For months now, I have tried to streamline my process of this analysis in a way that I am able to publish it maximum by 20th of the next month. Just as I thought I am getting better at it, Covid struck. While I have been lucky to dodge it in the past two and a half years, it struck with a vengeance, particularly for my husband.

I did contemplate whether it makes sense to publish it at all considering we are now left with only 3 market days in the current month. But, sometimes a check mark is important to keep a process going more than it’s timeliness. Or so I told myself this month. So, here goes the analysis for September 2022.

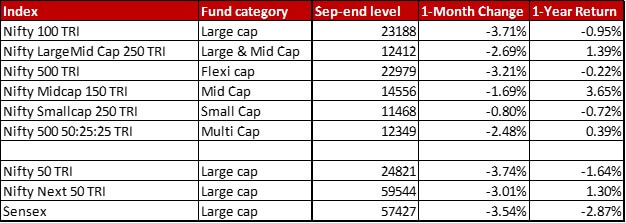

Like a yo-yo, September upturned the progress made in August with all indices in the red. Yet again, much against stereotypes, Small Cap index fell the least. Check out their movement last month. While all other indices are in TRI or Total Returns Index mode (meaning stock dividends add to the returns), Sensex is plain jane Sensex.

Some points that popped out as I was working on the analysis.

One, active funds in all categories did far better this month. Within the sixty funds I track, there were only a handful of reds for the September performance. As I often believe, India still has juice left for active fund managers. It’s great to have a Large Cap passive fund for some allocation but that’s where it should stop.

Two, September also saw the demerger of BEML Land Assets from it’s parent company BEML Limited. This reflected in some of the portfolios with the addition of the former stock.

Three, there were a few stocks that found favour with quite a few fund managers. I will name just a few that might pique your curiosity – Hatsun Agro Products, IndusInd Bank, Triveni Turbine, Harsha Engineers and Krishna Institute of Medical Sciences.

Check out how the portfolios of the top 10-by-AUM funds in different categories stack up against each other.

In case, you are curious what brought about this segment on the blog or how is this analysis even being done, then check out the introduction post where I go into all those details.

You could also check out all the other previous months of analyses – August 2022, July 2022, June 2022, May 2022, April 2022, March 2022, February 2022, January 2022, December 2021, November 2021 and October 2021.

Leave a Reply