Before I start off on any analysis in this segment, even at the cost of a repetitive bore I will put forth this disclaimer. All fund schemes are taken as direct. However, even if you are a direct investor, hire a financial advisor that you trust who can guide with investments. Pay for your advice.

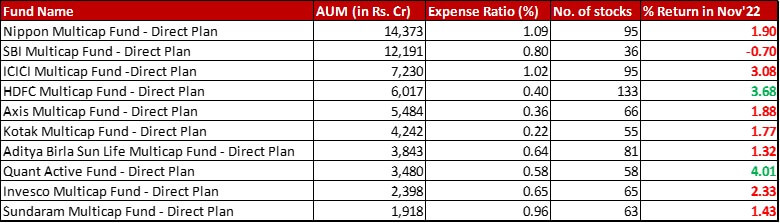

Fund category definition: Funds with minimum 25{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} each in Large, Mid and Small cap stocks

Benchmark: Nifty 500 50:25:25 TRI with change of 3.12{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in November 2022 and a one-year return of 8.90{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}

Data as on: 30th November, 2022

Summary

There is no change in AUM rankings.

Three funds have made noticeable changes to their expense ratio. ICICI has reduced it by 5 basis points (to come down to 1.02{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) while Invesco has reduced it by a big 14 basis points (now at 0.65{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). Axis on the other hand, has increased it’s expense ratio by 3 basis points, to go up to 0.36{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

Quite a few funds have a substantial change in the number of stocks. ICICI and Invesco have both increased their portfolio size by 3 stocks. Kotak has reduced it’s tally by 3. The biggest change though is reserved for HDFC, adding five more stocks to it’s already pretty long tail.

The month’s performance is strewn with red, with only HDFC and Quant beating the benchmark.

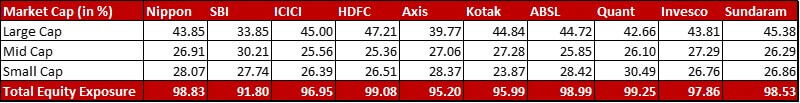

Market Cap Allocation

Axis has reduced it’s Large Cap allocation by 2.52{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}, resultantly also undergoing an equity exposure reduction by 1.51{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

Kotak has followed a similar trend with a 2.04{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} reduction in Large Cap allocation, and an overall 1.66{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} cut-down in equity exposure.

Quant, on the other hand, has increased it’s Small Cap exposure by 2.67{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}, with some bits trimmed from Large and Mid Caps and the overall equity exposure almost up to the brim at 99.25{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

Top 5 Sectors

SBI has a big 1.71{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} allocation to the newly-listed Archean Chemical Industries, leading to the Chemical sector nudging out Textiles from the Top 5.

ICICI has a 0.39{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} allocation to the newly-listed Fusion MicroFinance. Additionally, the fund has trimmed Phoenix Mills allocation by 0.56{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. With these two changes, Finance comes into the Top 5 in place of Construction.

Quant is again flirting with the Banking sector adding three big allocations – Bank of Baroda after a 3-month gap (1.26{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), HDFC Bank after a 4-month gap (1.04{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Union Bank of India (2.24{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). It has also increased it’s allocation in SBI by 1.12{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} and RBL Bank by 0.78{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. Hence, the Banking sector has bulked up from 11.57{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to 18.82{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}! There is a new 1.29{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} allocation to Strides Pharma Science and even the Abbott India allocation has increased by 0.72{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. Resultantly, Pharma has nudged out Chemicals for the fifth spot, even though the latter now has a new 0.51{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in Archean Chemical Industries.

Although the ranking hasn’t changed, Invesco has heavily fortified it’s Banking sector increasing it by 5.47{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}! This is thanks to three new positions – HDFC Bank (2.00{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Federal Bank (1.40{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and DCB Bank (0.99{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). The fund has also completely exited it’s 1.90{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in Bajaj Finance. To fill the vacuum of the fifth biggest sector, Consumer Durables goes right in.

