Before I start off on any analysis in this segment, even at the cost of a repetitive bore I will put forth this disclaimer. All fund schemes are taken as direct. However, even if you are a direct investor, hire a financial advisor that you trust who can guide with investments. Pay for your advice.

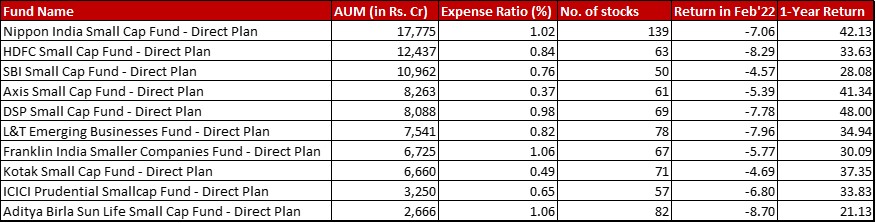

Fund category definition: Funds with minimum 65{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} portfolio allocation to Small Cap (251 and beyond by market cap size) stocks

Benchmark: Nifty Small Cap 250 TRI with a change of -9.31{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in January 2022 and a 1-year return of 30.07{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}

All data as on: 28th February, 2022

Summary

Unlike last month, this time all the ten funds have performed better than the benchmark, falling lesser in varying degrees.

Axis continues it’s upward ascent, now going above DSP to go to the fourth spot. When compared to SBI, the gap is quite a bit. But, Axis still atleast allows for some lumpsums and no SIP restrictions unlike SBI which only allows for SIPs up to R. 25,000. So, it would be interesting to see how it pans out.

As for expense ratio, Axis remains at the ridiculously low level of 0.37 when even index funds charge 0.30{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}!

Axis and ICICI are two funds to have reduced their number of stocks by a significant four counts.

Market Cap Allocation

Axis has reduced it’s equity exposure by a massive 5.03{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}! This comes at the back of 2.13{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} cut in Mid Cap and 2.73{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} cut in Small Cap while Large Cap has seen a miniscule increase of 0.17{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

ICICI has increased it’s Small Cap allocation by 2.36{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} taking it to a heavy 93.46{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}!

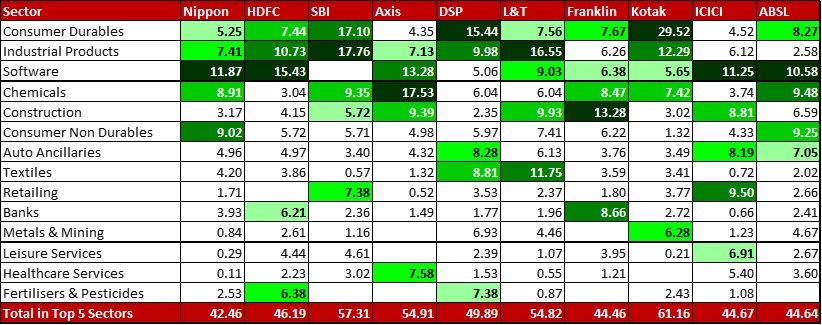

Top 5 sectors

In Nippon, Consumer Durables has nicked out Industrial Capital Goods from the top 5 sectors by a small margin.

With an increase of 0.70{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to Bank of Baroda, Banks replace Consumer Non Durables in HDFC’s fifth heaviest sector.

With a big 3.70{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} allocation to the newly listed parent brand of Manyavar, Vedant Fashions, SBI has put it’s weight behind Retail making it their fourth highest sector edging out Consumer Non Durables from the fifth.

With a slight 0.20{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} reduction in JM Financial, Finance gets edged out as the fifth sector by Leisure Services in case of ICICI. Anyway, their biggest stock Inox falls under the latter sector.

With a slight increase in all auto ancilliaries holdings and a new 0.22{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} allocation to Pricol, the sector edges ahead of construction in this month.

