Before I start off on any analysis in this segment, even at the cost of a repetitive bore I will put forth this disclaimer. All fund schemes are taken as direct. However, even if you are a direct investor, hire a financial advisor that you trust who can guide with investments. Pay for your advice.

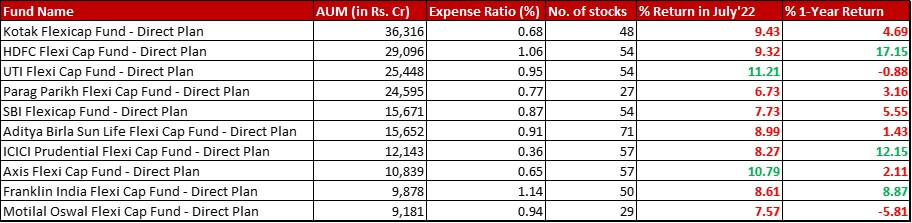

Fund category definition: Funds with no restriction on market cap allocation or number of stocks

Benchmark: Nifty 500 TRI with a change of 9.73{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in July 2022 and a 1-year return of 8.63{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}

Data as on: 29th July, 2022

Summary

In terms of AUM ranking, there is no change.

Motilal Oswal is the only fund with a noticeable change in expense ratio, bringing it down by 8 basis points to get to 0.94{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

SBI seems to have used this month to trim down it’s stocks from 59 to 54. Funnily enough, just last month it had gone shopping to take the number up from 53 to 59.

UTI and Axis were two funds with the highest lag in terms of performance and the two are now the only ones to have beaten the benchmark for the month of July 2022. In terms of 1 year performance, HDFC, ICICI and Franklin are the only ones in green above the benchmark.

Market Cap Allocation

Motilal Oswal sees more 5{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} reduction in it’s Large Cap allocation, whereas only a 1.18{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} increase in Mid Cap and a miniscule movement in Small Cap allocation. Overall the equity exposure has reduced by 3.53{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}, still remaining pretty high at 95.16{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

Parag Parikh is another fund to see an almost 3{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} reduction in it’s equity exposure, bringing it down to 90.60{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

Axis remains the only fund to be at a sub-90 level (87.06{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) although Parag Parikh seems to be approaching that mark soon.

Top 5 sectors

This month has been pretty boring in terms of sectoral movements.

Aditya Birla sees an organic swap between Finance and Telecom, the former finding a place in the Top 5 Sectors this month.

For Axis, although the Top 5 Sectors remain the same Software has lost it’s second spot to Finance. Within Software, Axis has completely exited Wipro (0.21{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and also cut down it’s exposure to TCS from 4.91{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to 2.97{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

