Before I start off on any analysis in this segment, even at the cost of a repetitive bore I will put forth this disclaimer. All fund schemes are taken as direct. However, even if you are a direct investor, hire a financial advisor that you trust who can guide with investments. Pay for your advice.

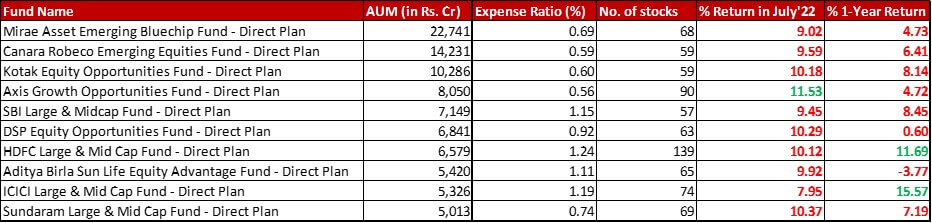

Fund category definition: Funds with minimum 35{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} portfolio allocation to Large Cap (top 100 by market cap size) stocks and 35{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} allocation to Mid Cap (101-250 by market cap size) stocks. Remaining 30{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} is as per fund management.

Benchmark: Nifty LargeMid Cap 250 TRI with a change of 10.54{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in July 2022 and a one-year return of 8.83{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

All data as on: 29th July, 2022

Summary

In terms of ranking, ICICI and Aditya Birla continue to play their close catch-up game with the latter being on the eighth spot this month. There is no substantial change in the expense ratio.

ICICI has slightly trimmed it’s portfolio to go down from 80 to 74 stocks.

While June saw most (9 out of 10) funds fall less than the benchmark, Axis is the only one to continue the trend of bettering the benchmark in July. In the one-year returns, only ICICI and HDFC have done a better job.

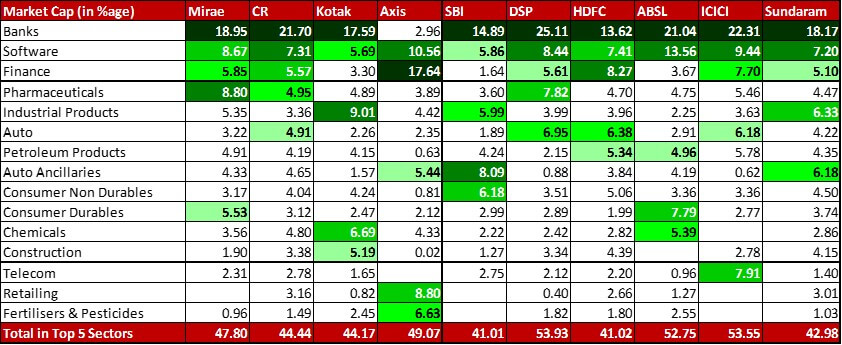

Market Cap Allocation

For Axis, the trend of reducing foreign equity continues considering no further investment in foreign stocks is possible.

When it comes to a change of atleast 2{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}, only ICICI has reduced it’s Large Cap allocation by 2.50{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} while increasing Mid Cap allocation by 2.43{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

Top 5 sectors

In Canara Robeco, with a reduction of 1.10{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in the Reliance Industries allocation Finance Petroleum Products is edged out by Finance in the Top 5 Sectors.

Kotak sees an organic swap between Construction and Pharmaceuticals, with the former finding a place in the Top 5 Sectors this month.

With a big increase of 1{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in the Infosys allocation, Software is now in the top 5 knocking out Textiles.

Aditya Birla sees a big change, magnitude of the likes unseen in months. The top stock Reliance Industries has been reduced from 9.09{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to 4.96{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} which is a reduction of 4.13{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}! Since the size of the fund is a small Rs. 5,420 that possibly allows for such big changes. Hence, Petroleum Products moves from third highest to the fifth highest sector.

There is an organic swap between Petroleum and Finance in Sundaram yet again, with the latter making it to the Top 5 this month.

