Before I start off on any analysis in this segment, even at the cost of a repetitive bore I will put forth this disclaimer. All fund schemes are taken as direct. However, even if you are a direct investor, hire a financial advisor that you trust who can guide with investments. Pay for your advice.

Fund category definition: Funds with minimum 80{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} portfolio allocation to Large Cap (top 100 by market cap size) stocks

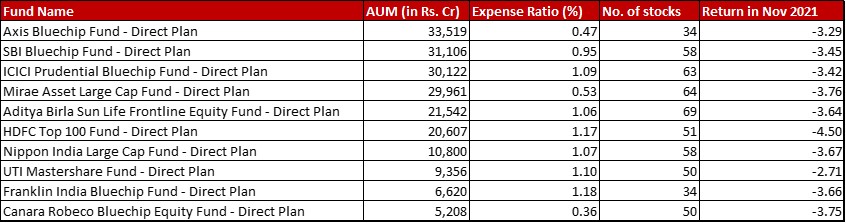

Benchmark: BSE 100 TRI or Nifty 100 TRI with return of -3.35{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in November 2021

Data as on: 30th November, 2021

Summary

Not a great month for Large Cap funds with only Axis and UTI managing to beat the benchmark by falling marginally lesser.

By size, the rankings remain pretty much unchanged.

Only Franklin has a noticeable increase in number of stocks, adding 4 to it’s kitty.

Market Cap Allocation

There is room for very little surprises in this category with a bulk of 80{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} reserved for a universe of mere 100 stocks. Axis remains the only fund in the ten which is a purely Large cap fund. ICICI remains the only fund of these ten with a microscopic exposure to US equity.

Even on the subject of equity exposure versus cash there has not been movement beyond 2{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in any of the funds.

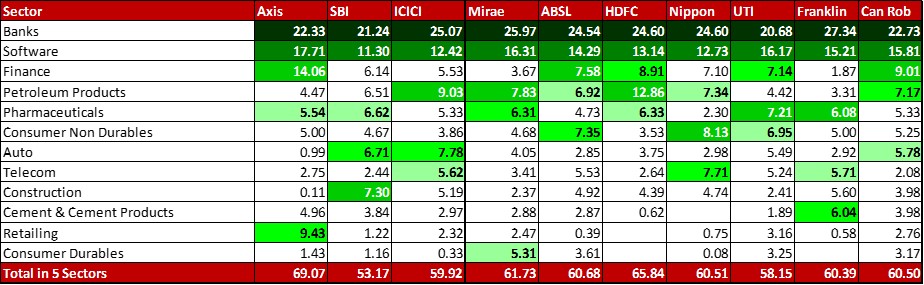

Top 5 sectors

Banks and Software remain the two favourites for the fund category. In fact, unlike last month where HDFC showed a slight deviation from this trend, even that falls in line for all funds to have the top 2 sectors common.

Of the funds, Nippon has had a bit of rejig. There’s been a 1.30{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} shaving off from Finance to moving it from the third highest to out of the top 5 sector list. On the other hand, Petroleum products has increased by 0.7{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to make it’s way to the top 5 sectors.

Franklin’s had a bit of a shuffle in the sectors as well. Software has increased from 8.18{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to 15.21{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. For third place, Pharmaceuticals have pushed Cement & Cement Products a place lower. Power as a sector has almost been halved in allocation from 6.17{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to 3.32{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} edging it out of Top 5 sectors to make place for Telecom with 5.71{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

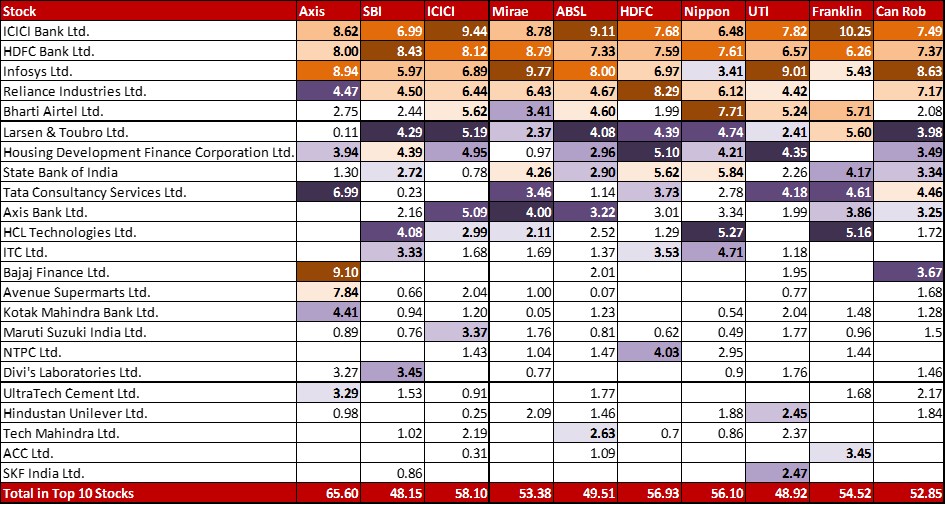

Top 10 stocks

With banking taking a hit in the last month, allocations for both ICICI Bank and HDFC Bank have reduced a bit in all funds. Franklin continues to steer clear of Reliance while L&T now finds a foot in the door in the only fund it was absent in – Axis.

TCS has probably had the biggest additions in the category with a small addition in SBI and a big 4.61{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} addition in Franklin Bluechip.

On the other hand, NTPC has been trimmed by about 0.58{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in Nippon and a big 3.11{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} by Franklin Bluechip. Franklin has also trimmed it’s allocation in Cipla by 1.11{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

Leave a Reply