Before I start off on any analysis in this segment, even at the cost of a repetitive bore I will put forth this disclaimer. All fund schemes are taken as direct. However, even if you are a direct investor, hire a financial advisor that you trust who can guide with investments. Pay for your advice.

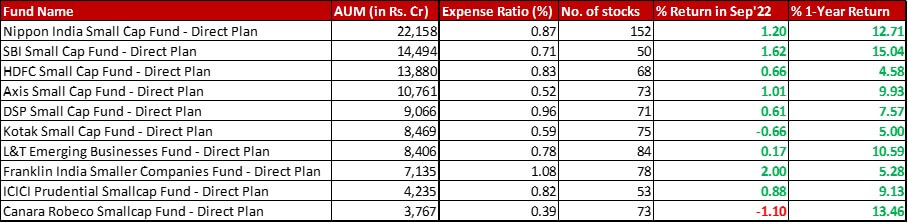

Fund category definition: Funds with minimum 65{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} portfolio allocation to Small Cap (251 and beyond by market cap size) stocks

Benchmark: Nifty Small Cap 250 TRI with a change of -0.80{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in September 2022 and a 1-year change of -0.72{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}

All data as on: 30th September, 2022

Summary

This month too, there is a small change in AUM rankings. Kotak has now gone ahead of L&T to zone in on the sixth place.

ICICI and Nippon have both increased their number of stocks by 4 each.

The performance report card, be it for the month or the last one year is a slew of green apart from Canara Robeco which has under performed the benchmark last month. For the rest, active funds continue to handsomely outperform.

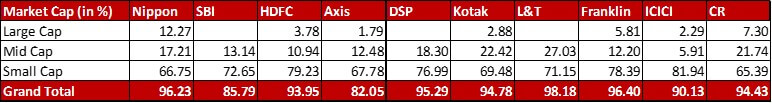

Market Cap Allocation

ICICI has finally increased it’s equity exposure this month substantially, by 4.60{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to go back to being over the 90-mark. Most of this comes in the form of a 2.88{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} increase in Mid Caps and a 1.91{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} increase in Small Caps.

Top 5 Sectors

There is an organic swap between Banks and Auto Ancilliaries in Nippon with the latter making it’s way to the Top 5 Sectors.

With a 0.62{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} increase in allocation for Krishna Institute of Medical Sciences, Axis sees Healthcare Services (8.47{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} allocation) zoom up from fifth to the second highest sector. Clearly, the second to fifth spots are quite tightly packed.

ICICI has taken a new 1.93{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in Sundaram Fasteners, taking Auto Ancilliaries (now at 9.57{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} allocation) up from fourth to the second highest sector. But, the biggest change is a huge fortification in the Healthcare Services sector with two new big positions – Krishna Institute of Medical Sciences (3.23{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Syngene International (1.46{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). This takes the sector from being nowhere on the horizon, right up to the third highest with 8.50{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. Software is the sector to have given in and made way for the new entrant.

Although there is no noticeable change in Construction for Canara Robeco, the sector makes way for Chemicals where the biggest change is a 0.90{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} increase in the Deepak Nitrite allocation taking it up to 1.55{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

