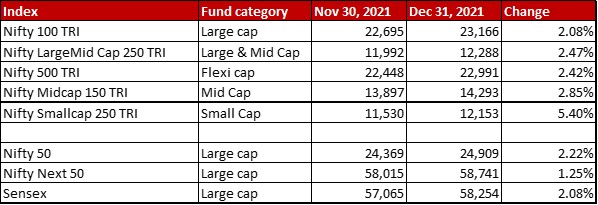

December was a month when some recovery was made after the jittery November witnessed by equity markets. Small Cap yet again surprised, with the Nifty Smallcap 250 Total Returns Index showing a jump of 5.40{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. Like almost any realist, the small cap party is now getting worrisome knowing that long parties are generally followed by awful hangovers.

Rest of the indices were pretty much in a range of 2-2.85{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} although Nifty Next 50 occupied the bottom rung with a 1.25{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} crawl.

With the end of the year, AMFI also released a revised market cap categorisation for the stocks. This time, considering quite a few big IPOs have made their mark in the last 6 months, the shuffle is substantial. In the market cap allocation analysis, the latest market cap categorisations as per AMFi has been considered.

So, here is how the index movements looked.

Check out how the portfolios of the top 10-by-AUM funds in different categories stack up against each other.

In case, you are curious what brought about this segment on the blog or how is this analysis even being done, then check out the introduction post where I go into all those details.

Leave a Reply