Before I start off on any analysis in this segment, even at the cost of a repetitive bore I will put forth this disclaimer. All fund schemes are taken as direct. However, even if you are a direct investor, hire a financial advisor that you trust who can guide with investments. Pay for your advice.

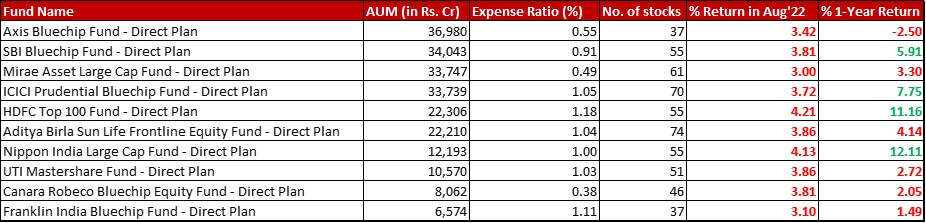

Fund category definition: Funds with minimum 80{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} portfolio allocation to Large Cap (top 100 by market cap size) stocks

Benchmark: BSE 100 TRI or Nifty 100 TRI with latter changing by 4.29{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in August 2022 and giving a 1-year return of 5.72{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}

Data as on: 30th August, 2022

Summary

In terms of AUM ranking, SBI has edged ahead of Mirae for the number two spot. The tussle between Aditya Birla and HDFC continues with the latter taking the lead this month.

Two of the pricey funds (with more than 1.00{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} expense ratio in Direct plans) have trimmed on their costs. Nippon has reduced it’s total expense ratio by 8 basis points to land at the round figure of 1.00{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} while Franklin India has trimmed it by 6 basis points to settle in at 1.11{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

There’s not much of a movement in the number of stocks, with the total numbers being one or two here and there from last month.

The August performance though is a full red scorecard with none of the funds having beaten the benchmark. Four funds – SBI, ICICI, HDFC and Nippon – are in the green for one-year performance with only Axis showing a negative trend (in absolute terms) for the period.

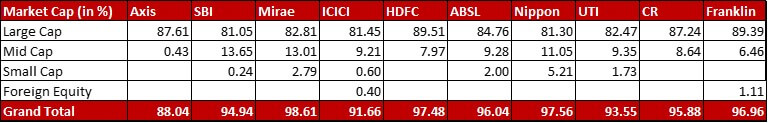

Market Cap Allocation

There is just one development worth mentioning. HDFC has exited it’s sole Small cap allocation of 0.59{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} from CESC to now hold only Large and Mid Cap stocks in the fund.

Axis, yet again, remains the only fund with a sub-90{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} equity exposure.

Top 5 Sectors

ICICI sees an organic swap between Pharmaceuticals and Construction, with the latter making the cut for the fifth sectoral spot this month.

UTI has increased it’s allocation to HDFC limited dramatically by 2.67{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} (from 3.57{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}, it’s now up to 6.24{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). This also results in the sectoral allocation of Finance going up from 6.42{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to 9.11{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} although it still remains third highest in the sectors.

Canara Robeco also witnesses an organic swap with Auto edging out Finance.

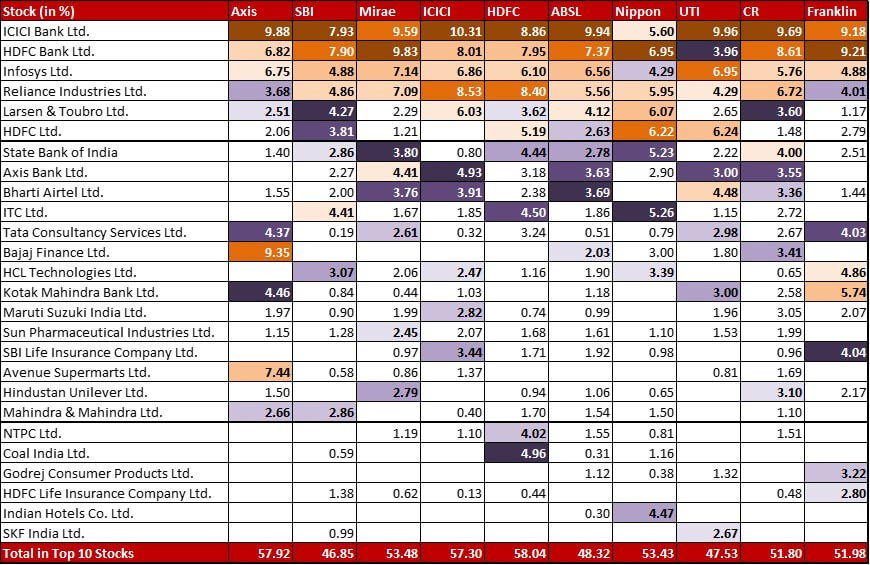

Top 10 Stocks & Movements

The share of Divi’s Laboratories in the Axis funds has been coming down for the last few months. This month, it’s trimmed by 0.83{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to land at 1.07{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. The fund has also made two small exits from Software stocks – Wipro (0.06{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Tech Mahindra (0.11{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

SBI just has one small exit – Mahindra & Mahindra Financial Services (0.32{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

Mirae has exited three stocks – Info Edge (0.18{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Equitas Holdings (0.12{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Equitas Small Finance Bank (0.05{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

ICICI has reduced it’s position in Infosys by 1.00{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} (taking it down to 6.86{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). The shears have also been used on Bharti Airtel to trim that position by 0.81{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} (now at 3.91{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). The fund has taken a substantial new 1.17{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in HDFC AMC (something to do with Prashant Jain’s exit?). It’s also exited a tiny two-month old position in Divi’s Laboratories (0.05{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

HDFC has added two new positions – Tata Consumer Products (0.43{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Zee Entertainment (0.43{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). Apart from the Small Cap stock exit mentioned above, there are two other exits – GAIL (0.45{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and ICICI Lombard General Insurance (0.06{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

Aditya Birla also has two new positions – Siemens (0.12{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Tata Consumer Products (0.10{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). There is just one exit from the fund – Lupin (0.17{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

Nippon has three new positions – Gland Pharma (1.01{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), United Spirits where they exited a minor position after experimenting for a month in June 2022 is now back (1.00{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Motherson Sumi Systems (0.50{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). They have also exited two stocks – Eicher Motors (0.26{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Aditya Birla Fashion and Retail (0.23{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

Balancing out the big increase in the HDFC Limited position is a trim of similar magnitude in HDFC Bank which sees a reduction of 2.79{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to bring it down to 3.96{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. This shuffle within the HDFC twins is the only significant change in the fund.

Canara Robeco has two new fairly chunky positions – SBI Life Insurance (0.96{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Sona BLW Precision Forgings (0.94{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). There is also a minor 0.07{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} exit from Divi’s Laboratories.

Franklin has reduced it’s position in Dabur by 1.00{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to land it down to 2.49{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. There are also two fairly big new additions – HDFC Limited (2.79{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Marico (1.00{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). There are some minor exits as well – Info Edge (0.48{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), AU Small Finance (0.33{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Coforge (0.33{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

Check out the other categories and what the funds there were up to:

Leave a Reply