Before I start off on any analysis in this segment, even at the cost of a repetitive bore I will put forth this disclaimer. All fund schemes are taken as direct. However, even if you are a direct investor, hire a financial advisor that you trust who can guide with investments. Pay for your advice.

Fund category definition: Funds with minimum 35{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} portfolio allocation to Large Cap (top 100 by market cap size) stocks and 35{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} allocation to Mid Cap (101-250 by market cap size) stocks. Remaining 30{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} is as per fund management.

Benchmark: Nifty LargeMid Cap 250 TRI with a change of -0.23{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in April 2022 and a one-year return of 21.68{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

All data as on: 29th April, 2022

Summary

This is personally one of my favourite fund categories. I have often been caught saying like an ad salesperson – stability of large cap, growth potential of mid caps.

But, when you look at the AUMs, you will see it’s not much of a favourite of investors apart from Mirae. In fact, it really is Mirae Emerging Bluechip which first got the AMC much popularity. Even now investors with high value SIP refuse to let go of it, concentration risk in the portfolio be damned.

In April, this has been a standout category with only Aditya Birla under performing the benchmark, and that too substantially. With the remaining funds, all are positive and some have even surpassed the benchmark by a healthy 3-5{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. It remains to be seen whether next month will be one of mean reversion.

There are two slight swaps in AUM rank. SBI outranked DSP while HDFC jumped over Aditya Birla, but the AUM amounts remain neck to neck and these ranks could well remain fluid for the next few months.

Axis has increased it’s Total Expense Ratio from 0.41 to 0.53 which is almost a 30{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} hike. There are some small reductions in TER of the more expensive funds. So, DSP has moved from 0.98 to 0.93 while Aditya Birla has moved down from 1.16 to 1.10.

Market Cap Allocation

It looks like Axis has been shopping this month. Large Cap sees a whooping 7{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} increase, Mid Cap about 2.5{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} while the others are a bit up too. Overall equity exposure is up by about 8.5{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. Just last month, they had been up and about with their trimming shears cutting off 8{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} from Mid Cap and about 4{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} from Foreign Equity (which could be a factor of no further investment as per RBI Mandate).

Aditya Birla has trimmed about 6{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} from Large cap and ploughed most of it back to Mid Cap.

ICICI has increased it’s Large Cap allocation by about 5{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} while reducing a bit each from Mid and Small Cap.

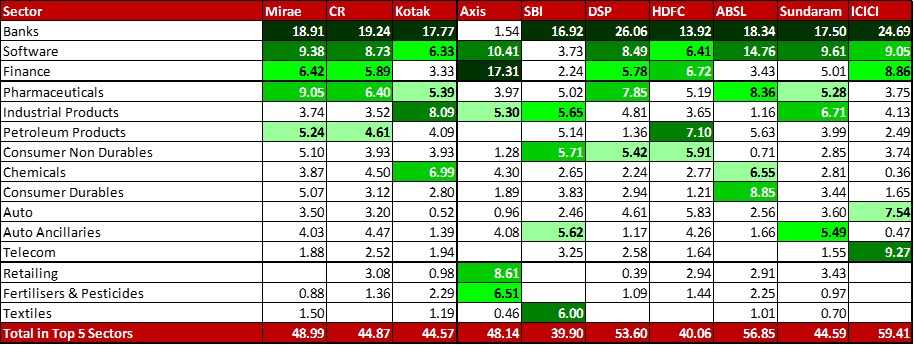

Top 5 sectors

In Mirae, organically, Petroleum Products (with Reliance and HPCL shares) has edged out Consumer Durables for the fifth sectoral spot.

For SBI, with a new 0.78{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in AIA Engineering, Industrial Products is now the fifth biggest sector replacing Pharmaceuticals.

Aditya Birla has made some big moves. Bajaj Finance has been slashed down by almost 4{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} while Pharma sees a new substantial position with 1.51{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in Biocon. So, it follows that Pharma (now third biggest sector) has replaced Finance (which was the fourth biggest sector).

In Sundaram, there is just an organic swap between Finance going out and Pharma coming in.

