Before I start off on any analysis in this segment, even at the cost of a repetitive bore I will put forth this disclaimer. All fund schemes are taken as direct. However, even if you are a direct investor, hire a financial advisor that you trust who can guide with investments. Pay for your advice.

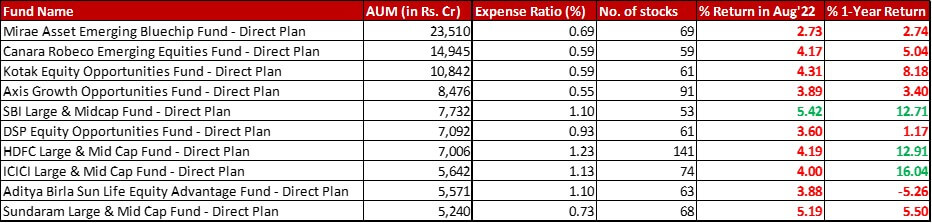

Fund category definition: Funds with minimum 35{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} portfolio allocation to Large Cap (top 100 by market cap size) stocks and 35{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} allocation to Mid Cap (101-250 by market cap size) stocks. Remaining 30{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} is as per fund management.

Benchmark: Nifty LargeMid Cap 250 TRI with a change of 5.21{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in August 2022 and a one-year return of 8.79{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

All data as on: 30th August, 2022

Summary

In terms of ranking, ICICI and Aditya Birla continue their game of swap with the former at seventh spot this month.

SBI has reduced it’s expense ratio by 5 basis points, still landing at a high 1.10{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. ICICI has also cut down it’s expense ratio by 6 basis points, yet remaining at 1.13{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

SBI is the only fund with a slightly noteworthy trim in the number of stocks, bringing it down from 57 to 53.

These moves seem to be working considering SBI was the only one to beat the benchmark this month. In terms of one-year performance, SBI is joined by ICICI and HDFC to be in the green and with returns more than the benchmark. Aditya Birla is the only fund to have a negative one-year return.

Market Cap Allocation

SBI has cut down it’s Large Cap allocation by a little over 3{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}, spreading it out between Mid and Small Cap. The total equity exposure too is down by over 3{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} making this the only fund with a sub-90{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} allocation.

DSP has also reduced it’s Large Cap allocation by 2.32{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} with some of it going to Mid Cap while also reducing it’s equity exposure by a bit.

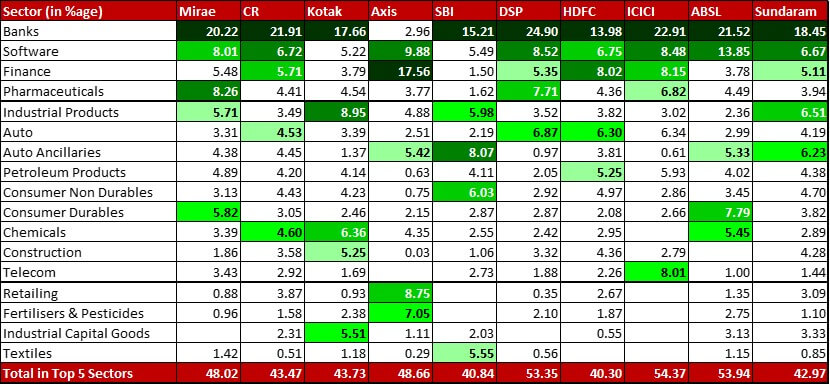

Top 5 Sectors

In Mirae, Finance and Industrial Products see an organic swap.

Chemicals and Pharmaceuticals swap for the fifth position in Canara Robeco fund this month.

Industrial Capital goods has nudged out Software for the fifth sectoral position in the Kotak portfolio.

