Before I start off on any analysis in this segment, even at the cost of a repetitive bore I will put forth this disclaimer. All fund schemes are taken as direct. However, even if you are a direct investor, hire a financial advisor that you trust who can guide with investments. Pay for your advice.

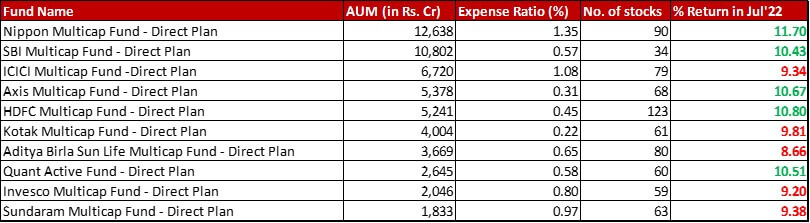

Fund category definition: Funds with minimum 25{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} each in Large, Mid and Small cap stocks

Benchmark: Nifty 500 50:25:25 TRI with change of 9.86{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in July 2022 and a one-year return of -6.22{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}

Data as on: 29th July, 2022

Summary

While there is no change in the AUM ranking, Aditya Birla has yet again increased it’s expense ratio substantially by 10 basis points to reach 0.65{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

ICICI seems to have adopted a very sharp trimming scissors this month, resulting it the number of stocks reducing from 90 to 79.

Sundaram as a fund seems to have undergone some trimming, reduced from 72 to 64 stocks.

The returns report card is now perfectly in balance with five beating and five getting beaten by the benchmark.

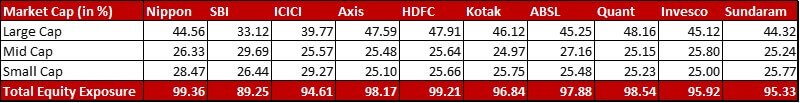

Market Cap Allocation

Kotak and Invesco are two funds with noticeable changes in market cap allocation.

In Kotak, the large cap allocation has increased by 3.68{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}, while Mid cap has reduced by 1.71{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} and Small cap has increased by 1.59{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. Overall, the equity exposure is up by 3.45{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

For Invesco, Large cap is reduced by 2.29{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} and Small Cap is reduced by 2.83{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. On the other hand, Mid Cap is up by 3.92{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}

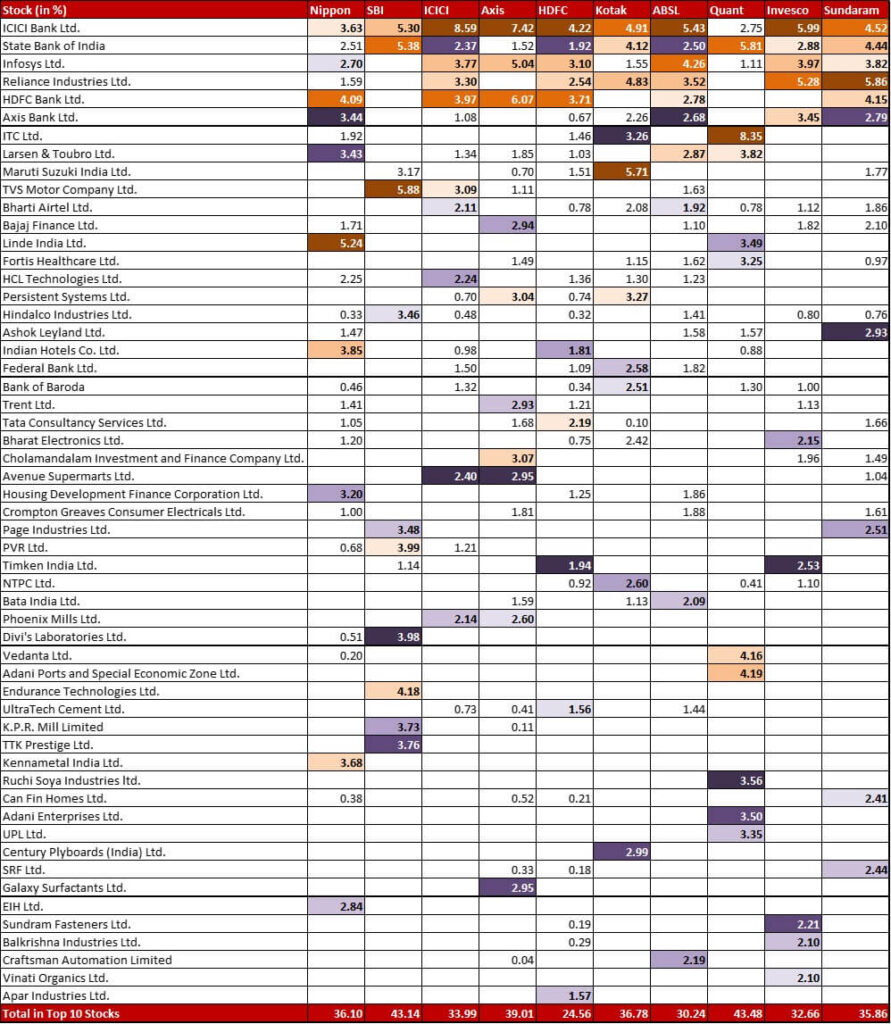

Top 5 sectors

SBI has raised it’s stake in the parent company State Bank of India by a big big 3.76{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}, taking it up to 5.38{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}, leading to Banks becoming the heaviest sector. Also, by exiting it’s 2.43{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in HCL Tech the fund has zero, I repeat zero allocation to Software.