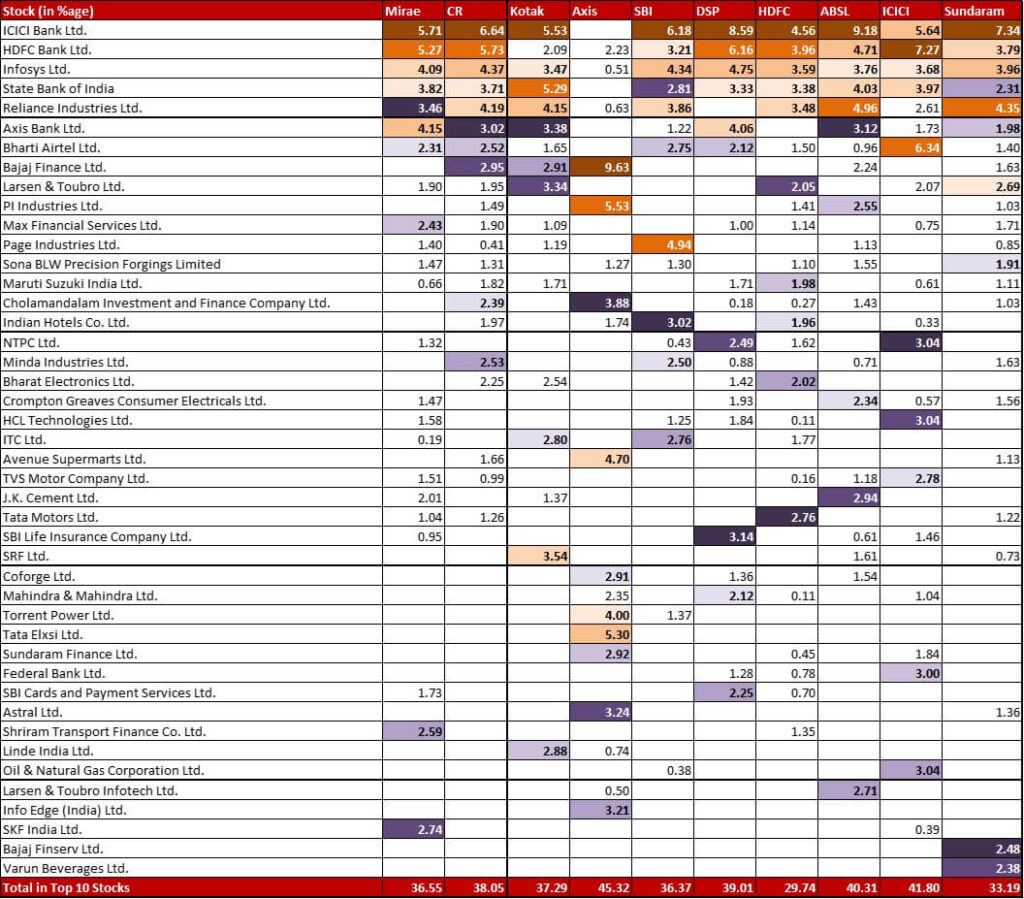

Top 10 stocks

Mirae has a new 0.76{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} allocation to PB Fintech. The fund has also made three exits – Ashok Leyland (0.62{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Kansai Nerolac (0.19{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Bharat Electronics (0.19{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

Canara Robeco is another fund to have reduced Reliance Industries allocation by a substantial 1.10{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} bringing it down to 4.19{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. The fund also sees a price-based 0.76{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} increase in the Bajaj Finance allocation taking it up to 2.95{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. There are two need additions – Titan (0.69{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Page Industries (0.41{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). There’s also a minor exit from the 0.09{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position of Indraprastha Gas.

Axis sees Bajaj Finance bounce back with a 1.41{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} increase in allocation, although that is less than the 33{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} increase in price the stock saw. There’s a small exit from the 0.08{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} allocation in Rainbow Children’s Medicare which was there in the portfolio for a mere two months.

In SBI, as mentioned earlier Infosys sees an increase of 1.00{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to go up to 4.34{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. Muthoot Finance sees a big increase from 0.04{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to 1.64{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. There is a new 0.27{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} addition to Persistent Systems. On the other hand, the fund has exited from Zydus Wellness (0.66{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Prataap Snacks (0.21{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

SBI has quite a few changes to it’s name. Infosys sees an increase of 1.21{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}, to go up to 3.34{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. There are six new stocks in their armoury – Tube Investments (1.44{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Ultratech Cement (1.36{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), United Breweries (1.03{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Motherson Sumi Wiring (1.01{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Muthoot Finance (0.04{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Ramco Cement (0.03{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). Of these, the fund had exited a 0.99{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in Muthoot in February, which now makes a reappearance. The new entrants are balanced out by two big exits – Cholamandlam Investment and Finance (2.10{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Kotak Mahindra Bank (1.42{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). The latter is out after a mere three months in the portfolio.

DSP exited it’s small 0.18{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} allocation from LIC. There are also three new stocks – Chambal Fertilizers (0.71{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), K.P.R. Mill (0.57{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Tech Mahindra (0.49{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

HDFC has trimmed 1.26{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} from Reliance Industries to bring it down to 3.48{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. The fund has taken a 1.25{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in TCS, a stock that enjoyed a one-month stint in January of this year as well.

For Aditya Birla, the slashing of allocation in Reliance hogs the limelight. L&T Infotech sees an increase of 0.79{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}, taking the position up to 2.71{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. The fund also has four new stocks added to it’s lineup – Craftsman Automation (0.88{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Minda Industries (0.71{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Tarsons Products (0.08{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Rolex Rings (0.02{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

ICICI sees a reduction in it’s allocation of HDFC Limited bringing it down to 1.79{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. It’s been another buzzing month for the fund in terms of entries and exits. Ten stocks have been completely exited out of – Bank of Baroda (1.02{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Torrent Pharma (0.76{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Dr. Reddy’s Labs (0.66{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), CESC (0.36{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Minda Industries (0.21{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Jubilant Foodworks after a mere two months (0.21{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Tata Steel too after two months (0.17{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), MphasiS after a single month (0.14{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Ashoka Buildcon (0.09{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Kansai Nerolac (0.06{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). To balance it out, there are five new entrants as well – Gujarat Gas (0.55{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), NHPC (0.49{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Motherson Sumi (0.33{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Biocon (0.23{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Oil India making a reappearance after a break of two months (0.13{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

Sundaram has added a 0.78{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in MRF. It’s exited four stocks from last month’s portfolio – MindTree (0.94{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Tata Steel (0.59{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Wipro (0.39{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Dalmia Bharat (0.36{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

Check out the other categories and what the funds there were up to:

Leave a Reply