Before I start off on any analysis in this segment, even at the cost of a repetitive bore I will put forth this disclaimer. All fund schemes are taken as direct. However, even if you are a direct investor, hire a financial advisor that you trust who can guide with investments. Pay for your advice.

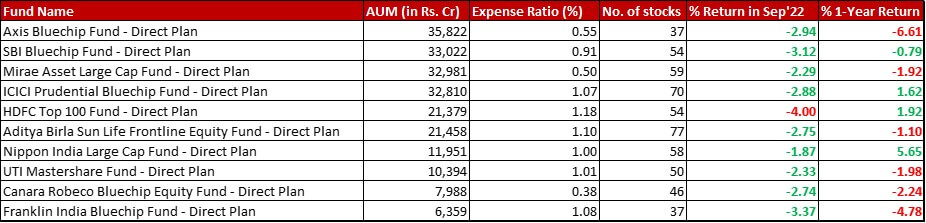

Fund category definition: Funds with minimum 80{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} portfolio allocation to Large Cap (top 100 by market cap size) stocks

Benchmark: BSE 100 TRI or Nifty 100 TRI with latter changing by -3.71{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in September 2022 and a 1-year change of -0.95{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}

Data as on: 30th September, 2022

Summary

There is no change in AUM rankings.

Aditya Birla Sun Life has increased it’s expense ratio by 6 bps, to inch up to 1.10{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} making it the second most expensive fund of the lot.

The month’s performance report card though is almost a complete U-turn as compared to the last one, with only HDFC shedding more than the benchmark. Although, in terms of one year performance nothing has changed with only four funds – SBI, ICICI, HDFC and Nippon having their number in the green.

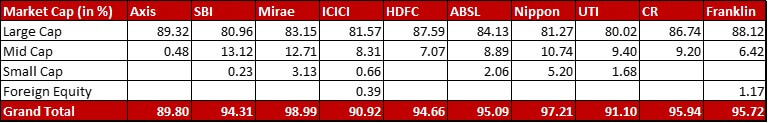

Market Cap Allocation

UTI has reduced it’s equity exposure by 2.45{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}, which is solely reflected in it’s Large cap allocation.

Axis on the other hand, has inched closer back to the 90{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} mark.

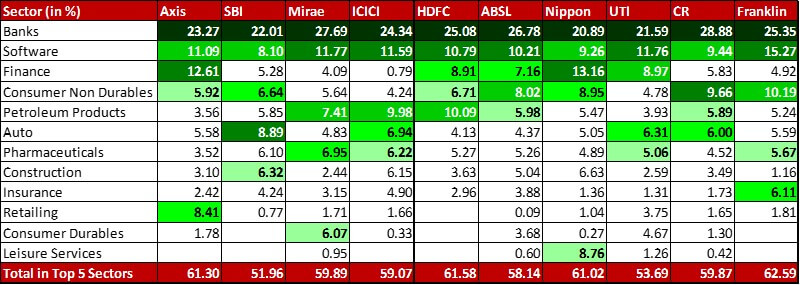

Top 5 Sectors

With a 45 basis points increase in the Britannia allocation, SBI sees Consumer Non Durables edge out Petroleum Products in the top 5 sectors.

In ICICI, Pharmaceuticals has organically edged out Construction from the Top 5 Sectors.

HDFC has trimmed it’s exposure to both Software and Petroleum Products. However, Petroleum sees a bigger cut with a 1.19{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} reduction in Reliance allocation leading to the sector dropping to third highest while Software has gone up to second highest.

There is an organic swap between Pharmaceuticals and Auto in the Franklin fund, with the former finding a place in the Top 5 Sectors this month.