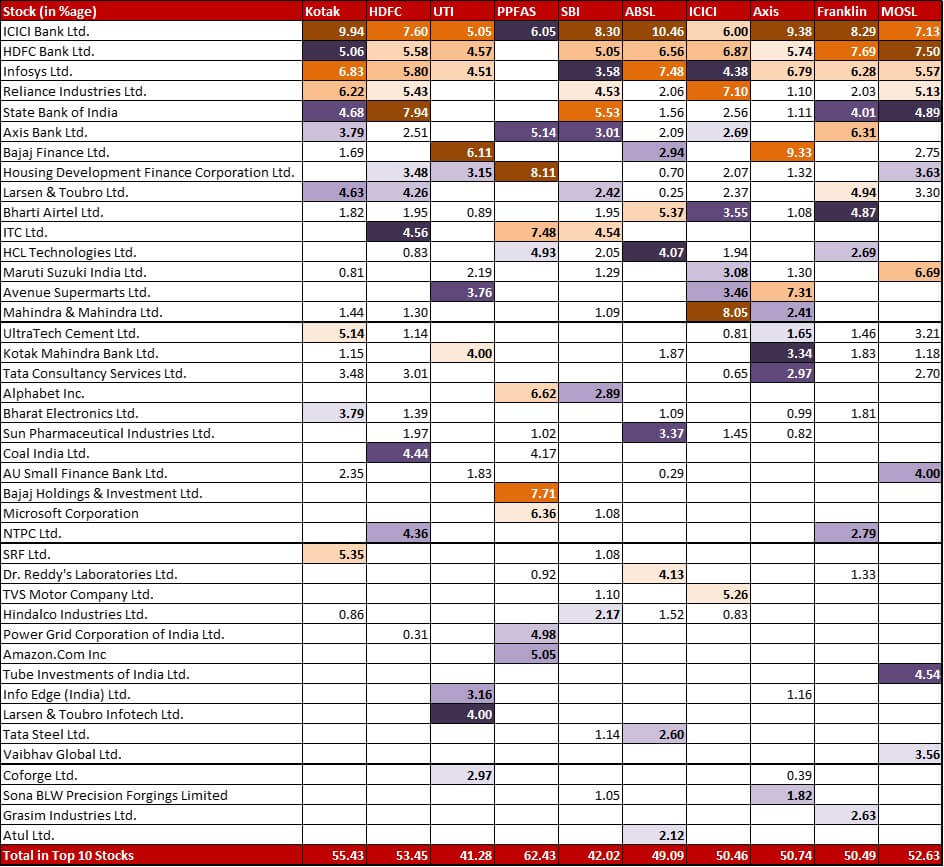

Top 10 stocks & Movements

Kotak has cut its allocation in Reliance Industries by 79 basis point bringing it down to 6.22{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

HDFC has completely exited from it’s 0.37{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in Maruti Suzuki.

Bajaj Finance had quite a rally in July with a 33{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} increase in price (from Rs. 5400 to Rs. 7209)! Hence, the increase in allocation in UTI from 5.08{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to 6.11{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. The fund has also completely exited two small positions – Cera Sanitaryware (0.11{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and La Opala RG both (0.13{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

Parag Parikh has rationalised it’s allocation to the top stock ITC bringing it down from 9.18{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to 7.48{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. Coal India also sees a small cut from 5.02{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to 4.17{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. On the other hand, HDFC Limited sees an increased allocation to 8.11{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} which is higher than just the 9.5{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} increase in the stock price.

This month yet again, SBI is full of action. ICICI Bank (from 7.27{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to 8.03{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), SBI (4.28{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to 5.53{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and AIA Engineering (0.06{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to 0.99{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) all three see a substantial increase in allocation. On the other hand, HDFC Bank sees a reduction from 6.51{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to 5.05{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. The list of exits from the fund is pretty long as compared to the rest of the category which shows in the reduced number of stocks as well – Power Grid (1.90{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Prism Johnson (0.53{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Indian Oil (0.49{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Crompton Greaves Consumer Electricals (0.44{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Zomato (0.48{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). The last one had a mere one month life in the portfolio.

Aditya Birla has reduced it’s allocation to Dr. Reddys by 0.78{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} down to 4.13{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. On the other hand, Apollo Hospitals which re-entered the portfolio last month has been increased by a big 1.17{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} bringing it up to 2.03{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. The fund has a new addition in Polycab India (0.16{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). There are also two small exits – M&M Financial Services (0.12{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Godrej Consumer Products (0.13{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

ICICI has increased it’s allocation in Reliance Industries from 5.85{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to 7.10{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. On the other hand, HCL Tech sees a reduced allocation from 3.40{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to a much lesser 1.94{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. There are also two minor exits – Vedant Fashion which entered as an IPO is now out with it’s 0.32{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. HUL (0.28{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) too is out with a 3 month stint in the portfolio.

In Axis, thanks to the price swing Bajaj Finance is beefed up to 9.33{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. TCS (4.91{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to 2.97{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Reliance Industries (2.81{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to 1.10{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) are two stocks that see a substantial reduction in allocation. The fund has three new allocations – Bharat Electronics (0.99{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), WABCO India (0.24{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Rolex Rings (0.01{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). The fund has also shown the door to two stocks – Wipro (0.21{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Data Patterns India (0.06{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

Franklin has one new addition – Escorts (0.48{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and two minor exits – Aditya Birla Capital (0.13{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Ramco Cements (0.11{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) after a mere one month.

Motilal Oswal is another fund with substantial changes. TCS sees a hug cut down from 6.13{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to 2.70{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} bringing it down from the top stock to the fourth highest in allocation. Gland Pharm also sees a reduction (from 3.92{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to 2.46{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). Two stocks have been beefed up substantially – Tube Investments (from 3.52{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to 4.54{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Bajaj Finance (1.84{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to 2.75{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). The fund has also added the Bajaj twin, Bajaj Finserv for 1.04{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. On the other hand, HCL Techonologies is completely liquidated of it’s 1.95{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} and FSN E-Commerce of it’s 0.53{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

Check out the other categories and what the funds there were up to:

Leave a Reply