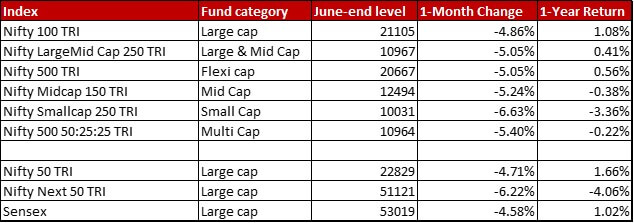

June continued to be a month of falling prices. Most indices sported a healthy shade of red, wiping out 1-year returns as well in the process. The fall ranged from 4.58{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} for Sensex to 6.63{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} for Smallcap 250. This has now had many commentators starting to wonder if we are anyway near the bottom. Considering the headwinds that business newspapers seem to remain agog with, my guess is markets might remain in their pendulum like range-bound trajectory for some more time.

Early this month, AMFI also declared it’s bi-annual reclassification of market cap. There were quite a few changes which also reflect in some of the funds market cap allocation. Apart from that, funds have mostly been content with the portfolio they have and very few have gone out all guns blazing to rip it apart.

Check out how all the major indices moved last month. While all other indices are in TRI or Total Returns Index mode (meaning stock dividends add to the returns), Sensex is plain jane Sensex.

Some points that popped out as I was working on the analysis.

One, a majority of the funds have exited the miniscule position they had taken in last month’s IPO – LIC (possibly post the mandatory holding period). This reflects in the over 20{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} drop in share price since listing.

Two, auto ancillary stock Tube Investments seems to be on every fund’s radar. There are new positions popping up or existing ones beefed up in quite a few funds.

Three, auto stocks too seem to be in favour, particularly Maruti Suzuki and TVS Motors. So much so that the latter is now the biggest stock in SBI Multicap. Another one that is finding favour is Mahindra & Mahindra.

Check out how the portfolios of the top 10-by-AUM funds in different categories stack up against each other.

In case, you are curious what brought about this segment on the blog or how is this analysis even being done, then check out the introduction post where I go into all those details.

You could also check out all the other previous months of analyses – May 2022, April 2022, March 2022, February 2022, January 2022, December 2021, November 2021 and October 2021.

Leave a Reply