of it’s 0.92{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in Bharat Petroleum.

Invesco though has seen a massive shuffle – increase of 1.16{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in Apollo Hospitals, 0.77{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in L&T Infotech and a new 0.95{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in Trent. On the other hand, it’s trimmed 1.27{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in Ashok Leyland, 0.78{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in Endurance Technologies and completely exited it’s 0.79{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in Indusind Bank.

HDFC has trimmed it’s positions in ICICI Bank (by a giant 2.03{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Infosys (by 0.96{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and SBI (by 1.06{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). On the other hand, there is a 0.97{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} boost in Lupin and a new 1.01{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in Bharat Forge.

Check out the other categories and what the funds there were up to:

Leave a Reply