Before I start off on any analysis in this segment, even at the cost of a repetitive bore I will put forth this disclaimer. All fund schemes are taken as direct. However, even if you are a direct investor, hire a financial advisor that you trust who can guide with investments. Pay for your advice.

Fund category definition: Funds with minimum 65{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} portfolio allocation to Mid Cap (101-250 by market cap size) stocks

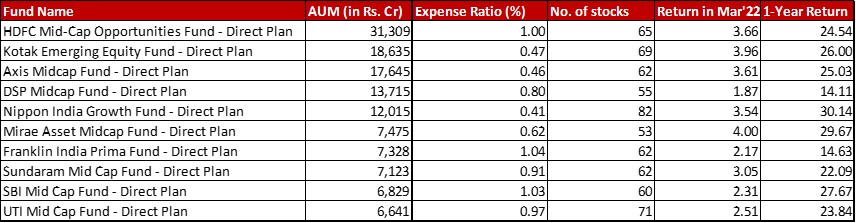

Benchmark: Nifty Mid Cap 150 TRI with a change of 4.84{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in March 2022 and a 1-year return of 25.05{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

All data as on: 31st March, 2022

Summary

This month, all funds have wiped off the good record from last month. None of the funds managed to better the benchmark. However, with respect to the 1-year performance Kotak, Axis, Nippon, Mirae and SBI have done better than the benchmark.

In terms of AUM, Mirae moves up one spot pushing Franklin one behind. As for the tenth spot, UTI has edged out L&T.

In the expense ratio, here too Nippon follows the strange trend of slashing it’s expense ratio from 1.21{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to 0.41{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

In the number of stocks, there’s no substantial change worth mentioning.

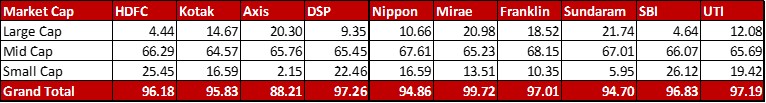

Market Cap Allocation

Kotak has reduced it’s overall equity exposure by about 2{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} with some trimming across market caps. Nippon has changed it’s colours keeping the boundary mostly same by cutting down some of it’s large cap allocation and adding it on to Mid Cap. Sundaram has also reduced it’s equity exposure by about 2.22{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} with a haircut to the mid cap allocation.

However, in this category too Axis is yet again the only fund to have it’s equity exposure down to the late 80s. The next fund has a gap of about 6.50{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in terms of equity exposure.

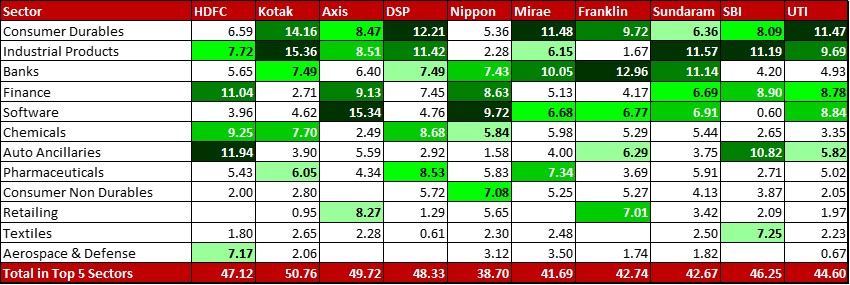

Top 5 sectors

In DSP, the fund has increased it’s allocation to 3 of the 4 chemicals stocks (Atul Ltd, Tata Chemicals and Linde India) leading to the sector becoming the third highest and edging out Finance from the Top 5.

Nippon has increased it’s allocation to Chemicals with a new 0.66{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} exposure to Tata Chemicals edging out Consumer Durables where Voltas got a 1.03{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} haircut to touch down to 1.64{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

In Mirae, Consumer Durables moves out of the Top 5 thanks to a 0.60{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} cut in Colgate Palmolive and Industrial Products takes it’s place despite a bare minimum change in constituent stocks.

