Before I start off on any analysis in this segment, even at the cost of a repetitive bore I will put forth this disclaimer. All fund schemes are taken as direct. However, even if you are a direct investor, hire a financial advisor that you trust who can guide with investments. Pay for your advice.

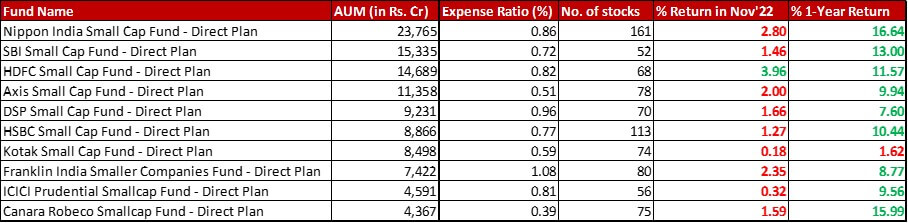

Fund category definition: Funds with minimum 65{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} portfolio allocation to Small Cap (251 and beyond by market cap size) stocks

Benchmark: Nifty Small Cap 250 TRI with a change of 3.04{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in November 2022 and a 1-year change of 4.45{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}

All data as on: 30th November, 2022

Summary

With the L&T and HSBC merger, the combined Small Cap fund has inched up above Kotak to go to the sixth highest by AUM spot.

Franklin and Axis have both increased their portfolio size by 3 stocks. HSBC, on the other hand, is an anomaly this month thanks to the merger which shows in the stock number jumping from 85 to 113. It will probably be a few months by the time the new entity consolidates this portfolio to a more constant number.

This month, the two greens have shrunken down to one. Even the spotless 1-year performance of being better than the benchmark now has a blemish with Kotak performing a tad lower.

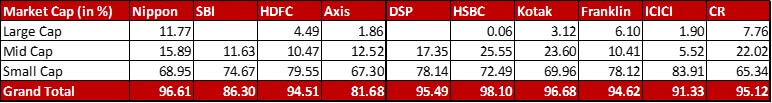

Market Cap Allocation

The HSBC fund has increased it’s Small Cap allocation by 2.01{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}, mostly cutting down the Mid cap allocation.

Top 5 Sectors

There is an organic swap between Chemicals and Industrial Capital Goods with the latter taking a spot in the Top 5 Sectors for Nippon.

SBI has consciously increased it’s allocation to Leisure Services with a 1.61{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} increase in Westlife Development (holding company for McDonalds master franchsie) and a 0.56{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} increase in Lemon Tree Hotels. Resultantly, Leisure Services enters the Top 5 Sectors at the cost of Retailing making an exit.

With a 0.43{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} increase in allocation to Cyient, Software inches it’s way into the Top 5 Sectors, nudging out Retailing in the Kotak fund.

ICICI has added a 0.49{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in the newly-listed Global Health and increased allocation to Tarsons Products by 1.16{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} leading to the sector becoming the highest by percentage.

Without much fuss, Banks have displaced Chemicals as the fifth highest sector in the Canara Robeco fund.

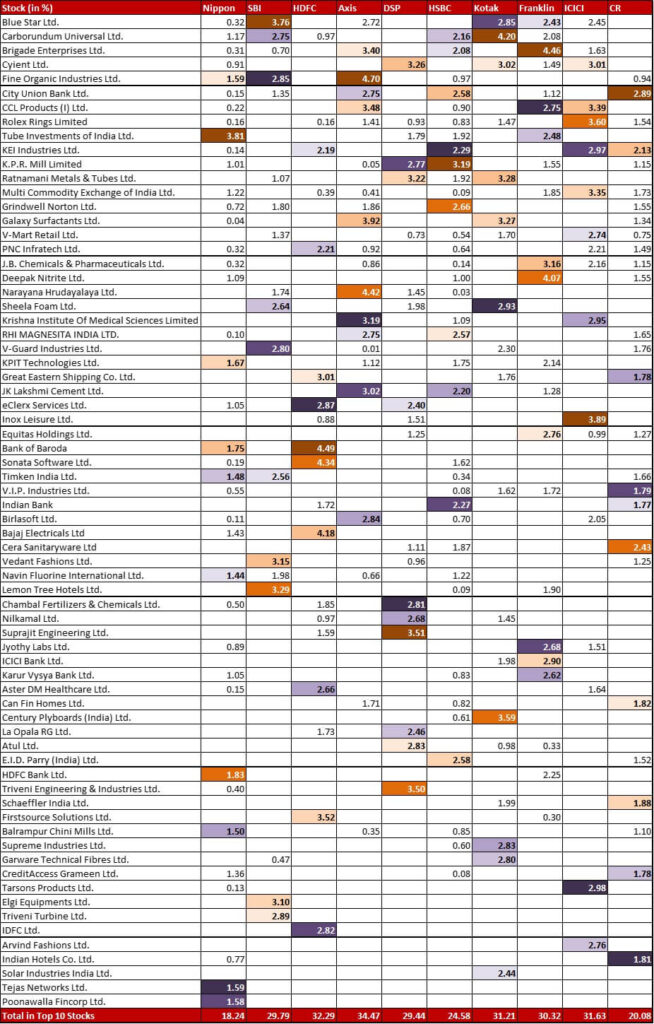

Top 10 Stocks & Movement

With a lot of IPOs come a lot of new names in the portfolio. Nippon is a great example of this wisdom of mutual funds. This month, there are five new substantial additions of which four are newly listed – Fusion Micro Finance (0.73{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Interglobe Aviation (0.44{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Archean Chemical Industries (0.30{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Global Health (0.11{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Uniparts India (0.11{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). There are two noteworthy exits for somewhat of a balancing act – Zomato (0.63{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Tata Consumer Products (0.44{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

Apart from the Leisure Services changes mentioned above, SBI has beefed up it’s position in Global Health by 0.90{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} (now at 1.74{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). The fund has added Gujarat State Petronet (0.14{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

HDFC has added a 0.25{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in Global Health.

The MindTree and L&T Infotech merger can be seen in the Axis portfolio. Apart from that, the fund has three new positions – MphasiS (0.16{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Global Health (0.13{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Kaynes Technology India (0.11{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

DSP has exited it’s 1.03{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in Prism Johnson.

HSBC has way too more changes than what can be fitted into this one little blog post. So, I will wait for the portfolio to be consolidated over the next few months.

The Shriram Finance merger is a part of the portfolio changes in Kotak this month. Apart from that, the fund has added a 0.46{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in Archean Chemicals. It also has two exits – Varroc Engineering (0.18{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Barbeque Nation Hospitality (0.15{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

Franklin has shaved off a big 1.09{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} from Tube Industries to bring it down to 2.48{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. The fund has two new additions – Global Health (0.23{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Kaynes Technology (0.09{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

Beyond the Healthcare Services changes mentioned above for ICICI, the fund has added a chunky 1.24{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in Archean Chemicals.

For a Small Cap fund, Canara Robeco strangely enough has both the Large Cap (MindTree and L&T Infotech) and the Mid Cap (Shriram Finance) mergers implementing in it’s portfolio. The fund has also added a 1.28{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in Bikaji Foods.

Check out the other categories and what the funds there were up to:

Large Cap Funds – November 2022

Flexi Cap Funds – November 2022

Multi Cap Funds – November 2022

Leave a Reply