Before I start off on any analysis in this segment, even at the cost of a repetitive bore I will put forth this disclaimer. All fund schemes are taken as direct. However, even if you are a direct investor, hire a financial advisor that you trust who can guide with investments. Pay for your advice.

Fund category definition: Funds with minimum 65{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} portfolio allocation to Mid Cap (101-250 by market cap size) stocks

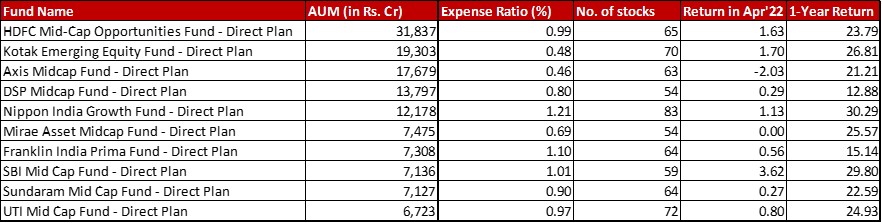

Benchmark: Nifty Mid Cap 150 TRI with a change of 0.64{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in April 2022 and a 1-year return of 23.86{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

All data as on: 29th April, 2022

Summary

This month, Axis and Mirae are the only two funds to have been trumped by the benchmark, Axis drastically so. The benchmark has a minutely positive record for the month, possibly with lower dependence on FII flows than their older sibling a-la Large Caps.

In terms of AUM, SBI has moved one spot above Franklin but with a wafer-thin margin of Rs. 9 Crores in the AUM this battle is clearly not over.

The total expense ratio for Mirae is hiked up 0.07 while that of SBI is up by 0.06.

In the number of stocks, there’s no substantial change worth mentioning.

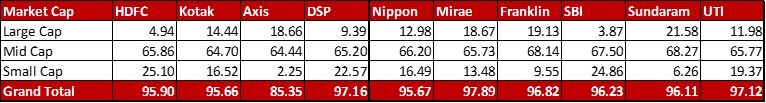

Market Cap Allocation

Not much has changed in this regard unless you count Mirae and Nippon increasing Large cap exposure by about 2{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} each.

Oh and Axis has further reduced it’s equity exposure by almost 3{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} by almost equally in Large and Mid cap stocks.

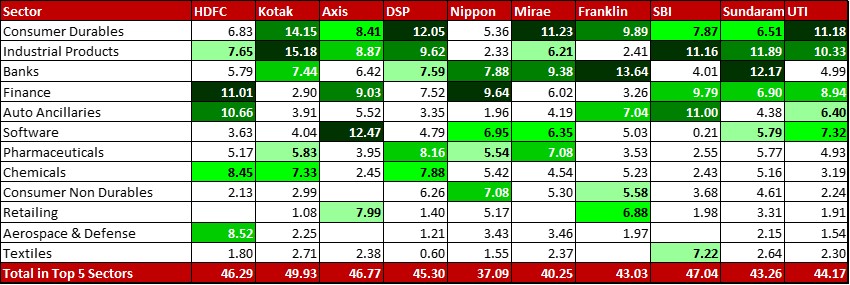

Top 5 sectors

There’s not much of a change in Sectors.

Nippon sees a massive reduction in Software taking it down from the highest to the fourth highest sector. No, it’s not the usual culprit this time. If anything Nippon has averaged out and increased the allocation Infosys taking it from 1.59{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to 1.70{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. There are two big changes in the sector. There is a complete exit from the 1.35{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in Mphasis and a 1.12{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} reduction in L&T Technology Services.

In Franklin, with a 1.14{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} reduction in Mphasis and an overall drop in almost every other software stock, the sector is edged out by Consumer Non Durables.

