Before I start off on any analysis in this segment, even at the cost of a repetitive bore I will put forth this disclaimer. All fund schemes are taken as direct. However, even if you are a direct investor, hire a financial advisor that you trust who can guide with investments. Pay for your advice.

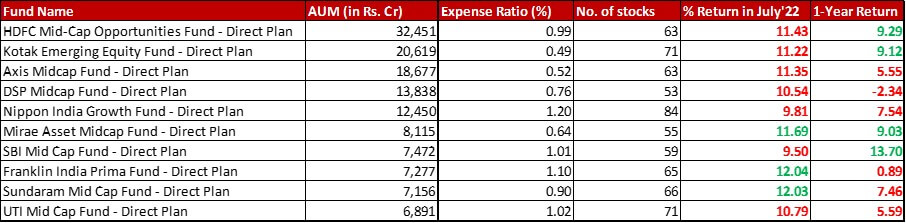

Fund category definition: Funds with minimum 65{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} portfolio allocation to Mid Cap (101-250 by market cap size) stocks

Benchmark: Nifty Mid Cap 150 TRI with a change of 11.67{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in July 2022 and a 1-year return of 7.69{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

All data as on: 29th July, 2022

Summary

In terms of AUM ranking, there’s no change.

Nippon has reduced its expense ratio by 4 basis points to still remain at a very high 1.20{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

In terms of number of stocks also, the funds have again been fairly stable.

In this category too, last months’ green dominated report card has been inverted. This month only 3 funds have outperformed the benchmark and the number goes up slightly to four for the 1-year performance.

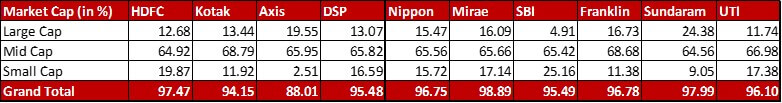

Market Cap Allocation

This month, many funds including Axis, HDFC, Nippon and Mirae see a 3{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} or more shift towards Mid Cap allocation. It looks like the remaining action from the AMFI reclassification last month.

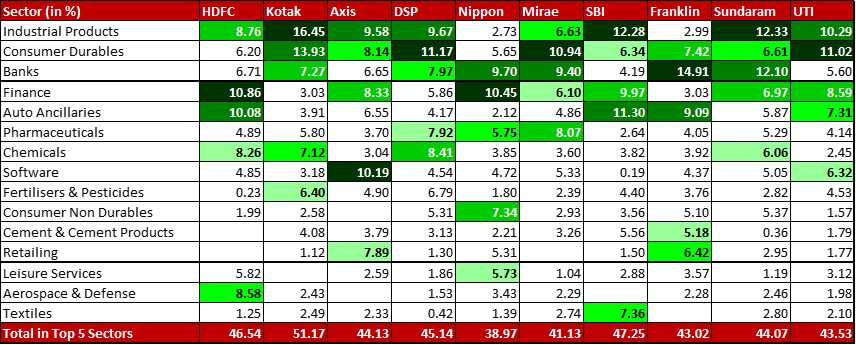

Top 5 sectors

In Nippon, there is an organic swap between Consumer Durables and Leisure Services, with the latter making the cut to the Top 5 Sectors this month.

Franklin sees an organic swap between Consumer Non Durables and Cement & Cement Products, with the latter featuring in the Top 5 Sectors this month.

Organic swaps seem to be the order of the day with Chemicals knocking out Auto Ancilliaries in Sundaram.