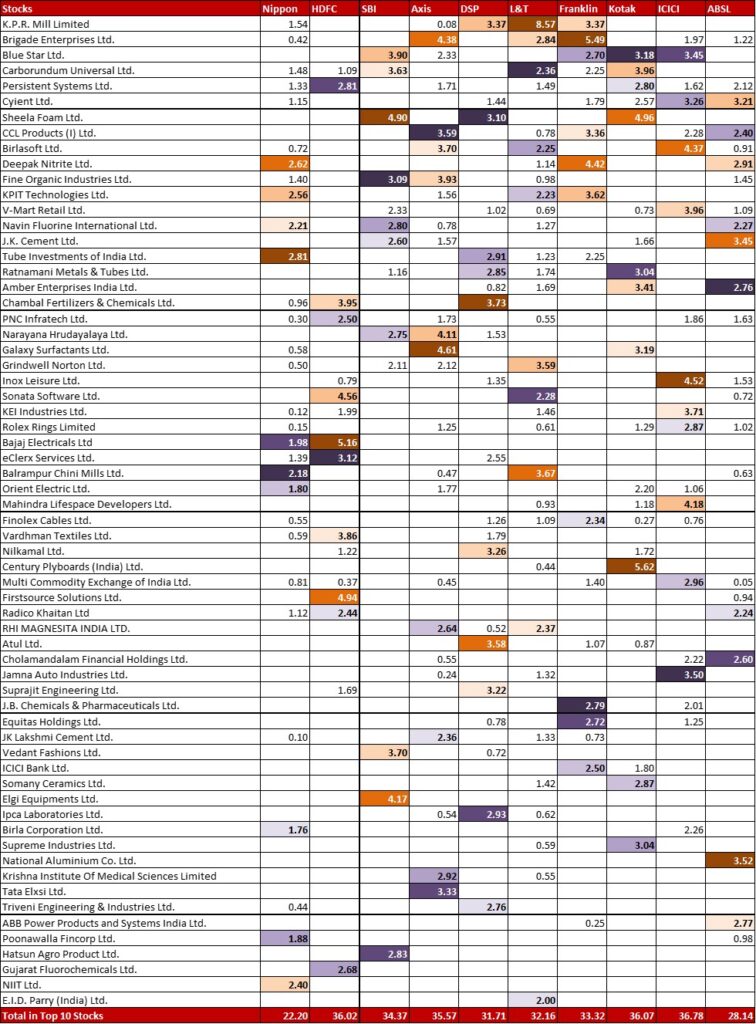

Top 10 Stocks & Movement

In Small Cap, the odds of a significant change of 0.80{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} and above are much lesser. Hence, just for this category I am reducing the requirement to 0.50{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. The one thing to note here is that in the last month, the share price of Bluestar increased by a whopping 23{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}! Yup, in one month. In most funds, this shows up with an increase in allocation to the stock.

Nippon has increased it’s allocation in Credit Access Grameen by 0.51{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} along with significant new positions in Adani Ports (0.50{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Pfizer (0.65{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

In HDFC, the biggest stock Firstsource Solutions gets a 0.73{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} trim while Vardhman Textiles and Bank of Baroda get a boost of 0.52{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} and 0.70{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} respectively.

SBI has been out shopping. Two new positions – Vedant Fashions (3.70{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Nuvoco Vistas (1.04{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) while Bluestar has increased by 0.84{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. On the other hand Elgi Equipments is trimmed down by 0.50{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} and GR Infra Projects by 0.64{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

Axis has trimmed it’s allocation to Tata Elxsi by 0.80{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} and to JK LLakshmi Cement by 0.52{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} while seeing a hike of 0.61{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in Bluestar.

DSP also has a 0.70{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} allocation to the newly listed Vedant Fashion while Kirloskar Ferrous Industries has been trimmed down to a negligible 0.07{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. Some other developments include a 0.54{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} trim to Suprajit Engineering and a 0.62{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} increase in Ratnamani Metals & Tubes.

L&T has two symmetrical changes. 0.48{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} out with an exit from Firstsource Solutions and into increase Bank of Baroda allocation to 0.80{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. Similarly, 0.55{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} trim from Welspun India and in to RHI Magnesita taking it up to 2.37{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}, Although for a small cap fund, having more than 8{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in one stock makes me wary.

Franklin has reduced it’s allocation to KPIT Technologies by 0.49{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} while Bluestar sees an increase of 0.65{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in this fund.

Kotak is also a Bluestar beneficiary with the stock increasing in allocation by 0.67{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} while Ratnamani Metals and Alembic Pharma also saw increases of 0.51{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} and 0.56{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} respectively. There is a new 0.50{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in Whirlpool.

ICICI has been very busy whacking off three big, whole positions in Advanced Enzyme Tech (1.26{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Motilal Oswal Financial Services (0.92{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and CAMS (0.87{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) along with a trim in GR Infra projects of 1.21{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. On the other hand, there are also significant upticks in Mahindra Lifespaces (0.91{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Bluestar (0.84{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Metropolis Healthcare (0.77{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Go Fashion (0.49{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

Aditya Birla two fairly symmetric moves – Exit of a 0.69{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position from Heritage Foods and addition of a new 0.63{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in Balarampur Chini.

Check out the other categories and what the funds there were up to:

Leave a Reply