Before I start off on any analysis in this segment, even at the cost of a repetitive bore I will put forth this disclaimer. All fund schemes are taken as direct. However, even if you are a direct investor, hire a financial advisor that you trust who can guide with investments. Pay for your advice.

Fund category definition: Funds with minimum 65{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} portfolio allocation to Mid Cap (101-250 by market cap size) stocks

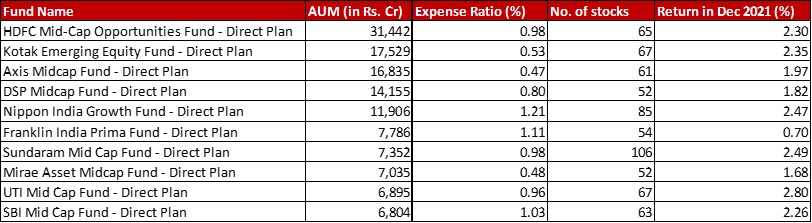

Benchmark: Nifty Mid Cap 150 TRI with return of 2.85{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in December 2021

All data as on: 31st December, 2021

Summary

Another not very pretty report card with none of the funds beating the benchmark in the month.

In terms of AUM ranking, L&T falls back another two spots to make it’s way out of the top 10. Of what I know, it has been under performing for some time leading to many investors weeding it out of their portfolios. The last spot is now taken by SBI Magnum Mid Cap.

There is a fair bit of expense ratio in two funds – 0.17{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} increase in Nippon Growth fund taking it 1.21{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} and a 0.18{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} reduction in Sundaram, probably thanks to the merger with Principal AMC. In fact, thanks to that Sundram sees an increase of 42 stocks in it’s portfolio of which I believe they will gradually be whittled out.

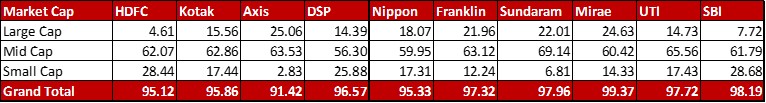

Market Cap Allocation

DSP sees a big shift from Mid Cap to Small Cap, mostly attributable to the recategorisation. Some of the major stocks which made the move from Mid Cap to Small Cap in the DSP portfolio include Mannapuram Finance, City Union Bank, Alembic Pharmaceuticals and Pheonix Mills.

Nippon has seen a lot of movement from Mid Cap to Large Cap on the back of three major stocks – Mphasis, Bharat Electronics and SRF. Mirae also sees a similar movement thanks to the same three stocks and Mindtree.

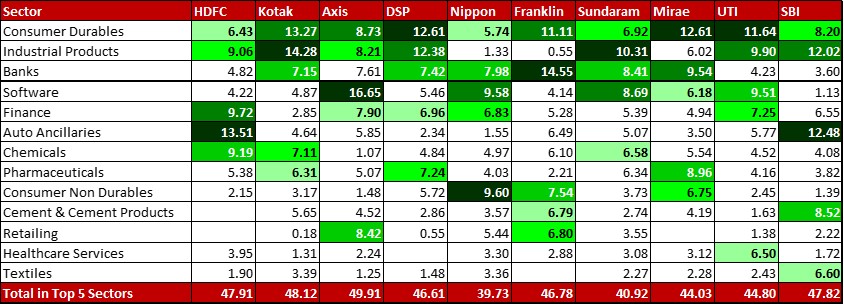

Top 5 sectors

In HDFC the tug-of-war between Aerospace & Defence and Consumer Durables continues with the latter making it’s way back to being the fifth biggest sector.

In the case of Kotak, pharma has edged out Cement & Cement Product for the fifth highest sector.

In Nippon, Finance gets a further trim by exiting Cholamandalam Investment and Finance Company as well as JM Financial. On the other hand, they have increased their allocation to Software by adding Mindtree, Affle (India) and Rategain Travel Technology.

In Mirae, Consumer Non Durables has edged out Software for the fifth highest sector.

In most other funds, there’s a slight bit of juggle between the same sectors as before probably thanks to the differing valuations.

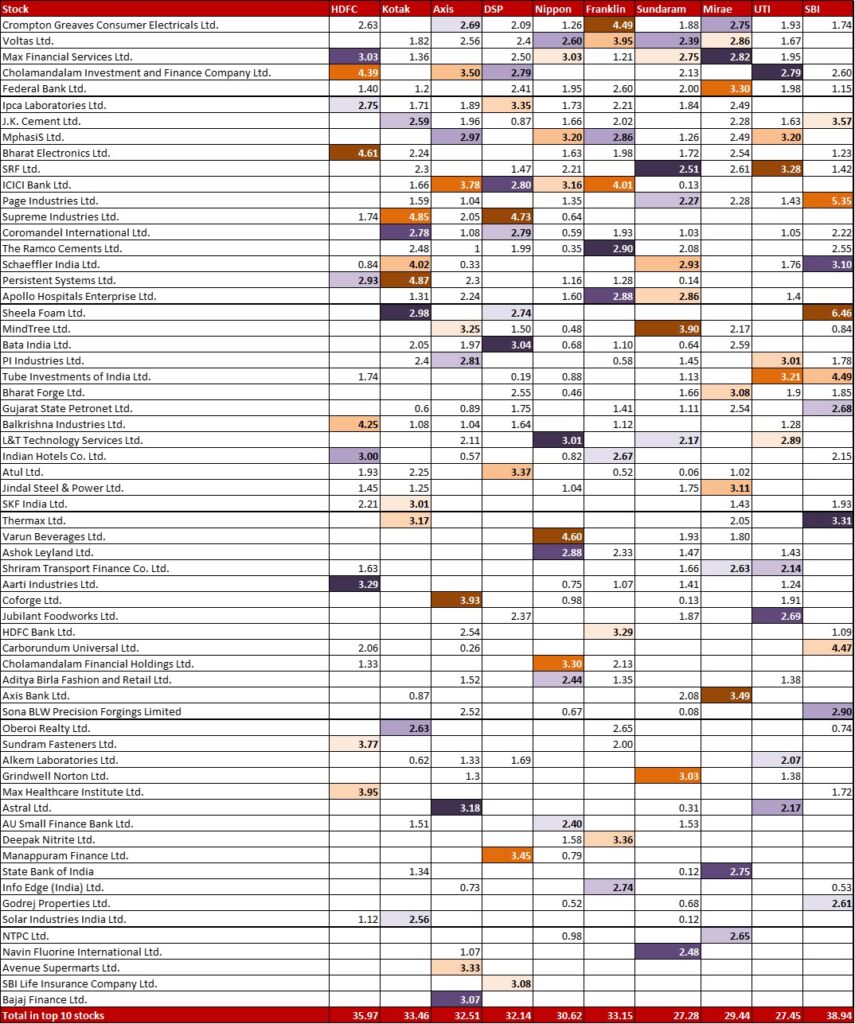

Top 10 stocks

Cholamandalam Investment and Finance has not only slipped from Large Cap to Mid Cap but also seen a reduction across funds, more than the 5{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} share price change in the month.

Apart from that, there are not too many changes in the top 10 stocks.

Leave a Reply