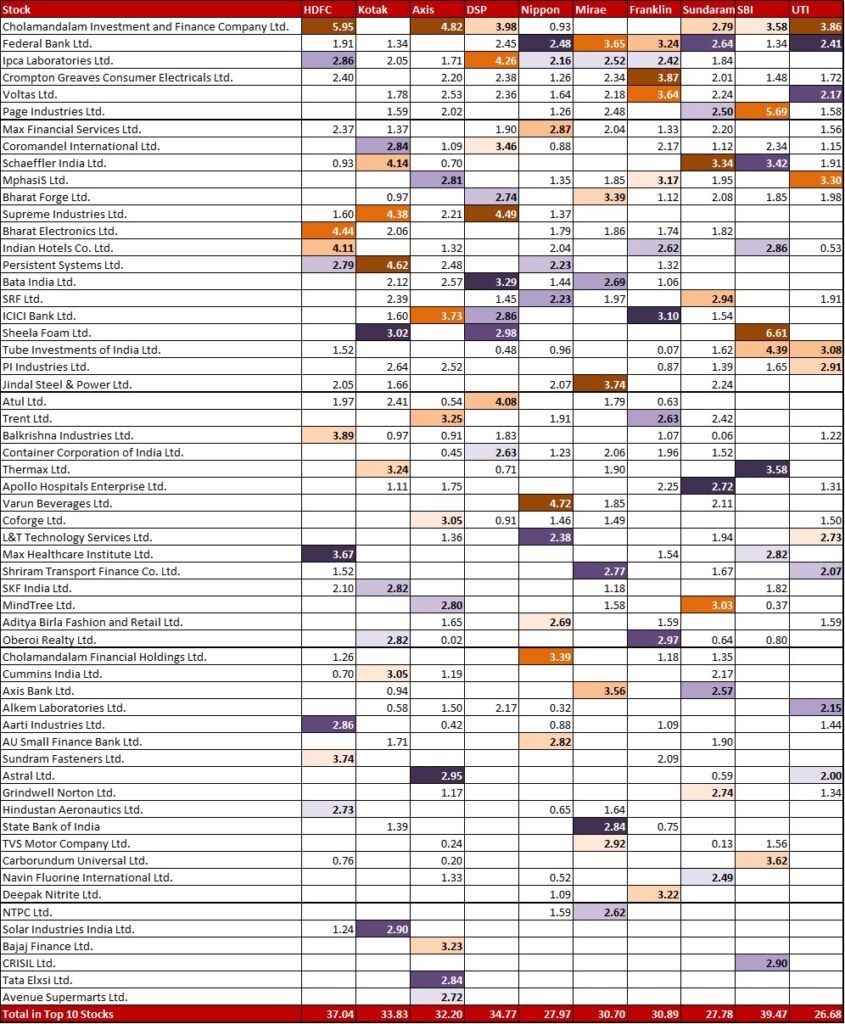

Top 10 stocks & Movement

DSP has reduced it’s allocation to Max Financial Services by 0.83{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} and Whirlpool by 0.98{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} (this brings down the exposure heavily to a mere 0.23{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

Although the headline numbers don’t reflect it, Nippon sees some massive changes, enough to make me go back to the original sheets and ensure I wasn’t making a mistake. So, Ashok Leyland and Voltas both get trimmed by 1.03{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} each, while Bank of Baroda gets beefed up by 0.83{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. Beyond that there are four major exits – ICICI Bank (2.70{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), J.K. Cement (1.44{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Maruti Suzuki (1.20{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Axis Bank (1.92{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). To make up for it, there are also three new substantial positions – Infosys (1.59{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Dr. Reddy’s Laboratories (1.54{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Cholamandlam Investment and Finance (0.93{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

Franklin is another fund to give a haircut to it’s Voltas exposure, of 0.79{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

Sundaram has made two noteworthy exits in the month – Ramco Cements (1.63{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Aarti industries (1.08{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

Mirae has two new additions worth a mention – Coforge (1.49{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Motherson Sumi Wiring (1.02{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

UTI and SBI have just one substantial change each. UTI has reduced it’s allocation to SRF by 1.41{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to come down to 1.91{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. SBI has completely exited its’ 0.80{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in Bharat Electronics.

Check out the other categories and what the funds there were up to:

Leave a Reply