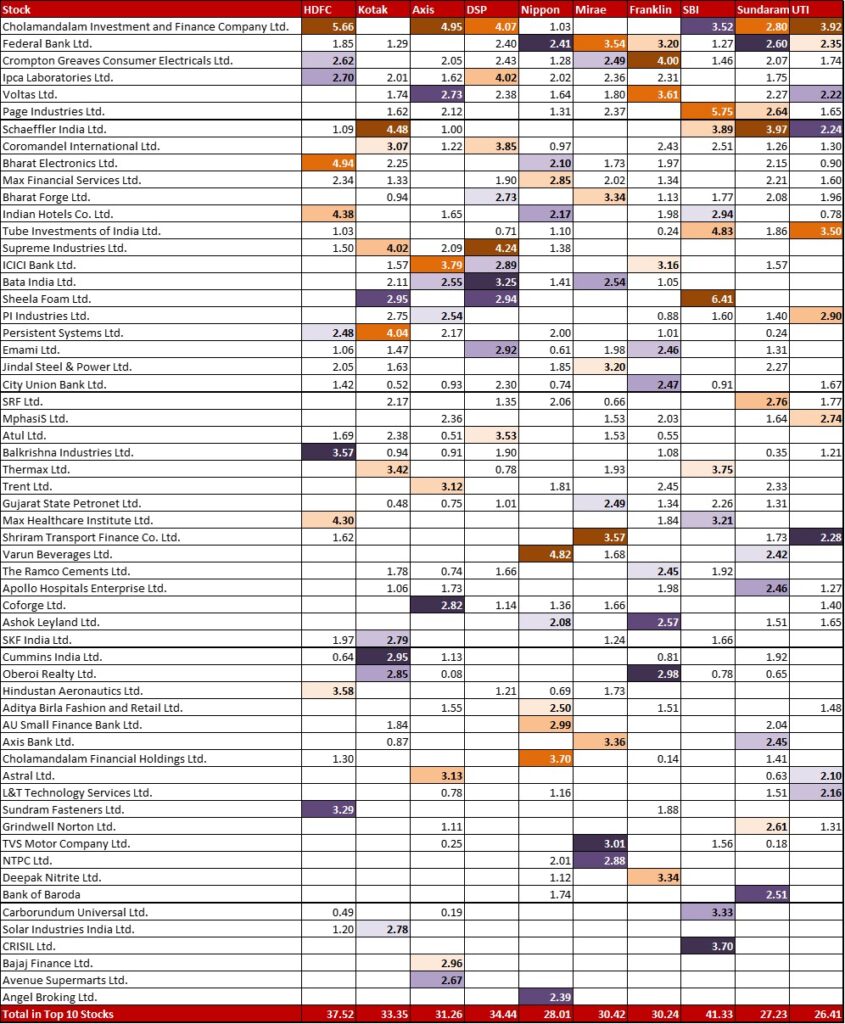

Top 10 stocks & Movement

HDFC has increased its’ allocation to Hindustan Aeronautics by 0.85{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}, taking it up to 3.58{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

DSP has made some significant clean movements – an exit from the 1.51{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in AIA Engineering and new allocations to Coforge (1.14{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Hindustan Aeronautics (1.21{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

While Nippon has trimmed it’s allocation in L&T Tech Services by 1.22{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}, it has also made complete exits from Mphasis (1.35{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Vardhman Textiles (0.76{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). There are two new positions as well – Indian Oil (0.98{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Mahindra & Mahindra (0.80{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

Mirae has increased it’s allocation to Shriram Transport Finance by 0.80{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} and cut down SRF to a third of it’s prior position with a 1.31{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} reduction.

Quite a few changes in Franklin. Mphasis sees a haircut of 1.15{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} while Cholamandlam Financial Holdings has been slashed by 1.04{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} down to a mere 0.14{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. In the last two months, this stock seems on track to be eliminated from this portfolio. There is also a full exit from the 1.06{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in Escorts. On the other hand, the fund has increased it’s allocation to Jubilant Foodworks by 0.80{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} while introducing a 0.81{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in Cummins.

SBI has increased it’s allocation in CRISIL by 0.80{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} taking it up to 3.70{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

Sundaram has added a 0.99{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} chunk of HDFC Bank.

UTI has shaved off 1.20{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in Escorts while building new allocations in Bharat Electronics (0.90{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Indian Hotels (0.78{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

Check out the other categories and what the funds there were up to:

Leave a Reply