Before I start off on any analysis in this segment, even at the cost of a repetitive bore I will put forth this disclaimer. All fund schemes are taken as direct. However, even if you are a direct investor, hire a financial advisor that you trust who can guide with investments. Pay for your advice.

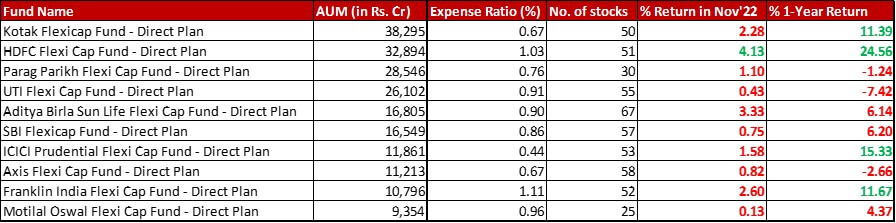

Fund category definition: Funds with no restriction on market cap allocation or number of stocks

Benchmark: Nifty 500 TRI with a change of 3.42{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in November 2022 and a 1-year change of 10.20{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}

Data as on: 30th November, 2022

Summary

In terms of AUM, Aditya Birla has upped SBI slightly to go on to the fifth spot. At the same time, the fund has also substantially slashed it’s expense ratio from 1.02{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to bring it down to 0.90{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

In terms of number of stocks, ABSL is back to 67 like it was before having increased to 70 just last month.

Apart from HDFC, all other 9 funds under performed the benchmark last month. In the one-year performance, the situation is marginally better with four funds in the green although there are three (UTI, Parag Parikh and Axis) where the one-year performance is negative in absolute terms.

Market Cap Allocation

It’s been a very quiet month in terms of market cap allocation. None of the funds have a change worth mentioning, or more than 2{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in terms of delta.

Top 5 Sectors

HDFC has increased it’s allocation to ONGC by 1.01{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} leading to Petroleum Products displacing Telecom from Top 5 Sectors.

UTI sees an organic swap between Consumer Durables and Pharma sectors

Motilal Oswal has brought down it’s allocation in Maruti Suzuki by more than half (from 6.60{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to 2.88{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) which shows in Auto going down to the fifth highest sector. Simultaneously, an increase of 1.36{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in the Reliance Industries allocation means Petroleum Products also comes into the Top 5 Sectors and edges out Auto Ancilliaries.

