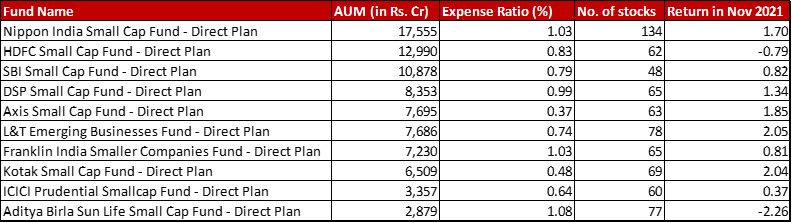

Before I start off on any analysis in this segment, even at the cost of a repetitive bore I will put forth this disclaimer. All fund schemes are taken as direct. However, even if you are a direct investor, hire a financial advisor that you trust who can guide with investments. Pay for your advice.

Fund category definition: Funds with minimum 65{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} portfolio allocation to Small Cap (251 and beyond by market cap size) stocks

Benchmark: Nifty Small Cap 250 TRI with return of -0.34{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in November 2021

All data as on: 30th November, 2021

Summary

This month sees another jump for Axis with a slight nudge ahead of the L&T fund. The action between Franklin, Axis and L&T with a range of 300 Crores only is pretty heated anyway.

As for the expense ratio, brace up for something eye popping. Nippon has increased it by a whopping 0.17{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} which translates to a hike of almost 20{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}! I was so surprised that I double checked to see I got it right and this has come into effect from 25th of last month. Rest of the funds are pretty much same as last month.

Aditya Birla and HDFC were the only two funds that under performed the benchmark with all others being in the green, unlike the slight red performance for the benchmark.

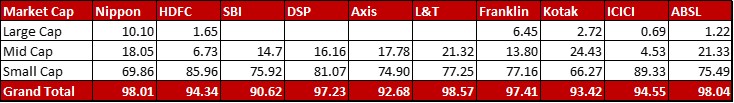

Market Cap Allocation

There are no major changes in the market cap allocation per se. Nippon and Kotak remain the lowest on small cap with a sub-70{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} allocation.

SBI and Kotak have increased their cash component with a reduction in equity exposure by 2.53{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} and 1.69{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. While ICICI has increased it’s equity exposure by 1.04{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. Rest of the changes are not really worth a mention.

Top 5 sectors

In HDFC auto ancillaries has become the fifth biggest sector nudging out banks by a slim margin.

In ICICI, software has seen a fairly big increase of 2.22{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} which has moved that sector from fourth biggest to making it the lion’s share. This comes on the back of two additional stocks – Zensar Technologies and Latent View Analytics.

While in ABSL, Auto Ancillaries edged out Finance by a whisker.

Mind you, the slipping in sector weights for Banks and Finance could be because both those sectors did take a bit of a beating last month.

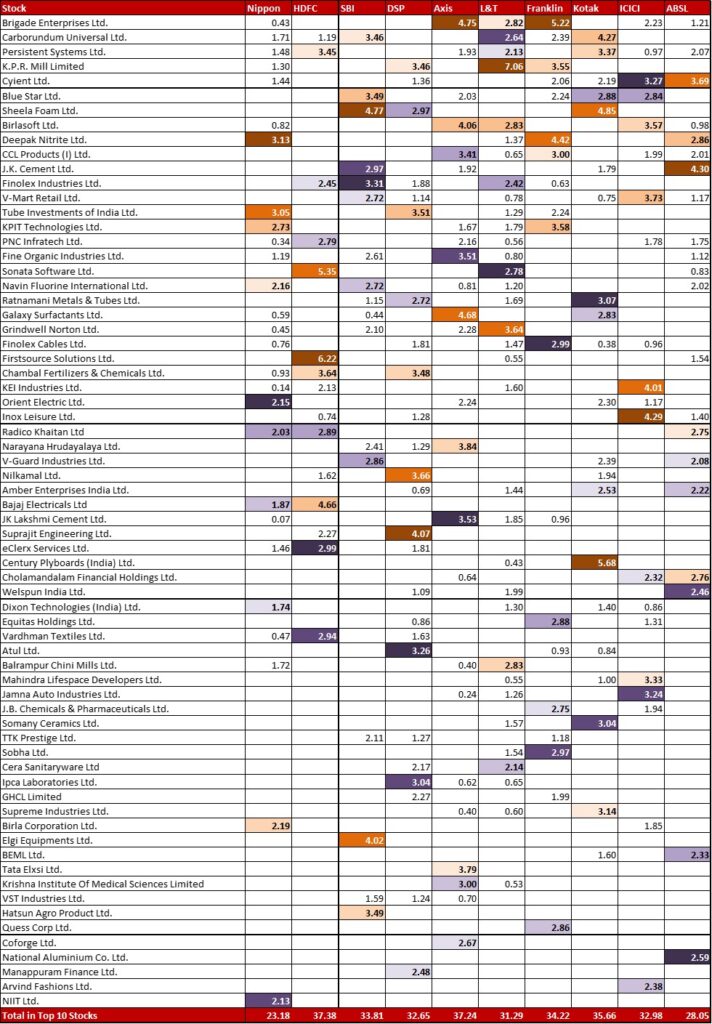

Top 10 stocks

I think in this case I still need a bit more of method to the madness considering just how spread out this terrain is. Even when I do, I will mention it only in case there is atleast a 1{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} movement.

But, there were some interesting patterns I could notice. In SBI, Sheela Foam’s allocation increased by 1{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to make it the heaviest stock at 4.77{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. In fact, Sheela Foam sees an increase of almost 1{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in the Kotak portfolio as well. I thought that was a little strange and a little digging revealed that this particular stock gained a crazy 30{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in that one month of November!

In Axis, Birlasoft has increased by 1.20{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to become the third biggest stock. This stock too rose by 15{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in the month but that clearly played only a minor role in this increase.

Leave a Reply