Before I start off on any analysis in this segment, even at the cost of a repetitive bore I will put forth this disclaimer. All fund schemes are taken as direct. However, even if you are a direct investor, hire a financial advisor that you trust who can guide with investments. Pay for your advice.

Fund category definition: Funds with minimum 25{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} each in Large, Mid and Small cap stocks

Benchmark: Nifty 500 50:25:25 TRI with change of 3.30{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in October 2022 and a one-year return of 3.42{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}

Data as on: 31st October, 2022

Summary

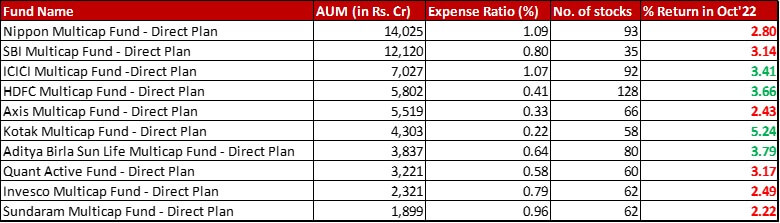

There is no change in AUM rankings or even anything worth mentioning in expense ratio.

There’s been little activity on the number of stocks front. ICICI took a jump of 4 stocks, Nippon increased it’s tally by 3 while Quant surprisingly reduced it’s tally by 3.

This time, the all-green record has been turned around for a 6-4 tilt in favour of red.

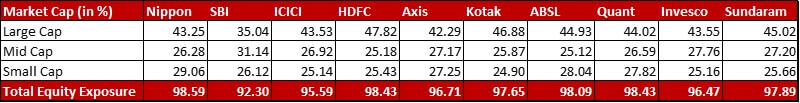

Market Cap Allocation

Nippon’s increased tally of stocks is reflected in a 2.30{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} increase in Large Cap allocation and resultantly little over 1{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} increase in overall equity exposure.

Quant’s reduced number of stocks shows in a 2.71{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} lower Large Cap allocation and an almost 1{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} lesser equity exposure.

Although Invesco’s equity exposure is mostly constant, the fund has increased it’s allocation to large Cap by about 2.18{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}, trimming both Mid and Small Caps by a bit. This move is almost a mirror reversal of what it did last month.

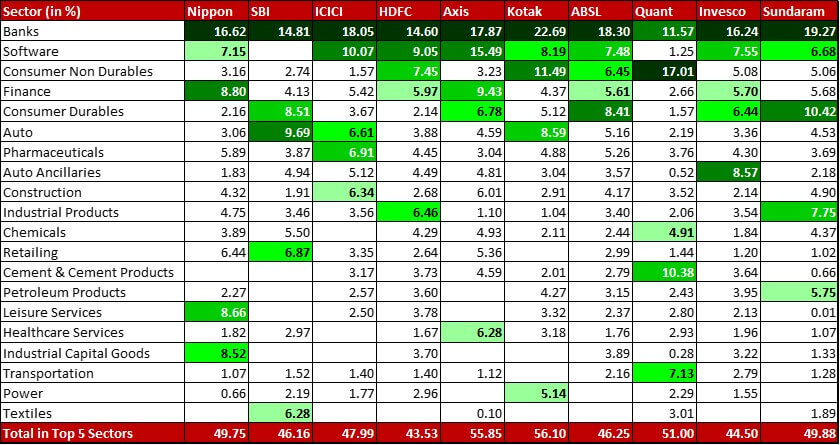

Top 5 Sectors

In Kotak, there is an organic swap between Consumer Durables and Power, with the latter entering the Top 5 this month.

Quant retains it’s reputation of being action packed month after month. There are two main sectoral changes. Banking has jumped up from the third to the second highest allocation with an increase of 2.47{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. This, despite an exit of 0.61{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} from Canara Bank as that is balanced by 1.89{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} hike in PNB (now at 3.26{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and 0.86{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} upswing in Kotak Mahindra bank (now at 2.62{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). The second big change is Chemicals replacing Construction in the top 5 for two specific stock movements. The fund has exited a 3.96{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in the Construction stronghold of L&T while doubling chemical stock Anupam Rasayan’s allocation to 2.20{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

Sundaram sees an organic swap between Petroleum Products and Finance, with the former inching into the Top 5 Sectors this month.