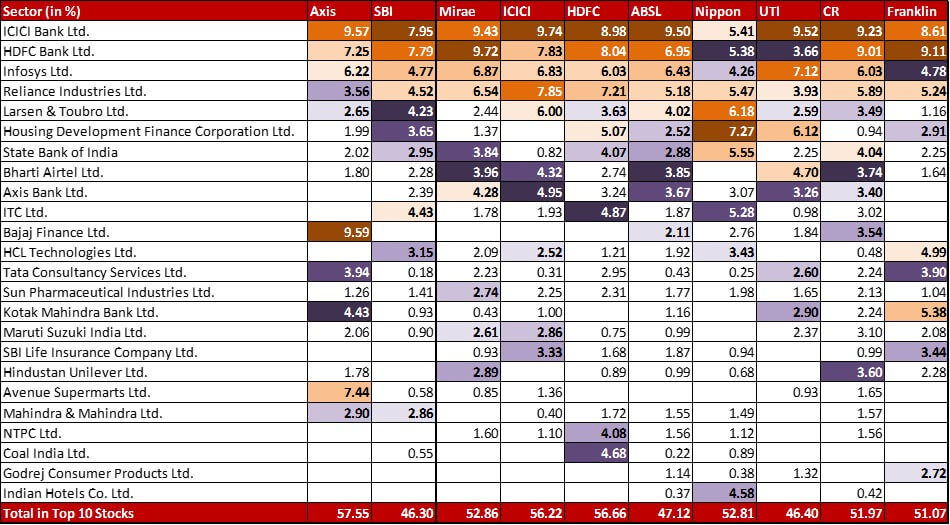

Top 10 Stocks & Movements

SBI has one minor change worth mentioning – it has exited from it’s 0.43{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in Crompton Greaves Consumer Electricals.

Mirae has one minor exit –Power Finance Corporation (0.04{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

ICICI has cut down it’s allocation to TVS Motors by 0.79{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}, bringing it down to 1.37{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. The fund has completely exited three stocks – Ambuja Cements (0.33{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), ACC (0.31{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and the barely-there Ipca Laboratories (0.01{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). It also has a few new additions – DLF (0.16{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Gland Pharma (0.09{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Power Grid Corporation (0.05{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

There are three exits this month – Power Grid (0.68{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Indian Oil (0.46{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Tech Mahindra (0.37{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). The fund has also added two stocks to it’s portfolio – Cholamandlam Investment and Finance (0.41{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and IndusInd Bank (0.28{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

Aditya Birla has only added to it’s portfolio with some new entrants – HDFC Life (0.64{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) after a hiatus of 5 months, Interglobe Aviation (0.36{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Apollo Hospitals (0.14{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

Nippon has done a bit of a balancing act between the HDFC twins, trimmed off 1.57{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} from HDFC Bank (now at 5.38{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and added 1.05{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to HDFC Limited (taking it up to 7.27{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). The fund also has an increased allocation (by 0.88{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) to Sun Pharma, which now stands at 1.98{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. There are four new stocks as well – Power Grid (0.62{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), HDFC Life (0.42{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) after a hiatus of two months, Dr. Reddy’s Labs (0.40{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) after a 5-month break and Marico (0.23{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

UTI has completely exited it’s 1.33{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in Shree Cements.

Canara Robeco has trimmed it’s allocation meaningfully in two stocks – Reliance Industries by 0.83{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} (now at 5.89{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Tata Motors by 0.93{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} (now at a small 0.71{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). The fund has exited three of it’s positions, HDFC Life (0.48{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Voltas (0.07{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Tata Steel (0.03{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). On the other hand, there are three fairly substantial new allocations – IndusInd Bank (0.96{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Bharat Electronics (0.92{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Indian Hotels (0.42{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

Franklin India has substantially beefed up it’s position in Reliance Industries by 1.22{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} taking it up to 5.24{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}! There is one meaningful exit out of Dr. Reddy’s Labs (0.97{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). In place of it is another pharma stock – Sun Pharma (1.04{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

Check out the other categories and what the funds there were up to:

Flexi Cap Funds – September 2022

Multi Cap Funds – September 2022

Large & Mid Cap Funds – September 2022

Leave a Reply