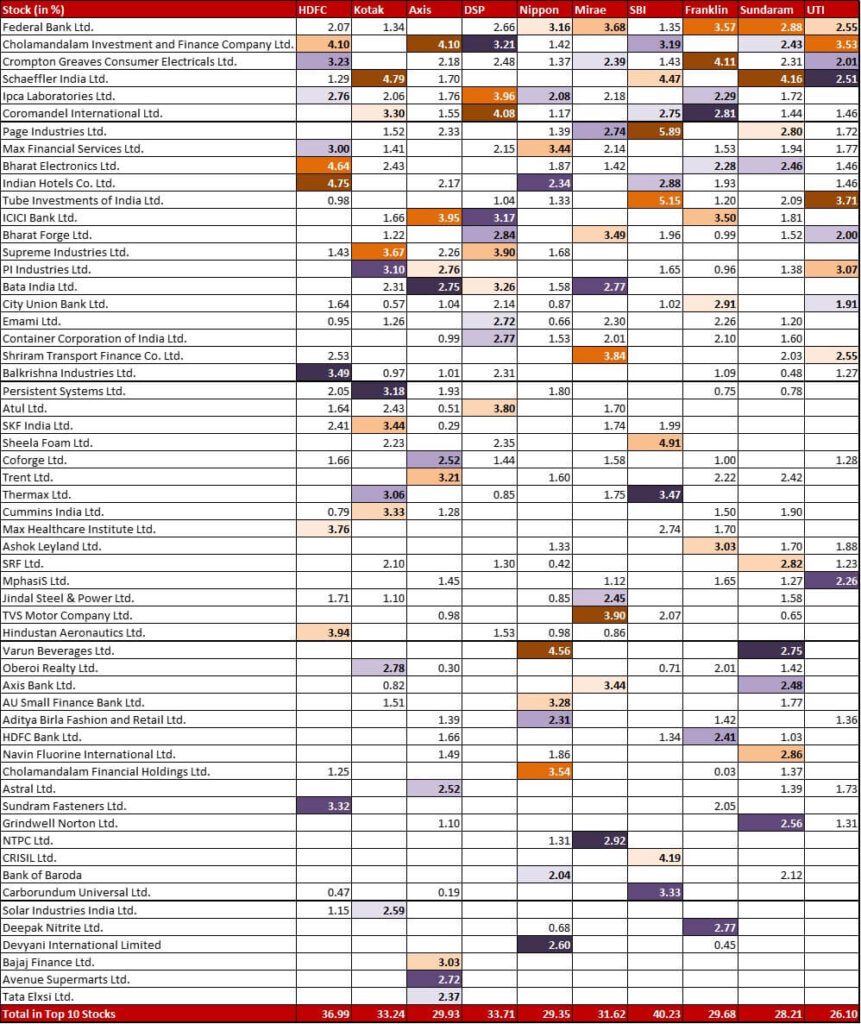

Top 10 stocks & Movement

HDFC has substantially increased its’ position in Coforge zooming up from 0.26{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to 1.66{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. There are also three exits – RITES (0.43{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Blue Star (0.42{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and WABCO India (0.27{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

Axis has a new 0.29{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in SKF India. There are also two exits – Divi’s Labs (0.20{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Gujarat Fluorochemicals (0.04{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

Nippon has drastically cut down it’s allocation in Dr. Reddy’s Labs from 1.68{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to 0.31{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. The fund has four new stocks – J.K. Cement make a re-entry after February (0.42{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Poonawalla Fincorp (0.39{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Ajanta Pharma (0.23{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and NMDC (0.22{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). There’s also a long line of exits – Oil India (0.72{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Macrotech Developers (0.48{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), ICICI Prudential Life Insurance after a mere four months (0.41{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Lux Industries (0.17{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Fine Organic (0.13{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and LIC after two miniscule months (0.12{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

Mirae has reduced it’s position in Hindustan Aeronautics by 0.88{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}, bringing it to less than half at 0.86{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. There are two new entrants – HPCL (0.86{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and NALCO (0.60{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). The fund has also exited it’s 0.67{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in Jyothy Labs.

Franklin has exited three stocks – Infosys (0.95{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Atul Ltd. (0.55{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and RBL Bank (0.15{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). To make up for it, there are four new entrants – Coforge (1.00{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Escorts after a gap of 3 months (0.56{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Zomato (0.43{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Indusind bank (0.42{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

Sundaram has two new entrants – United Breweries (0.74{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and APL Apollo Tubes (0.15{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

UTI has exited it’s 0.23{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in Kansai Nerolac.

Check out the other categories and what the funds there were up to:

Leave a Reply