Quant used to be the fund in this category with zero software allocation. However, with a 1.11{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in Infosys and 0.22{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in Wipro, they seemed to have joined the herd.

By exiting 1.01{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in L&T Technology Services and 0.91{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in Birlasoft, Invesco sees a reduction in it’s Software allocation taking it to the third highest sector. Consumer Non durables has edged out Petroleum products with the usual price shifts.

Sundaram has increased it’s allocation to Can Fin Homes by 1.15{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}, taking it up to 2.41{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} boosting Finance to the third highest sector. Chemicals also seems to have grown enough in the month without needing much to be done. Resultantly, Petroleum products and Auto find themselves on the bench.

Top 10 stocks & Movements

Nippon has reduced it’s allocation to HCL Tech by 0.86{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to come down to 2.25{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. But that’s just the start of it. There are a string of exits – BPCL (0.55{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Bharat Forge after a two month stint (0.29{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Sterlite Technologies (0.20{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Persistent Systems (0.15{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Sobha (0.11{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). There are three new entrants as well – Bandhan Bank (0.66{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Gland Pharma (0.35{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Hindalco Industries (0.33{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

SBI has a new 1.19{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in Blue Star. Apart from the HCL exit mentioned above, the fund has also exited a 1.30{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in GAIL.

As mentioned in the summary, ICICI has been very busy with it’s trimming shears. There are 10 stock exits this month – Britannia (0.43{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Tata Steel (0.31{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Ashok Leyland (0.30{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Wipro (0.28{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Bata India (0.14{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Relaxo Footwear (0.11{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Zensar Technologies (0.09{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Birla Corporation (0.07{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Balkrishna Industries (0.07{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Nuvoco Vistas Corporation (0.04{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

Axis has completely exited it’s 2.59{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in Reliance Industries, along with Titan (0.43{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Divi’s Labs (0.04{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). There are three new minor positions – Kotak Mahindra Bank (0.50{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Chemplast Sanmar (0.50{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and V-Guard (0.01{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

Four stocks see a substantially increased allocation in Kotak – Reliance Industries by 2.18{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} (goes up to 4.83{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), ICICI Bank by 1.31{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} (up to 4.91{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Bank of Baroda by 1.25{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} (now at 2.51{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Axis Bank by 1.12{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} (zooming up to 2.26{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). Shriram Transport Finance, on the other hand is trimmed by 0.90{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to settle down at a measly 0.16{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. The fund has added a new 0.28{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position to Prataap Snacks. There are also three exits in the portfolio – Tata Motors (1.51{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), HPCL (1.24{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Ruchi Soya (0.11{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

ABSL has reduced it’s allocation to Reliance Digital by 1.06{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}, bringing it down to 3.52{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. There are three new entrants – SBI Cards (0.81{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), IndusInd Bank (0.57{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and MindTree (0.56{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

Quant has increased it’s allocation to Adani Ports by 1.09{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}, landing up at 4.19{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. Yet again, there are many high magnitude entries and exits. Apart from the two new software stocks mentioned above, there are three more additions – UPL (3.35{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Cummins (1.09{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Escorts (0.99{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). This is balanced off by four exits – HDFC Bank after a mere three months (2.12{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Reliance Industries also after two months (1.91{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Dr. Reddy’s Labs yet again after two months (1.54{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Gland Pharma (1.54{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

Invesco is another fund with an action packed month. Cholamandlam Investment and Finance has been trimmed by 0.92{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to go down to 1.96{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. Six additions to the portfolio – Trent (1.13{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Tube Investments (1.00{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Prestige Estates (0.98{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Abbott India (0.97{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Aavas Financiers (0.68{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Rolex Rings (0.27{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). These come at the cost of five exits – V-Mart Retail (1.14{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), L&T Technology (1.01{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Gland Pharma (0.91{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Birlasoft (0.91{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and GR Infra projects (0.90{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

Sundaram is one fund that just can’t bear the thought of not taking action. Apart from the substantial movement in Canfin Homes, there are six new entrants – KSB (0.81{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Blue Star (0.70{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), United Breweries (0.47{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), APL Apollo Tubes (0.44{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Astral Ltd. (0.16{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and J.B. Chemicals and Pharma (0.03{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). This is balanced out by seven exits – Radico Khaitan (1.10{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Subros (0.86{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Emami (0.61{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Force Motors (0.54{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Bank of Baroda (0.48{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Metropolis Healthcare (0.42{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and KNR Constructions (0.36{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

Check out the other categories and what the funds there were up to:

Leave a Reply