Before I start off on any analysis in this segment, even at the cost of a repetitive bore I will put forth this disclaimer. All fund schemes are taken as direct. However, even if you are a direct investor, hire a financial advisor that you trust who can guide with investments. Pay for your advice.

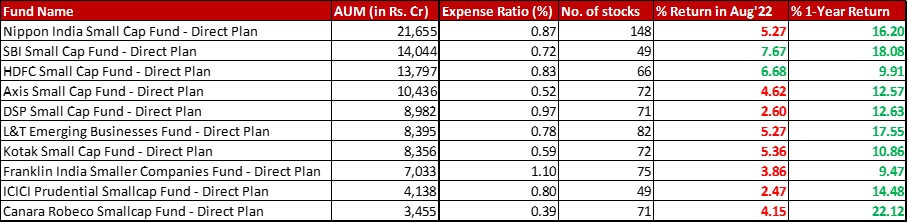

Fund category definition: Funds with minimum 65{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} portfolio allocation to Small Cap (251 and beyond by market cap size) stocks

Benchmark: Nifty Small Cap 250 TRI with a change of 5.82{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in August 2022 and a 1-year return of -6.01{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}

All data as on: 30th August, 2022

Summary

There is one significant change in the AUM ranking. SBI has inched ahead of HDFC to go up to the second spot. I see it as a sort of a coup, considering for quite a while SBI has closed lumpsum inflows and limited it to monthly SIPs of Rs. 25,000. Clearly, their popularity continues.

In this category too, Nippon has reduced it’s expense ratio by 15 basis points to drop down to 0.87{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

There is no significant change in the number of stocks with all funds keeping it limited to 5.

The one-year report card is still spotlessly green. However, for August the reds have increased with only two funds – SBI and HDFC having beaten the benchmark.

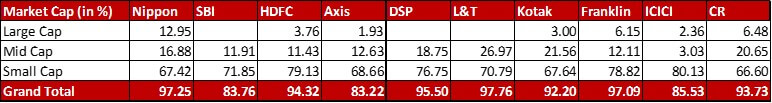

Market Cap Allocation

ICICI has followed it’s trend from last month. It has further reduced it’s Small Cap allocation by 3.37{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}, resulting in an even lower equity exposure at 85.53{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. This is the only category with three funds in the sub-90{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} zone choosing to wait for more opportunities to deploy their cash – SBI, Axis and ICICI.

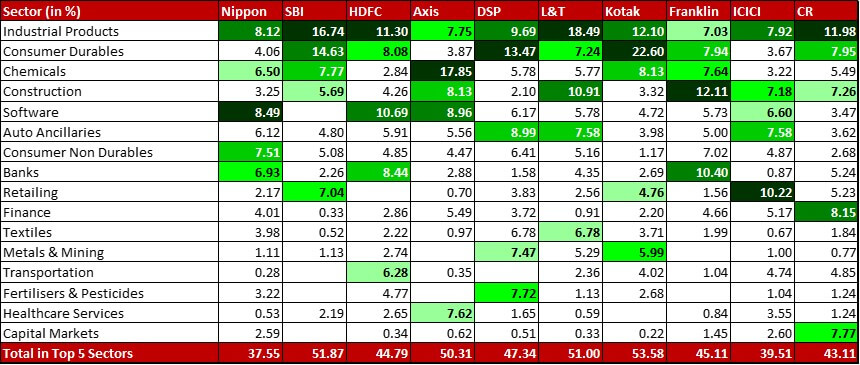

Top 5 Sectors

Kotak sees an organic swap between Software and Retailing, with the latter making space for itself in the Top 5 Sectors.

In Franklin, Industrial Products has edged out Consumer Non Durables organically.

