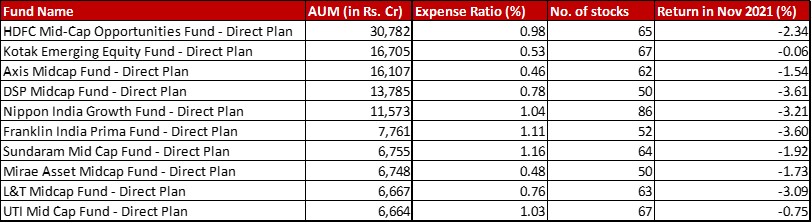

Before I start off on any analysis in this segment, even at the cost of a repetitive bore I will put forth this disclaimer. All fund schemes are taken as direct. However, even if you are a direct investor, hire a financial advisor that you trust who can guide with investments. Pay for your advice.

Fund category definition: Funds with minimum 65{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} portfolio allocation to Mid Cap (101-250 by market cap size) stocks

Benchmark: Nifty Mid Cap 150 TRI with return of -1.31{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in November 2021

All data as on: 30th November, 2021

Summary

It’s not a very pretty report card with only Kotak and UTI managing to beat the benchmark in the month. In terms of AUM, Kotak, Mirae and Axis were the only three funds with an increase.

In terms of AUM ranking, Mirae jumps another spot to go over L&T Mid Cap which has slipped to ninth spot. The last four funds in the category anyway look pitched in a stiff battle.

Even with the performance that it has, L&T sees a hike of 0.06{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in expense ratio, with four stocks getting added.

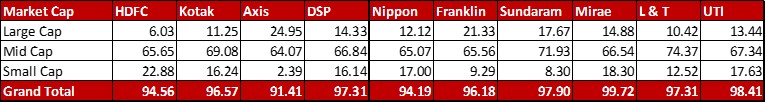

Market Cap Allocation

The only noteworthy action in this respect is an approximately 2{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} cut in equity exposure in the case of Nippon whereby it’s fallen from 96.50{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to 94.19{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

Within these funds, Franklin and Axis remain the more conservative ones with a more than 20{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} allocation to Large Caps with most other funds choosing to side with Small Caps instead.

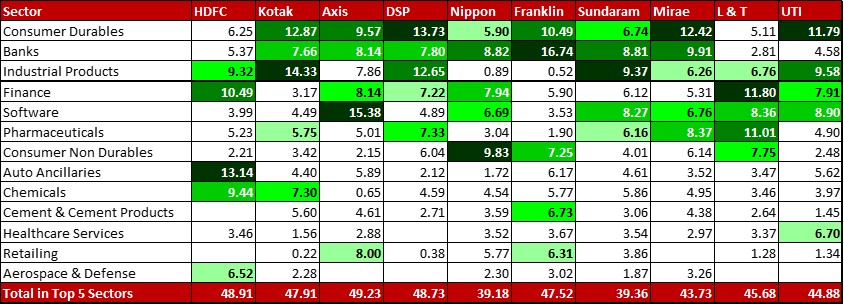

Top 5 sectors

Aerospace & Defence seems to have nudged out Consumer Durables in the case of HDFC’s portfolio. In the case of Kotak, pharma has edged out Cement & Cement Product for the fifth highest sector.

In Nippon, Finance has been trimmed from 10.13{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to 7.94{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}, shaving a cool 2.19{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} taking it from the highest to the third highest sector allocation.

In most other funds, there’s a slight bit of juggle between the same sectors as before probably thanks to the differing valuations.

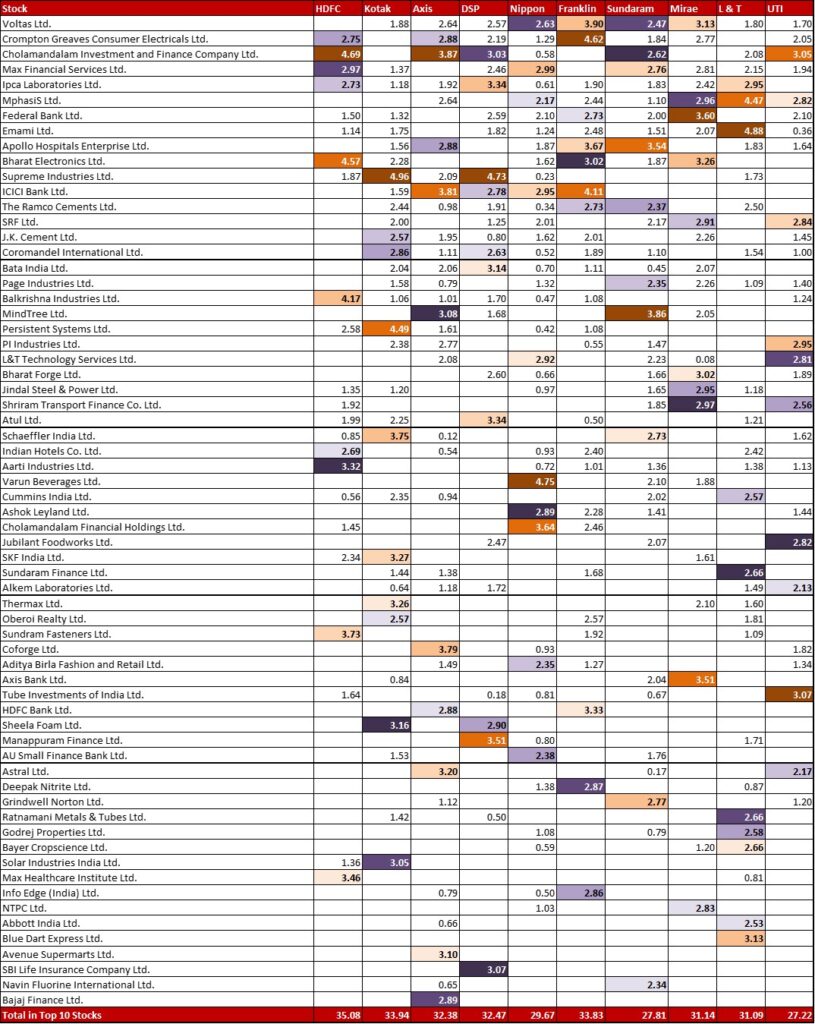

Top 10 stocks

HDFC has increased it’s allocation in Aerospace & Defence by adding a 1.95{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in Hindustan Aeronautics.

With Nippon, the reduction in Finance has happened thanks to exiting it’s position in SBI Cards & Payments while trimming a few other positions.

Leave a Reply