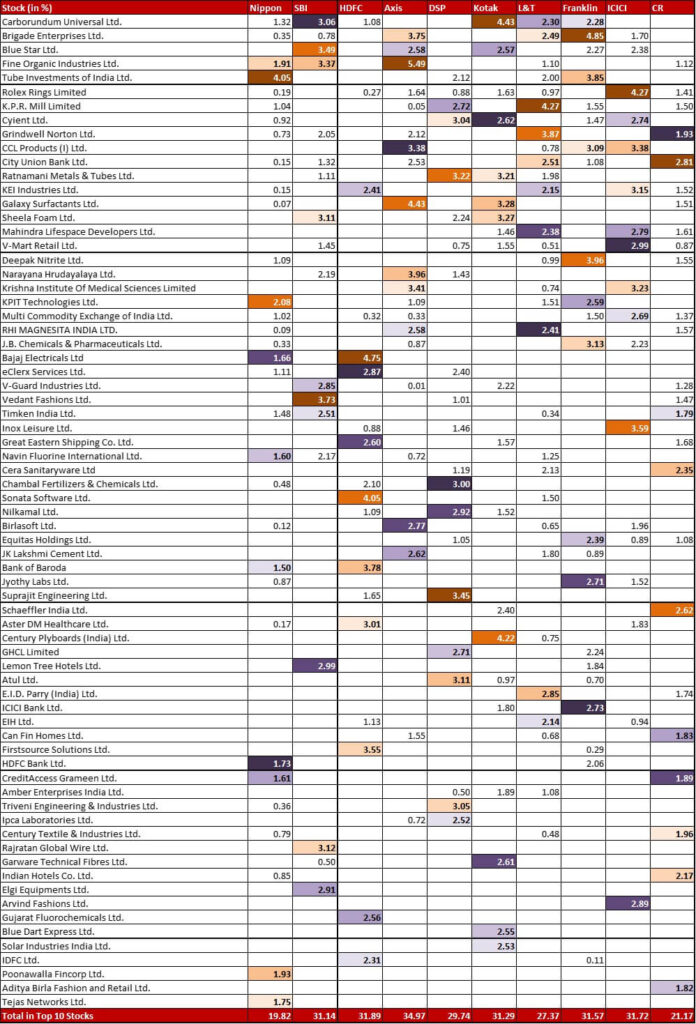

Top 10 Stocks & Movement

Nippon has one meaty exit with a complete out from it’s 1.15{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in Mahindra & Mahindra. The fund more than makes up for it with five new additions – Ambuja Cements (0.70{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Harsha Engineers (0.52{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Bharat Heavy Electricals (0.43{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Sundaram Fasteners (0.08{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Rategain Travel Technologies (0.03{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

After a big price rally in August, SBI used this month to shaved off a massive 1.88{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} from Elgi Equipments (down to 2.91{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), while increasing by 0.92{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} its’ allocation in G R Infra projects (now at 2.28{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). Interestingly, the fund has also increased it’s allocation to PVR by 0.74{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} which is now at a healthy 2.27{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. The fund also has a meaty new 1.88{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} allocation to LIC Housing Finance.

HDFC has three new additions – BEML (0.78{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Harsha Engineers (0.20{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), and BEML Land Assets (0.11{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). The latter is most likely a bonus share allocation.

Axis has a single noteworthy change – a new 0.38{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in Ramco Cements.

DSP is betting big on travel with a 0.75{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} increase in Safari Industries (now at 1.24{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). The fund has exited it’s miniscule 0.02{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in Equitas Small Finance Bank while adding a 0.17{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in Harsha Engineers.

After 5 months of lugging around a minor allocation, Kotak has completely exited from Ruchi Soya (0.02{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). On the other hand, there are four new additions – Tata Chemicals (1.05{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), G R Infraprojects (1.02{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}, KNR Constructions (0.41{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Exide Industries (0.37{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

L&T has beefed up it’s position in EIH by 0.80{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} (now at 2.14{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). There are two new additions – Century Textile & Industries (0.48{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Federal Bank (0.31{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

Franklin has added three new stocks to it’s arsenal – MTAR (0.26{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Harsha Engineers (0.20{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Anupam Rasayan (0.17{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

Apart from the three big new positions mentioned above, ICICI has also added Harsha Engineers (0.29{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

Beyond beefing up Deepak Nitrite, Canara Robeco has shaved off 0.81{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} from Can Fin Homes (now at 1.83{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). Surprisingly, in the four months of my monitoring the fund hasn’t exited a single stock. There are two new entrants, both non-Small Cap – Bajaj Finance (0.84{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Abbott India (0.66{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

Check out the other categories and what the funds there were up to:

Large Cap Funds – September 2022

Flexi Cap Funds – September 2022

Multi Cap Funds – September 2022

Leave a Reply