Before I start off on any analysis in this segment, even at the cost of a repetitive bore I will put forth this disclaimer. All fund schemes are taken as direct. However, even if you are a direct investor, hire a financial advisor that you trust who can guide with investments. Pay for your advice.

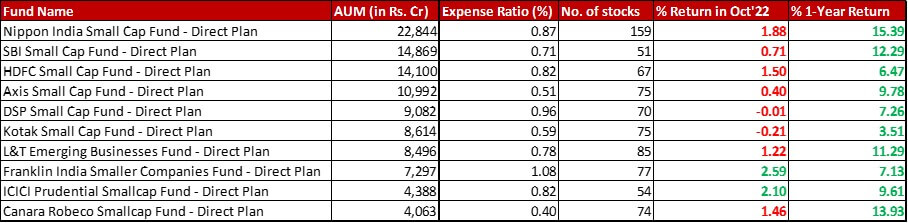

Fund category definition: Funds with minimum 65{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} portfolio allocation to Small Cap (251 and beyond by market cap size) stocks

Benchmark: Nifty Small Cap 250 TRI with a change of 1.92{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in October 2022 and a 1-year change of 1.02{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}

All data as on: 31st October, 2022

Summary

There is no change in AUM ranking and neither have expense ratios changed noticeably.

However, Nippon continues to make waves with it’s long number of stocks. This month their tally has increased by seven to land up at 159.

As for the performance, this month Canara Robeco is joined by seven other funds (barring only Franklin and ICICI) in the red for the October performance. The 1-year returns yet again remain spotlessly green, championing the cause of active funds for the category.

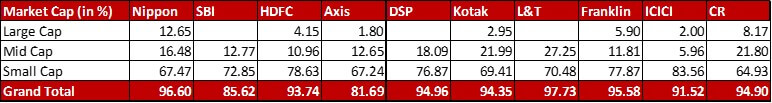

Market Cap Allocation

It’s a very stable month in terms of market cap allocation. None of the funds show a shift larger than 2{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} for any market cap category.

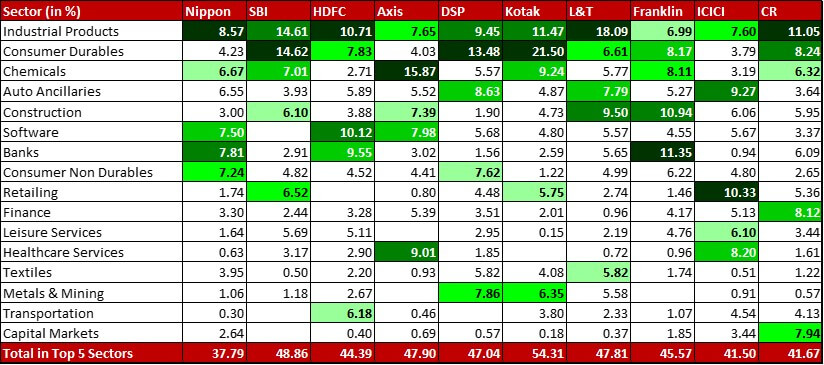

Top 5 Sectors

With an addition of 0.30{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in RBL Bank, last month’s development has been reversed and Banks have toppled Auto Ancilliaries in the Top 5 Sectors for Nippon fund.

Without much action, Fertilisers & Pesticides have given way to Consumer Non Durables in the DSP fund.

There’s an organic swap between Leisure Services and Construction in the ICICI fund, with the former making it’s way to the Top 5 Sectors.

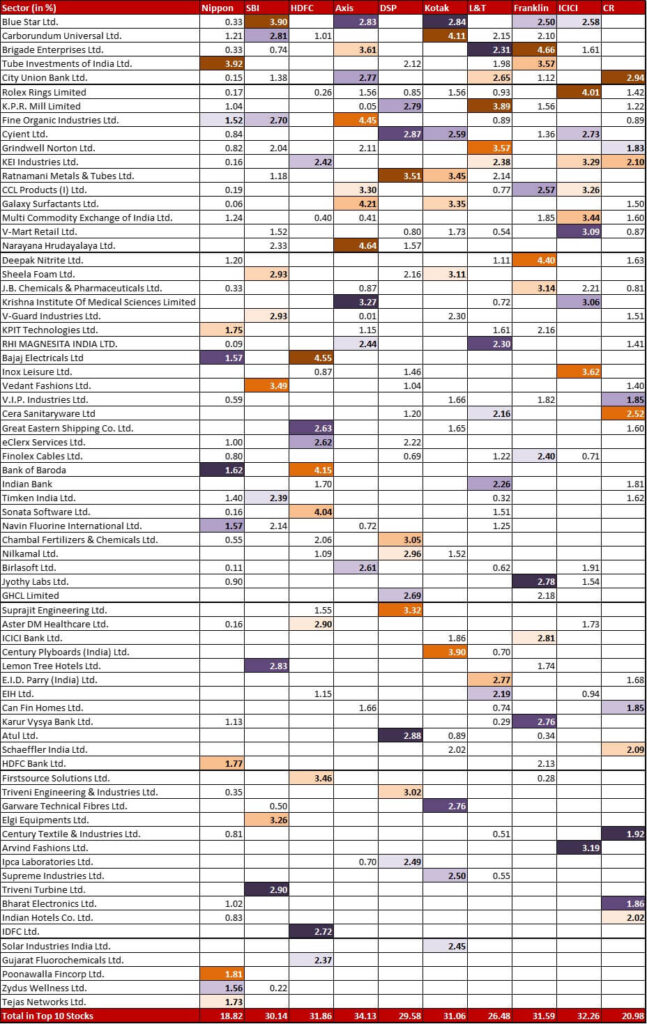

Top 10 Stocks & Movement

Nippon has exited from TD Power Systems (0.62{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Varroc Engineering (0.02{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). Apart from the RBL bank mentioned above, there are a grand total of eight more new entrants. However, I will mention just the five which have an allocation in excess of 0.10{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} – TD Power Systems (0.61{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Bluestar (0.33{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Trackxn Technologies Limited (0.24{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), CCL Products (I) (0.19{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Sonata Software (0.16{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

SBI has trimmed it’s position in Rajratan Global Wire by 0.97{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}, taking it down to 2.15{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. It has also added a new 0.84{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in Global Health.

HDFC has exited from Engineers India (0.06{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

Axis has reduced it’s allocation in Fine Organic by a substantial 1.04{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}, leaving it at a still high figure of 4.45{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. This has pushed it from numero uno to the second biggest stock in the portfolio. The fund also has two minute entrants – Mahindra & Mahindra financial services (0.08{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Aarti Pharmalabs (0.05{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

DSP has exited from Muthoot Capital Services (0.11{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

Kotak has one exit, Finolex Cables (0.06{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and one new entry in BEML Land Assets (0.26{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

L&T has exited Greenpanel Industries (0.25{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). The fund has two new stocks – Karur Vysya Bank (0.29{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and IIFL Finance (0.22{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

Franklin has exited IDFC (0.11{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

ICICI has one sole new entrant – Tracxn Technologies (0.69{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

Canara Robeco has buffeted up it’s allocation in Abbott India by 0.81{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}, taking it up to 1.47{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. In the five months of tracking this fund, for the first time there is new entrant – J.B. Chemicals & Pharmaceuticals (0.81{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

Check out the other categories and what the funds there were up to:

Large Cap Funds – October 2022

Flexi Cap Funds – October 2022

Multi Cap Funds – October 2022

Leave a Reply