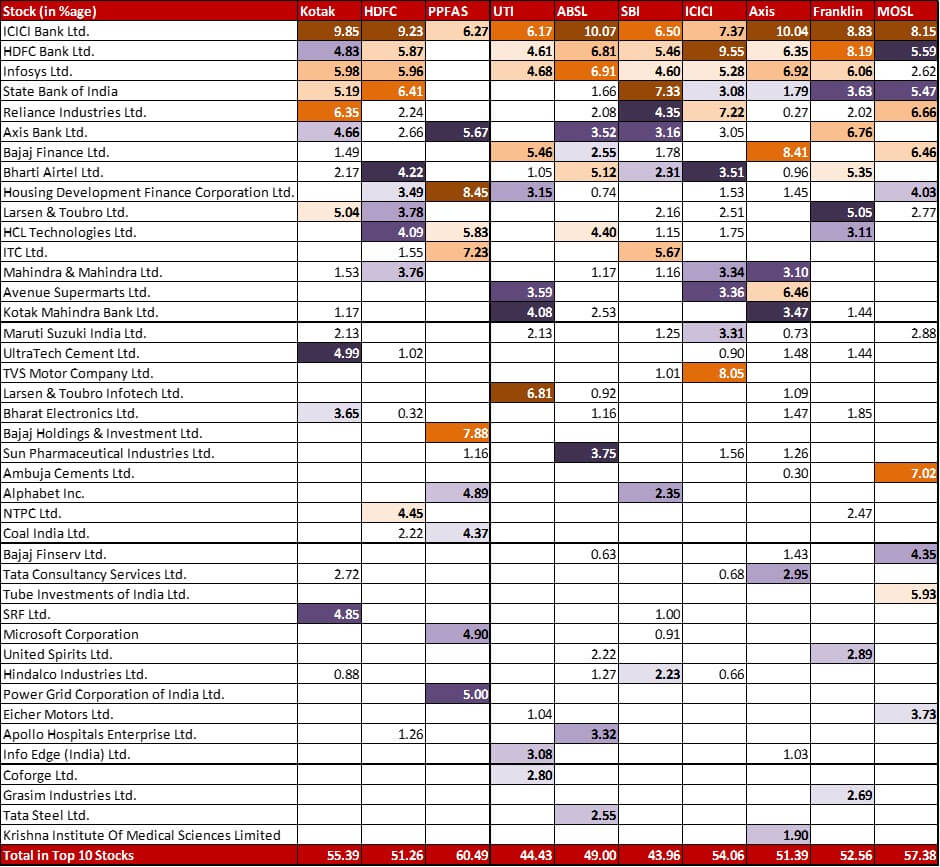

Top 10 Stocks & Movements

The one change that is sighted in many portfolios is a complete exit from MindTree and an addition of approximately the same allocation to L&T Infotech. This is thanks to the approval of merger between the two companies although the joint entity was listed only in early December. Hence, that change will only have a short mention instead of a long-winded description.

Apart from loading up on ONGC, HDFC has shaved off a big 1.99{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} from Coal India (now at 2.22{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and 0.87{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} from ITC (now at 1.55{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). The fund has added a 0.24{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in Bosch while exiting from Power Finance Corporation (0.73{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) & TCS (0.38{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

Parag Parikh has trimmed its allocation to Bajaj Holdings & Investment by 0.95{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to take it down to 7.88{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. It’s also added a new 0.22{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} allocation to UTI AMC.

With the MindTree and L&T Infotech switch, the latter is now the biggest stock holding in the UTI portfolio.

Apart from the MindTree and L&T Infotech switch, ABSL has also added a tiny 0.11{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to Solara Active Pharma Sciences. There is a bit of tail reduction also this month with four more small exits – Bajaj Auto (0.31{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Bandhan Bank (0.20{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Hero Motocorp (0.18{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Tata Motors (0.04{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

SBI seems to have done quite a bit of a rejig in it’s banking allocation. Axis Bank gets a big shave (or profit booking) of 2.83{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to wind down to 3.16{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} while ICICI Bank is trimmed down by 1.53{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to come down to 6.50{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. Simultaneously, HDFC Bank has been beefed up by 2.41{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} (now at 5.46{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and SBI is up by 1.78{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} (going up to 7.33{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). The fund also has a new 1.05{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} allocation to Havells India.

ICICI has further cut down it’s allocation to Mahindra & Mahindra by 1.45{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to go down to 3.34{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. The fund has added a 0.12{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} allocation to PCBL or Phillips Carbon Black while exiting from Indraprastha Gas (0.43{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Polycab India (0.35{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

Axis, too sees the MindTree and L&T Infotech shift. After a gap of eleven months, Zomato makes it’s way back to the Axis portfolio with a lower 0.45{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} allocation. The fund has also added 0.15{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in the newly listed Global Health.

Franklin has two new small additions – Delhivery (0.50{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Teamlease (0.28{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

It’s been a far more stable month for Motilal Oswal. Apart from the Maruti and Reliance allocation changes mentioned above, Motilal Oswal has substantially increased it’s allocation in Ambuja Cements by 0.87{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to reach 7.02{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. There’s a 0.36{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} allocation in the newly listed Global Health while the fund has exited it’s position in Fino Payments Bank (0.12{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

Check out the other categories and what the funds there were up to:

Large Cap Funds – November 2022

Multi Cap Funds – November 2022

Leave a Reply