Before I start off on any analysis in this segment, even at the cost of a repetitive bore I will put forth this disclaimer. All fund schemes are taken as direct. However, even if you are a direct investor, hire a financial advisor that you trust who can guide with investments. Pay for your advice.

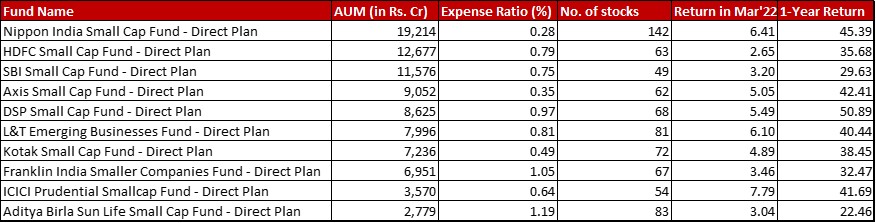

Fund category definition: Funds with minimum 65{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} portfolio allocation to Small Cap (251 and beyond by market cap size) stocks

Benchmark: Nifty Small Cap 250 TRI with a change of 6.28{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in January 2022 and a 1-year return of 37.02{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}

All data as on: 31st March, 2022

Summary

Unlike last month when all funds showed higher resilience with a lesser drop, this month most funds have also risen lesser than the benchmark, the exceptions being Nippon and ICICI. However, when you look at a one-year performance, then the benchmark-beating list is far longer – Nippon, Axis, DSP, L&T, Kotak and ICICI.

In terms of AUM, Kotak has moved one up to go on to seventh spot, beating Franklin off that place.

Nippon continues it’s bewildering expense ratio trend, slashing it from 1.02{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to 0.28{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. HDFC has reduced its’ expense ratio by 0.05{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} while Aditya Birla has done so by 0.13{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

Market Cap Allocation

Even after a 5{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} cut, Axis continues the trend of further slashing it by 2.63{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} mostly in the small cap exposure. That means it is now down to 81.96{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}, while the next in queue is atleast 9{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} more! Axis is known to get high on cash and that has often helped them with a consistent performance. Let’s see if that strategy works out again.

ICICI is another fund to have cut down it’s equity exposure by almost 5{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}! So the fund is down from 97.84{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to 92.95{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

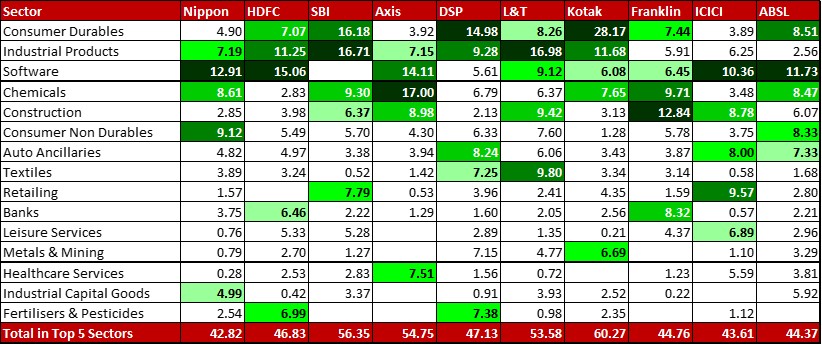

Top 5 sectors

In Nippon, Consumer Durables and Industrial Capital Goods continue to play ping pong for the fifth spot.

Surprisingly, no other fund has much of a sectoral shift worth mentioning about.

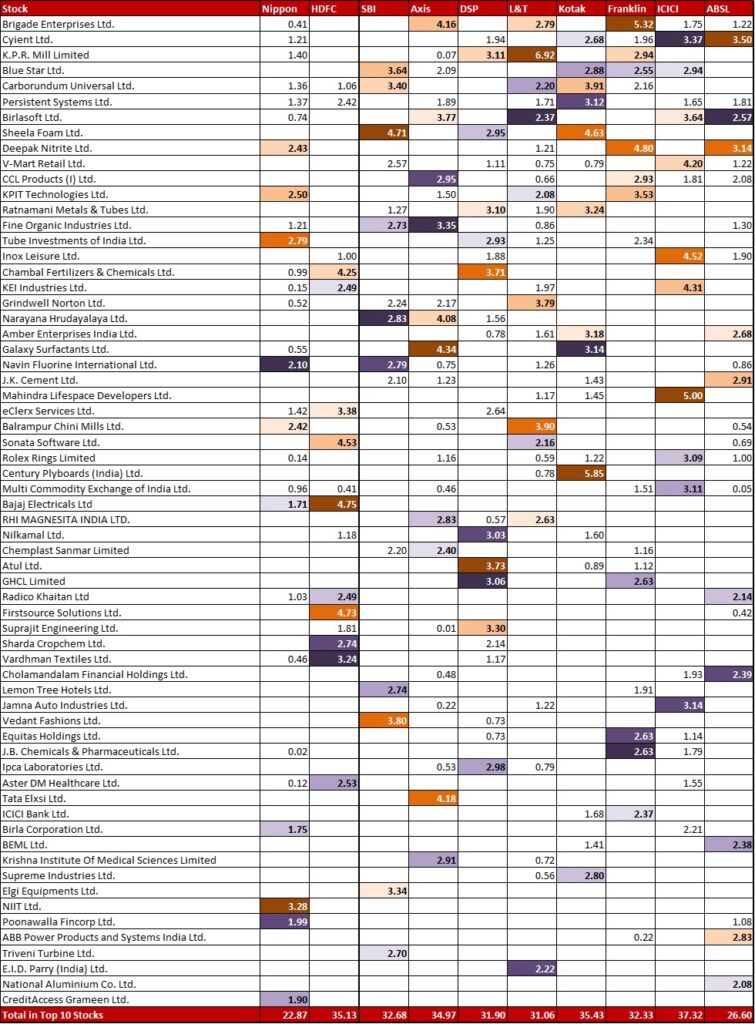

Top 10 Stocks & Movement

Nippon has increased it’s allocation in NIIT by 0.88{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to make it the biggest stock at 3.28{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

SBI has an increase and reduction in very similar quantities, worth mentioning about – increase in Ahluwalia Contracts (0.85{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) while trimming exposure in Elgi Equipments (-0.83{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). Last month too, SBI trimmed Elgi Equipments by 0.50{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

Axis has increased its’ exposure to Tata Elxsi by 0.85{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}, zooming it up to the second highest stock by allocation. Funnily enough, the same stock made it to last months’ analysis with a 0.80{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} trim. Some see-saw this is.

L&T has made a welcome change. Last month, their 8.57{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} allocation to K.P.R. Mills was making me a bit comfortable considering it is a Small Cap fund. In March that exposure was trimmed by 1.65{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to come down to 6.92{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

Kotak has taken a big, bold new position of 1.00{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in Shoppers Stop. So, you know they are betting on the pull of offline shopping.

ICICI has beefed up it’s exposure to Mahindra Lifespaces by 0.83{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to land at 5.00{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} while making an exit from two substantial positions – J.M. Financial (0.95{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and G R Infra Projects (0.81{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

Check out the other categories and what the funds there were up to:

Leave a Reply