Before I start off on any analysis in this segment, even at the cost of a repetitive bore I will put forth this disclaimer. All fund schemes are taken as direct. However, even if you are a direct investor, hire a financial advisor that you trust who can guide with investments. Pay for your advice.

Fund category definition: Funds with no restriction on market cap allocation or number of stocks

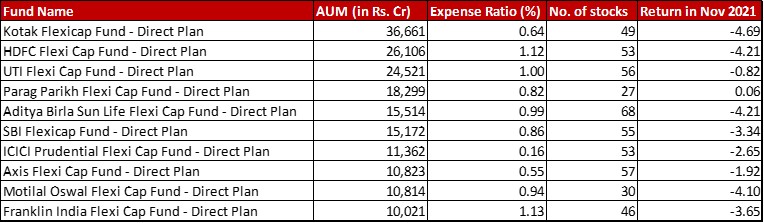

Benchmark: Nifty 500 TRI with return of -2.83{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in November 2021

Data as on: November 30, 2021

Summary

Flexi cap funds remain a highly varied category, be it in terms of market cap or the resultant returns. As for AUM wise ranking, Motilal Oswal has dropped two spots to go down to number 9 with ICICI and Axis moving up a spot each.

The only fund with a (very slight) positive movement was Parag Parikh, helped of course by their foreign equity allocation. Even in the negative performance, only UTI, Axis and ICICI beat the benchmark by falling lesser than the 2.83{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

Axis Flexi Cap was the only fund to have substantially added to the number of stocks increasing to 57.

Market Cap Allocation

Changes in market cap allocation are barely noticeable. SBI and Parag Parikh remain heaviest on Small Cap. Most funds have kept the cash levels same or even reduced them further resulting in a less than 5{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} cash level.

ICICI Flexicap is the exception whereby they still seem to be in the mode of portfolio construction. However, that’s also because the fund is new and is still building it’s portfolio. Hence, the increase from 78{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to 83{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

Top 5 sectors

There is slight movement in the most important sectors in the category.

Pharmaceuticals replaces Finance as the fifth biggest category for SBI.

Within Motilal Oswal, they have reduced their allocation to Finance slightly which means Software and Finance interchanged their positions as second and third highest sectors.

For ICICI, construction has become the fourth biggest sector, pushing petroleum products lower and nudging out Insurance from the top 5 sectors.

In Axis Flexi Cap, auto ancillaries became the fifth biggest sector with cement and cement products going to the sixth in sector allocation.

Top 10 stocks

Unlike market cap based categories, flexi cap as usual sees a more scattered version of the top 10 stocks.

The usual suspects remain the same and there is no stock that has suddenly made a splash enough to be worth commenting about here.

Leave a Reply