Before I start off on any analysis in this segment, even at the cost of a repetitive bore I will put forth this disclaimer. All fund schemes are taken as direct. However, even if you are a direct investor, hire a financial advisor that you trust who can guide with investments. Pay for your advice.

Summary

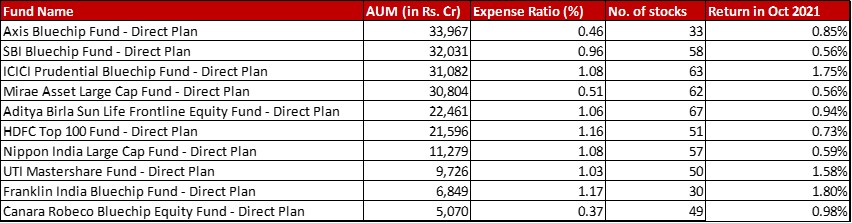

The large cap funds had a good report card to show for themselves overall. All of them beat both of the two benchmarks mostly used. So, while Nifty 50 TRI gave a return of 0.42{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} and Nifty 100 TRI gave a return of 0.30{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}, the top 10 funds in the category outperformed both these numbers without exception. Ideally, I do not recommend looking at the performance in the short term. However, it is still a valid enough thing to check if your funds are beating the benchmark consistently.

No drastic change in the expense ratio apart from 0.01{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} – 0.02{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} here or there. Even with the number of stocks, the changes are limited to 3 stocks up or down.

Market Cap Allocation

There is room for very little surprises in this category with a bulk of 80{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} reserved for a universe of mere 100 stocks. Axis remains the only fund in the ten which is a purely Large cap fund. ICICI remains the only fund of these ten with a microscopic exposure to US equity.

However, one thing to note is that Axis has reduced their equity allocation (and increased cash in effect) by almost 1.5{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. On the other hand, Franklin has increased it’s equity exposure by about 4{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}!

Top 5 sectors

Banks and Software remain the two favourites for the fund category, with Franklin being the only deviant to have the second biggest sector in cement. Even for the third biggest sector, while most funds have it at NBFCs or Petroleum products thanks to Reliance, Franklin has it at Pharma. This allocation seems to have worked for them in October leading to the fund spiking the most.

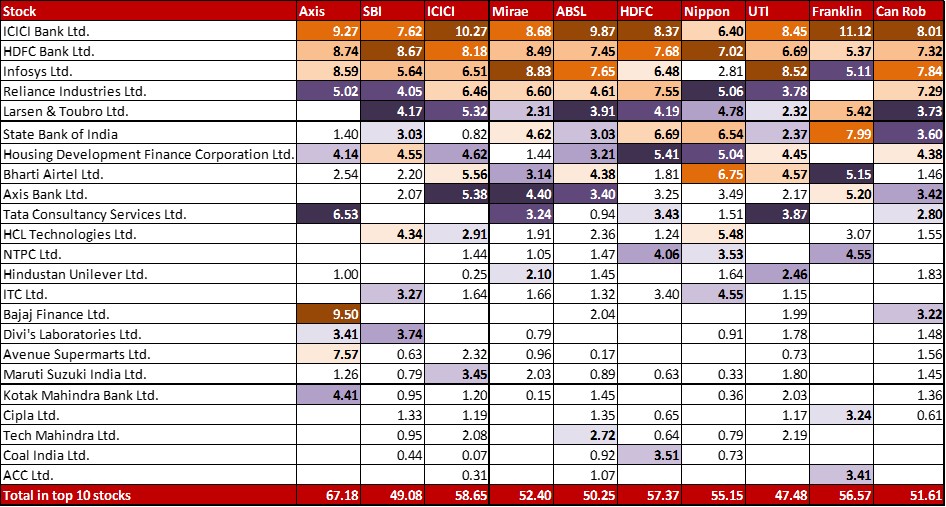

Top 10 stocks

ICICI Bank and HDFC Bank continue to be the darlings in this category, finding a place in the top 10 in all of these funds. In fact, the top 9 stocks seen above find a place in 90{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} of these mutual fund portfolios. Overall, the top 10 stocks haven’t seen much of a change.

Leave a Reply