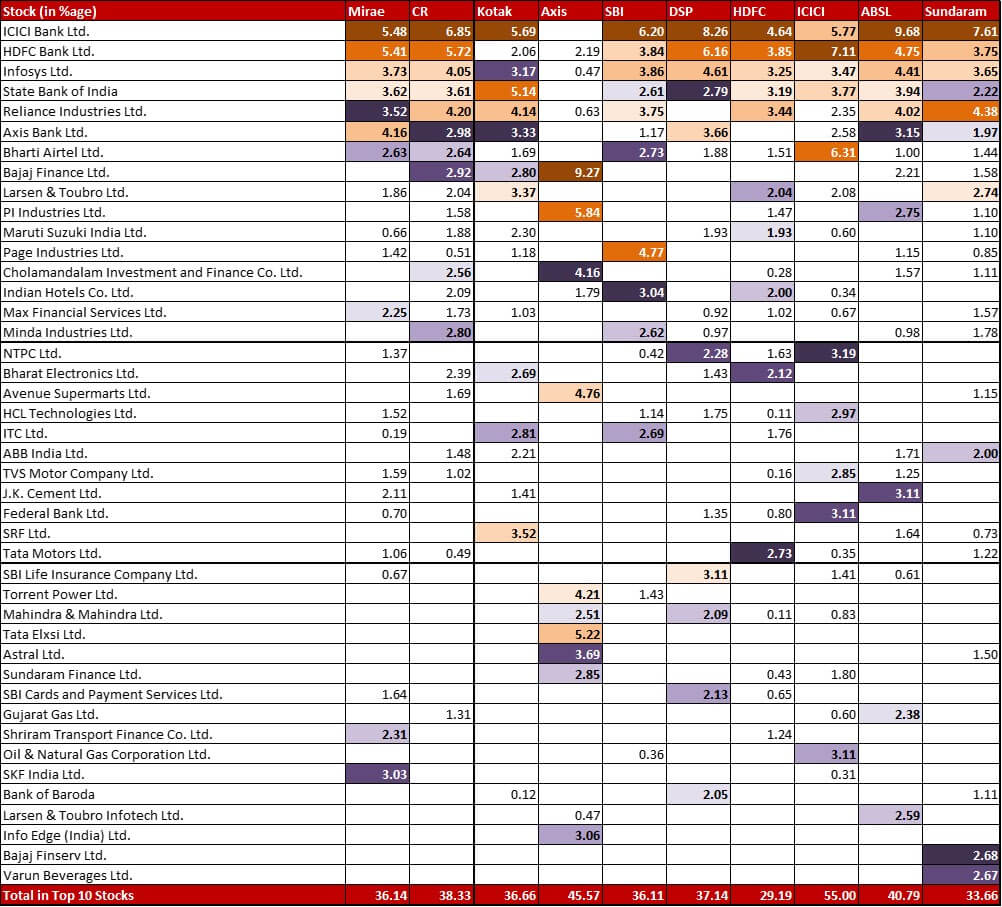

Top 10 Stocks

Mirae has a new 0.76{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} allocation to PB Fintech. The fund has also made three exits – Ashok Leyland (0.62{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Kansai Nerolac (0.19{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Bharat Electronics (0.19{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

Canara Robeco is another fund to have reduced Reliance Industries allocation by a substantial 1.10{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} bringing it down to 4.19{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. The fund also sees a price-based 0.76{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} increase in the Bajaj Finance allocation taking it up to 2.95{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. There are two need additions – Titan (0.69{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Page Industries (0.41{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). There’s also a minor exit from the 0.09{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position of Indraprastha Gas.

Axis sees Bajaj Finance bounce back with a 1.41{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} increase in allocation, although that is less than the 33{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} increase in price the stock saw. There’s a small exit from the 0.08{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} allocation in Rainbow Children’s Medicare which was there in the portfolio for a mere two months.

In SBI, as mentioned earlier Infosys sees an increase of 1.00{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to go up to 4.34{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. Muthoot Finance sees a big increase from 0.04{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to 1.64{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. There is a new 0.27{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} addition to Persistent Systems. On the other hand, the fund has exited from Zydus Wellness (0.66{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Prataap Snacks (0.21{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

DSP has been fairly quiet this month. There is a new 0.63{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in AU Small Finance Bank. There are also three exits from the fund – Godrej Consumer Products (0.66{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), KEI Industries (0.46{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Cholamandlam Finance & investments (0.18{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

HDFC has three new positions – Bata India (0.76{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), AU Small Finance Bank (0.56{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and HDFC Life Insurance Company (0.49{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

ICICI has beefed up on Alkem Industries by 0.93{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} (more than doubling it to 1.66{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and by 0.85{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in Axis Bank (now at 2.58{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). Tata Motors is back in the fray (0.35{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) after a hiatus of three months with it’s last exit from the fund in April 2022. There are two additional new positions – EPL Ltd (0.31{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and HPCL (0.26{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). To balance it out, the fund also has three exits – AIA Engineering (0.34{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Polycab India after a mere three months (0.21{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Gillette India (0.04{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

In the case of Aditya Birla, Reliance continues to get a trim, this month of 0.94{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} (taking it further down to 4.02{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). Rolex Rings has got a massive uplift going up from a tiny 0.02{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to a much more substantial 0.95{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. The fund also has two minor exits – Hindalco (0.46{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Tata Steel with a five month sojourn (0.29{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

Sundaram has had a quiet month with just one exit – Gujarat Gas (0.22{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

Check out the other categories and what the funds there were up to:

Leave a Reply