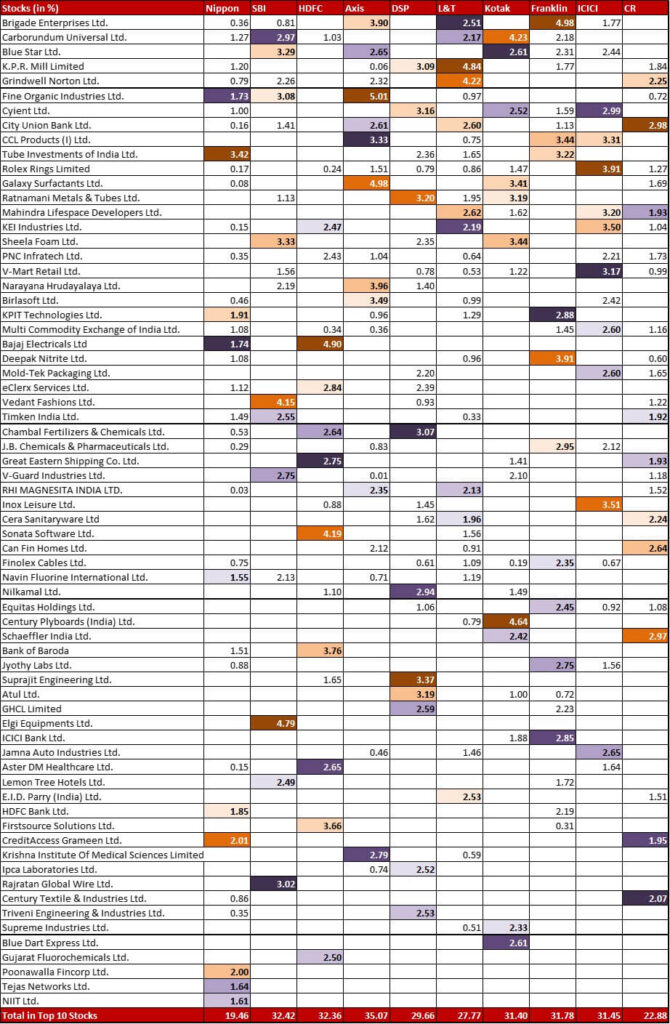

Top 10 Stocks & Movement

Stock Allocation Ranking Colour Code

With a lineup of more than 140 stocks, you know the fund will always have some leeway to experiment. This month sees five new entrants – Thyrocare Technologies (0.22{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Kirloskar Ferrous Industries (0.18{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Jubilant Ingrevia Limited (0.09{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) Equitas Small Finance Bank (0.09{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) after a gap of four months and Mishra Dhatu Nigam (0.01{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). The fund has only one exit of 0.73{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} from Sun Pharma.

SBI has buffered up it’s allocation to Elgi Equipment by 0.90{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to reach 4.79{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. The fund has two exits – Kirloskar Oil Engines (0.87{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Delhivery (0.07{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) now out after the IPO. There are two new entrants as well – a big position in PVR (1.53{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Westlife Development (0.43{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

HDFC has taken a new 0.47{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in Rolex Rings. On the other hand, the fund has two exits – Persistent Systems (0.66{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Aurobindo Pharma (0.40{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

There are two new additions in the DSP lineup – Rolex Rings (0.79{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Heritage Foods (0.49{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

L&T has cut down it’s position in Balarampur Chini Mills by 1.19{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to land at a lower than half allocation of 1.13{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. It has elevated the Mahindra Lifespace allocation by 0.96{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to reach 2.62{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. The fund has taken a new 0.71{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} allocation to Kirloskar Pneumatic Company while exiting the 0.74{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in Ipca Labs.

Franklin has added two stocks – Syrma SGS Technology (0.94{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Kirloskar Pneumatic Company (0.73{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). It has also exited the tiny 0.09{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position out of Latent View Analytics.

ICICI has massively cut down by 1.60{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} it’s position in Home First Finance Company to bring it down to a barely-there 0.06{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

Canara Robeco has four big new additions – Rolex Rings (1.27{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), MCX (1.16{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), KEI Industries (1.04{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Westlife Development (0.68{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

Check out the other categories and what the funds there were up to:

Leave a Reply