Before I start off on any analysis in this segment, even at the cost of a repetitive bore I will put forth this disclaimer. All fund schemes are taken as direct. However, even if you are a direct investor, hire a financial advisor that you trust who can guide with investments. Pay for your advice.

Fund category definition: Funds with minimum 65{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} portfolio allocation to Mid Cap (101-250 by market cap size) stocks

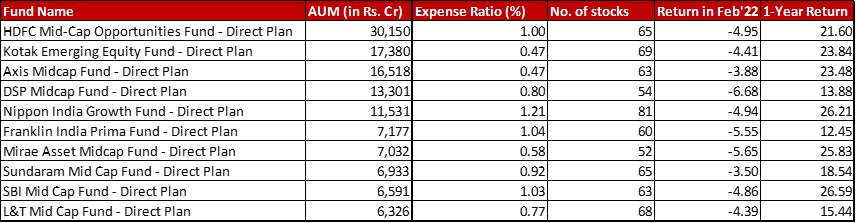

Benchmark: Nifty Mid Cap 150 TRI with a change of -6.72{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in February 2022 and a 1-year return of 21.71{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

All data as on: 28th February, 2022

Summary

Well well well. This is one of the two categories where all ten funds have done better and fallen lesser than the benchmark. Now, that’s a pleasant surprise.

As for the expense ratio, Mirae sees yet another increase, this time by 0.06{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to make it a 0.10{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} hike over the last two months. On the other hand, Kotak has come down by 0.06{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} while Franklin sees a cut of 0.03{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

Franklin’s gone for a bit of shopping with 4 extra stocks while Sundaram sees another month of rationalisation with four stocks lesser to carry.

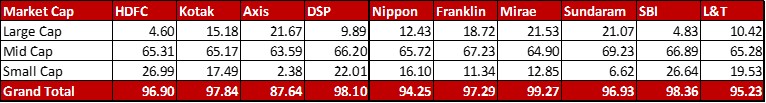

Market Cap Allocation

Not much of a change in this aspect to write home about. Slight reduction in Small Cap and simultaneous increase in Mid Cap for HDFC and DSP.

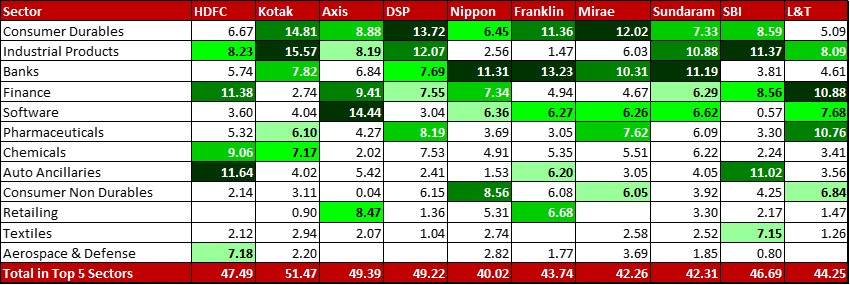

Top 5 sectors

Within sectors, the most discernible shift is in Franklin. Consumer Non Durables as a sector sees a cut of 1.28{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. This is led, in a major part, by a 1.08{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} cut in Tata Consumer Products.

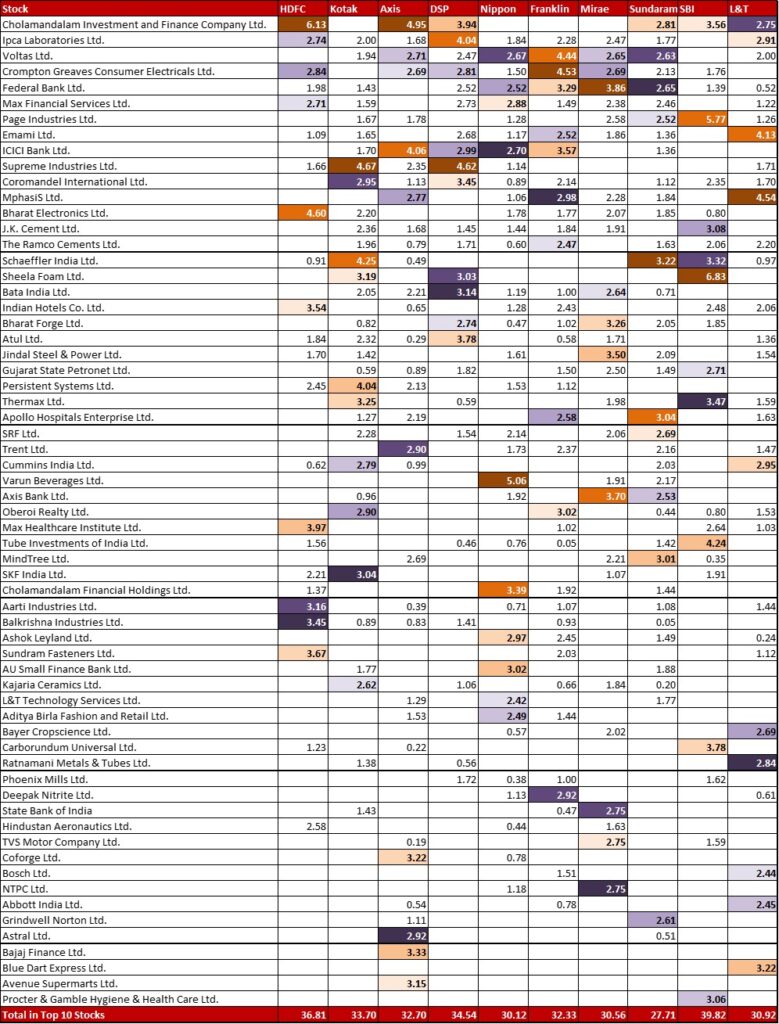

Top 10 stocks & Movement

Two significant movements in HDFC – increase of 0.85{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in Cholamandlam Investment and Finance while there is a 0.78{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} reduction in Balkrishna Industries.

This is another category where Kotak has taken an allocation to the newly listed Vedant Fashion (0.75{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), maker of Manyavar brand.

Nippon has increased it’s position in Axis Bank by 0.84{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} while completely exiting from it’s 0.73{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in L&T.

The Franklin fund manager has probably been the most active last month with quite a few noticeable moves – 1.31{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} reduction in HDFC Bank and 1.08{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} reduction in Tata Consumer Product. This has been redeployed in new positions – Max Healthcare (1.02{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Bharat Forge (1.02{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Infosys (1.01{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

Sundaram has reduced it’s allocation to MRF by a big 1.02{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} bringing it down to a tiny 0.39{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. It has also completely exited it’s 0.76{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in Aavas Financiers.

SBI has made one major move of increasing it’s allocation to P&G healthcare by 1.02{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

Check out the other categories and what the funds there were up to:

Leave a Reply