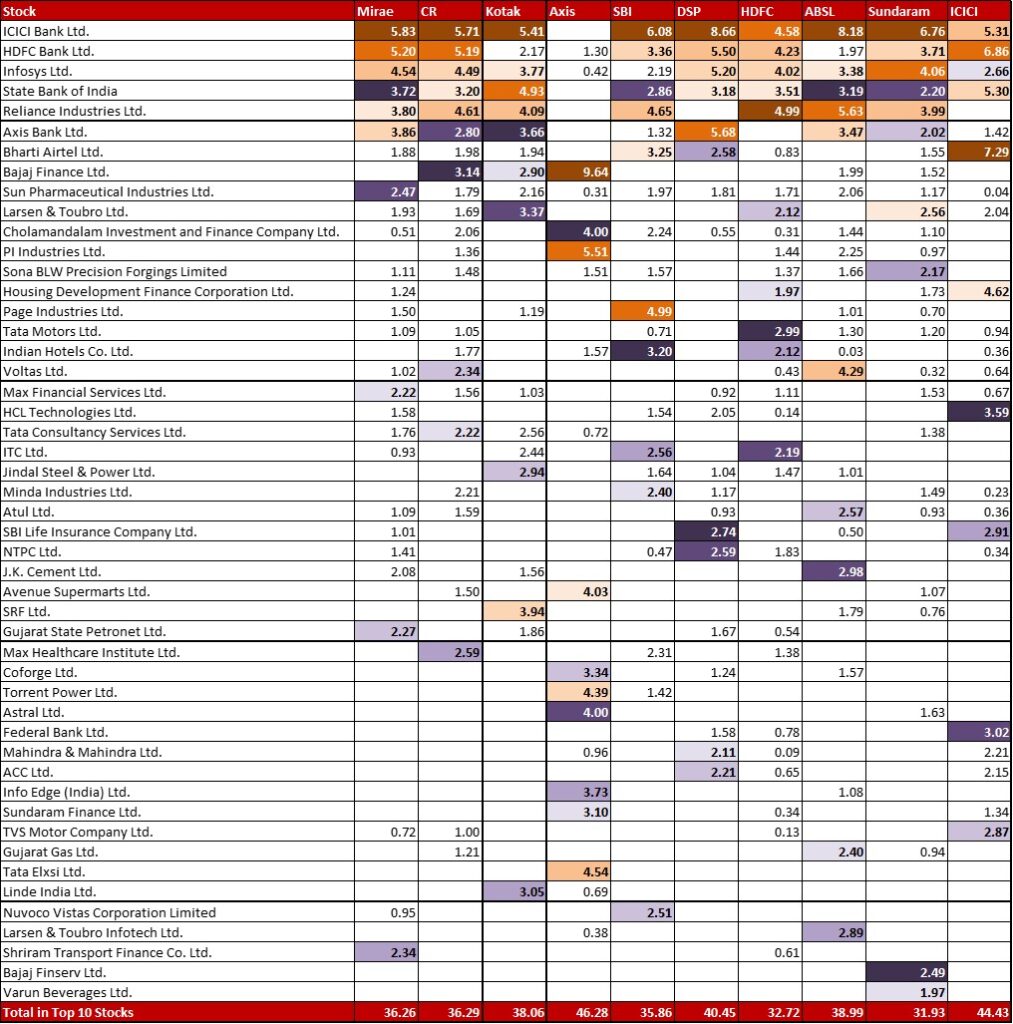

Top 10 stocks & Movement

The Infosys story continues in this category with big drops in Mirae (0.98{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Canara Robeco (1.47{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Kotak (0.87{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), DSP (1.01{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), HDFC (0.99{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Aditya Birla (2.07{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Sundaram (1.02{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

In Mirae, the allocation to Shriram Transport Finance has increased by 0.81{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

Canara Robeco and Kotak see 0.76{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} and 1.16{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} increased allocations respectively to Reliance Industries.

Axis sees two new big positions in HDFC Bank (1.30{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Mahindra & Mahindra (0.96{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). Bajaj Finance further fortifies it’s position as the biggest stock with a 0.87{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} increase. Divi’s Laboratory has almost been doubled to reach 1.87{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

SBI has two new positions worth a mention – Jindal Steel & Power (1.64{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and AIA Engineering (0.78{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

DSP has completely exited it’s 0.75{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in Maruti Suzuki and replaced it with a 0.90{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in Ashok Leyland within the Auto sector.

There have been quite a few changes in Aditya Birla. Apart from the massive trim in Bajaj Finance (3.92{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) mentioned above, L&T Infotech is trimmed by 1.55{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}, Mindtree by 1.07{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} and Hindalco by 1.26{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. ICICI Bank gets a boost of 0.90{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} and Reliance Industries too sees an increase of 1.41{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}, moving it from the fifth largest to the second largest share. There are also three new substantial positons – Biocon (1.51{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Trent (1.01{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Jindal Steel & power (1.01{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

Check out the other categories and what the funds there were up to:

Leave a Reply