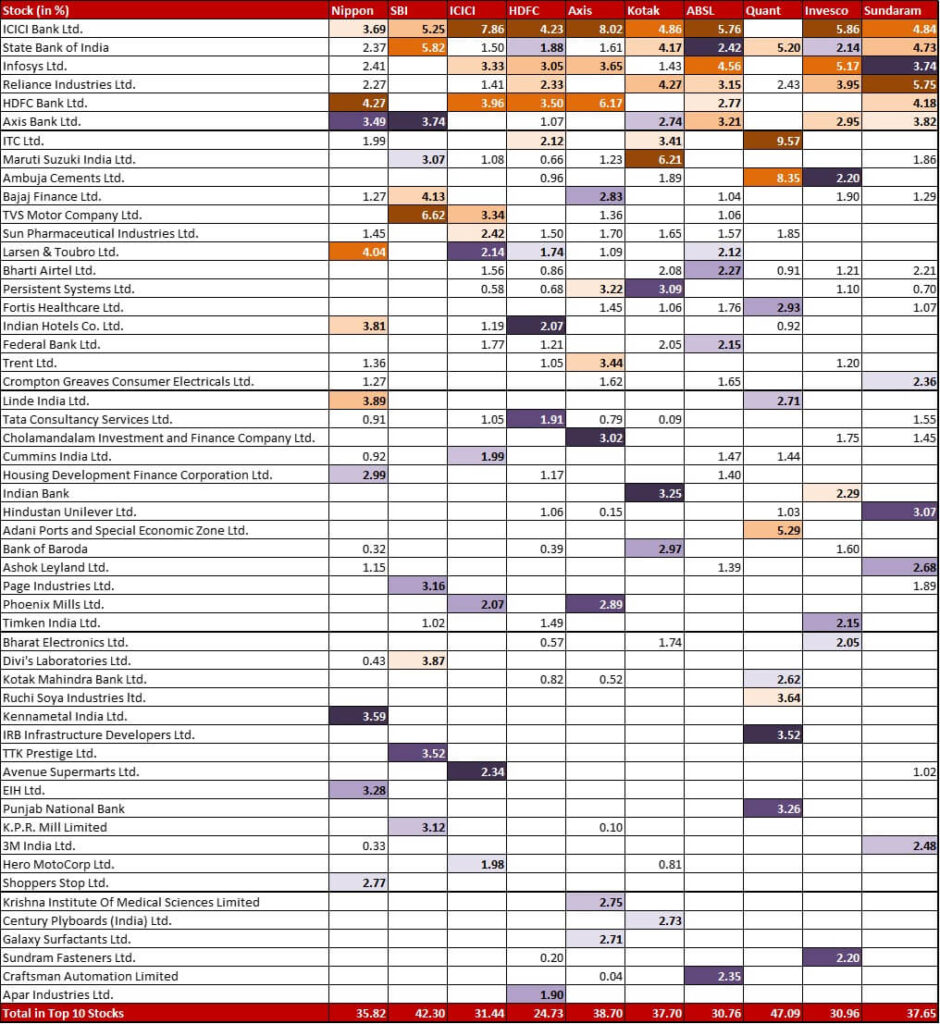

Top 10 Stocks & Movements

Nippon has exited out of two stocks – Garden Reach Shipbuilders and Engineers (0.31{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Indiabulls Real Estate. To top it off, there are five new entrants – Canara Bank (0.52{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), AU Small Finance Bank (0.39{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Cadila Healthcare (0.31{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), HDFC Life Insurance (0.26{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Power Finance (0.25{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

ICICI continues to be a trigger-happy fund. There are five exits – Bharat Forge (0.85{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Axis Bank (0.47{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Sanofi India (0.25{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Brigade Enterprises (0.05{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and BASF (0.01{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). Oh and the list of new entrants? IndusInd Bank (0.92{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), SAIL (0.78{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), NTPC (0.51{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Wipro (0.40{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), HDFC AMC (0.28{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), V.S.T. Tillers Tractors (0.21{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), V-Guard Industries (0.16{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Gland Pharma (0.10{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Schaeffler India (0.03{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). Phew!!

HDFC has just one new entrant – Aarti Pharmalabs (0.04{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

Axis has let go of it’s much touted favourite Avenue Supermarts (0.64{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

Kotak has made two substantial exits – Cummins India (1.22{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Westlife Development (1.20{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). To somewhat balance it out, there are two new entrants – Power Finance (1.06{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Karur Vysya Bank (0.53{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

Aditya Birla has trimmed it’s position in Tech Mahindra by 0.88{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} leaving it at a tiny 0.14{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}, while beefing up Anupam Rasayan by 0.81{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} taking it up to 1.04{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. The fund has one miniscule new entry – Aarti Pharmalabs (0.13{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

Apart from the changes mentioned above, Quant sees substantial shifts in three allocations – Reliance Industries has been beefed up by 1.04{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} (up to 2.43{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Gokaldas Exports is fortified by an additional 0.93{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} (going up to 1.74{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) while Welspun has been trimmed by 1.16{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to leave it at a barely-there 0.17{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. Beyond the two exits mentioned above, the fund has taken six more stocks to the chopping block for exit – Adani Enterprises (1.21{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), NALCO (1.12{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Glenmark Life Sciences (1.08{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), TV 18 Broadcast (0.84{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), United Spirits (0.28{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and VRL Logistics (0.10{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). Five new entrants balance things out – after a two-month break UPL (1.45{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) is back, IDFC (0.78{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Grindwell Norton (0.62{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Mahindra & Mahindra Financial Services (0.30{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Abbott India (0.30{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

Invesco has beefed up it’s allocation in two stocks – Infosys by 0.89{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} (now up to 5.17{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Axis Bank by 0.85{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} (taking it up to 0.85{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). There are two exits – UTI AMC (0.87{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Asian Paints (0.42{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

Sundaram has accentuated it’s position in PI Industries by 1.30{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} taking it up to 2.13{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. The fund has exited KPIT Technologies (0.31{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), while adding SBI Life Insurance (0.33{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

Check out the other categories and what the funds there were up to:

Large Cap Funds – October 2022

Flexi Cap Funds – October 2022

Leave a Reply