Before I start off on any analysis in this segment, even at the cost of a repetitive bore I will put forth this disclaimer. All fund schemes are taken as direct. However, even if you are a direct investor, hire a financial advisor that you trust who can guide with investments. Pay for your advice.

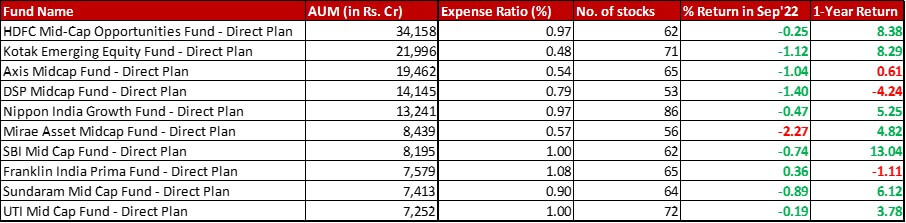

Fund category definition: Funds with minimum 65{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} portfolio allocation to Mid Cap (101-250 by market cap size) stocks

Benchmark: Nifty Mid Cap 150 TRI with a change of -1.69{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in September 2022 and a 1-year return of 3.65{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

All data as on: 30th September, 2022

Summary

It is another month of consistent AUM rankings.

After a month of slashing expense ratio big time, this month Nippon has raised it by 8 basis points to settle in at 0.97{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

In this category too, the performance for the month sees an almost complete overhaul with only Mirae being unable to beat the benchmark. In this case, even in the one-year performance seven out of ten funds have done far better and in some cases handsomely beaten the benchmark.

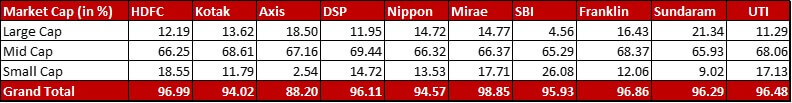

Market Cap Allocation

DSP has increased it’s allocation to Mid Cap stocks by 3.40{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}, partly through shaving off 1.62{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} from Small Cap and partly from increasing overall equity exposure to 96.11{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

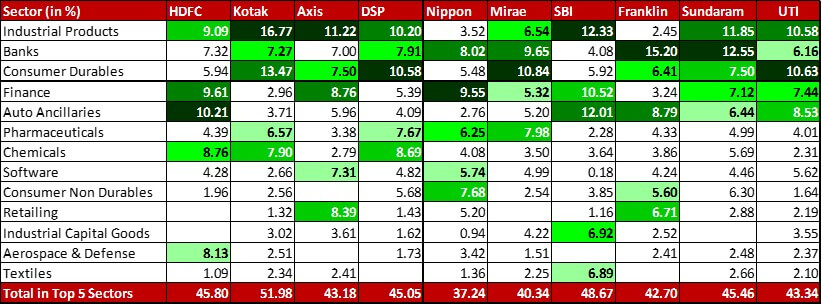

Top 5 Sectors

Although there’s been no major movement, Auto Ancilliaries and Finance have swapped positions to end up at second and third respectively in the HDFC fund.

Kotak sees an organic swap between Pharma and Fertilisers and Pesticides with the former finding a place in the Top 5 Sectors this month.

While there have been no exits, the allocation to Software has decreased by 1.21{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} taking the sector from third to the fifth highest in Axis.

Nippon has chopped off quite a bit from it’s Banking allocation – exit from City Union Bank (0.08{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and three meaningful trims – Bank of Baroda by 1.00{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}, Axis Bank by 0.73{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} and Federal Bank by 0.47{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. Consequently, even though Cholamandlam Investment and Finance has been trimmed by 0.81{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}, Finance is now the top sector dethroning Banks. In Pharma, the fund has re-entered Dr. Reddy’s (0.92{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) after a month’s break, with the sector replacing Consumer Durables in the fifth spot.

SBI has taken a chunky new 2.16{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} allocation to Triveni Turbine, leading to Industrial Capital Goods knocking out Consumer Durables from the Top 5 Sectors.

Top 10 Stocks & Movement

With a 16{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} increase in share price, Indian Hotels allocation has moved up by 0.80{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in the HDFC portfolio to now be at a hefty 5.69{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. The fund has exited from Carborundum Universal (0.20{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

Axis has one new miniscule position in Delhivery (0.03{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

DSP has completely exited two of it’s positions – Vardhman Textiles (0.40{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Zensar Technologies (0.29{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). The fund has made two new substantial entries – Persistent Systems (0.97{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and CG Power and Industrial Solutions (0.61{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

Yet again, it’s a month of relatively high action for Nippon. Apart from the changes mentioned in the Sectoral rebalancing, the fund has also trimmed it’s allocation in Tech Mahindra by 0.80{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} (now at 1.07{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Tata Motors by 0.96{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} (now down to 0.55{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). The fund has also made some minor exits – Oriental Hotels (0.19{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Hathway Cable & Datacom (0.16{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and City Union Bank (0.08{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). The list of new entrants (apart from Dr. Reddy’s mentioned above) is far more impressive – Infosys (1.85{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Interglobe Aviation (0.91{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), LIC Housing Finance (0.59{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Radico Khaitan (0.42{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Coforge (0.18{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

Mirae has added a new 0.99{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in Indraprastha Gas.

SBI has exited from it’s 0.30{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in CAMS. To over compensate, it has a string of new additions beyond the Triveni Turbines mentioned above – G R Infraprojects (0.60{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Sundaram Finance (0.42{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and LIC Housing Finance (0.15{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

Franklin has completely exited out of Balkrishna Industries (0.52{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Kajaria Ceramics (0.14{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). To balance it out, there are two new additions – ACC (0.65{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Mahindra & Mahindra Financial Services (0.24{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

Sundaram also has two exits – Quess Corp (0.61{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and ICICI Securities (0.28{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). They have also added a new allocation of 1.08{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to Hatsun Agro Product.

UTI has increased it’s allocation to Tube Investments by 0.80{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} taking it up to 4.65{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

Check out the other categories and what the funds there were up to:

Large Cap Funds – September 2022

Flexi Cap Funds – September 2022

Multi Cap Funds – September 2022

Leave a Reply