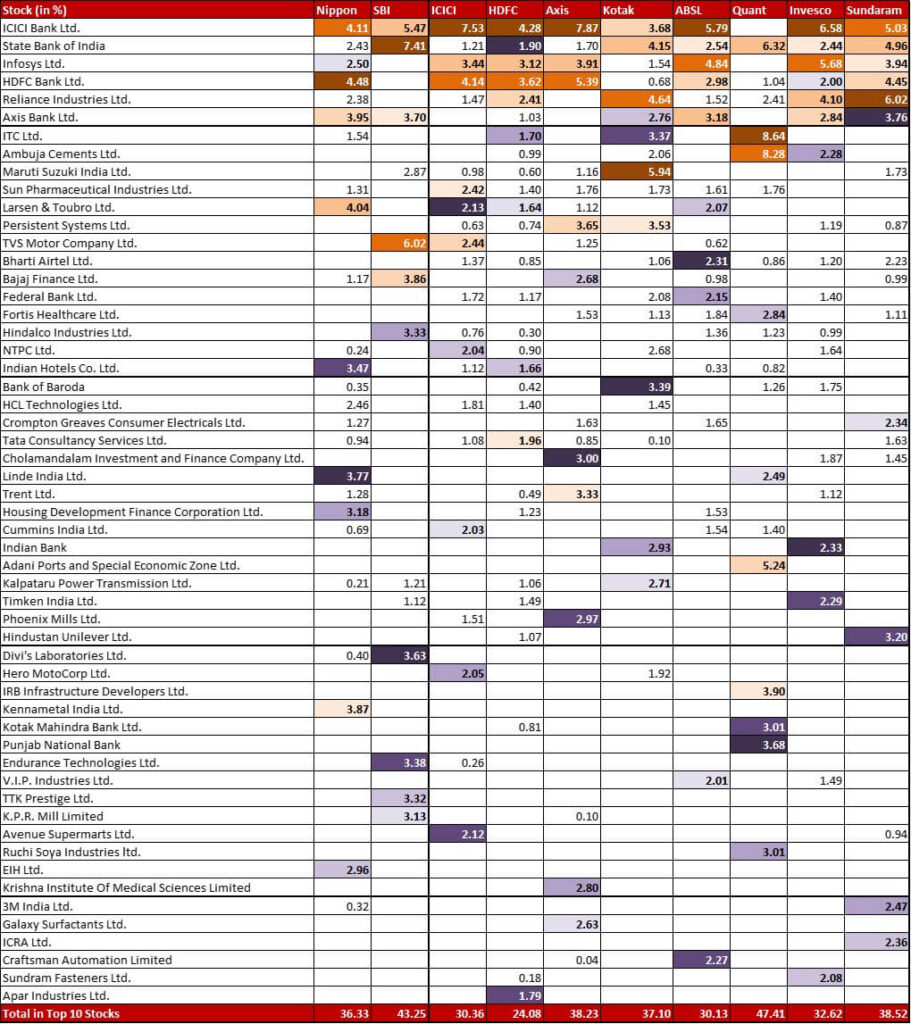

Top 10 Stocks & Movements

Nippon has yet again added five new stocks to the portfolio – NHPC (0.47{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), PB Fintech (0.47{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), NTPC (0.24{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Restaurant Brands Asia (0.03{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Electronics Mart India (0.03{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). There are three exits – HDFC Life Insurance (0.26{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Torrent Pharma (0.23{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Vedanta (0.20{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

SBI has increased the allocation to it’s parent bank SBI by a substantial 1.59{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} (now up at 7.41{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). Apart from the big Archean Chemicals addition, the fund has also added a 0.36{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position to yet another newly listed Global Health stock. There is just one, but pretty big 2.77{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} exit from ICICI Prudential Life Insurance.

ICICI has beefed up NTPC by 1.53{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} (now at 2.04{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) while trimming TVS Motor by 0.90{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} (to bring it down to 2.44{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). This fund seems to have a history of FOMO and wanting to have all possible stocks. In the portfolio. There are a whopping nine new stocks and simultaneously six exits!! If I list all of these down, god save us all. So, I am going to adopt the rule of ludo where three times six on the dice mean you skip your chance. Too much activity means I don’t elaborate on it for ICICI this month.

HDFC has five new entrants – Archean Chemical Industries (0.95{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Voltas (0.65{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Aurobindo Pharma (0.39{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Chambal Fertilizers and Chemicals (0.32{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Bikaji Foods (0.17{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

Axis has trimmed HDFC Bank by 0.78{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} (now at 5.39{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). There are two tiny new positions – Global Health (0.12{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Kaynes Technology (0.03{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). It has also exited a miniscule 0.15{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in HUL and 0.52{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in Kotak Mahindra Bank.

Kotak has trimmed it’s allocation in ICICI Bank by 1.18{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} (now at 3.68{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and by 1.11{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in Bharti Airtel (now at 1.06{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). There is also the Shriram Transport Finance and Shriram City Union Finance merger in the portfolio. The fund has added a tiny 0.68{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in HDFC Bank. The list of exits is longer with three stocks – Mahindra & Mahindra (1.57{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Motherson Sumi Systems (0.52{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Motherson Sumi Wiring India (0.47{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

Aditya Birla has reduced it’s allocation to Reliance by 1.63{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} shrinking it to . There is also the MindTree and L&T Infotech switch in the portfolio. Apart from that, with six new entrants and five exits, I will choose to not enlist all of those for this fund either.

As usual, Quant has been trigger happy yet again this month. However, considering it is a known evil, many of those changes have been mentioned above as they showed up in the sectoral allocations as well. Apart from that, the fund has cut it’s allocation in ITC by 0.93{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. There also three additional entrants – Bikaji Foods (1.66{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Hindalco (1.23{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Jindal Steel (0.48{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). As for the ten stocks that the fund has completely exited, it’s a story for another month when they will probably come back anyway.

Invesco has just two other chunky exits in it’s portfolio apart from Bajaj Finance mentioned above –Tech Mahindra (1.28{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Whirpool (0.91{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). As for the additions, beyond the bank sector muscling up, there are three more – Bharat Dynamics (0.97{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), NHPC (0.49{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Expleo Solutions (0.57{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

Sundaram has two new entrants – Cyient (0.55{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Inox Leisure (0.32{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). In this quieter month, it just has one exit from Orient Electronic (0.35{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

Check out the other categories and what the funds there were up to:

Large Cap Funds – November 2022

Flexi Cap Funds – November 2022

Leave a Reply