Before I start off on any analysis in this segment, even at the cost of a repetitive bore I will put forth this disclaimer. All fund schemes are taken as direct. However, even if you are a direct investor, hire a financial advisor that you trust who can guide with investments. Pay for your advice.

Fund category definition: Funds with no restriction on market cap allocation or number of stocks

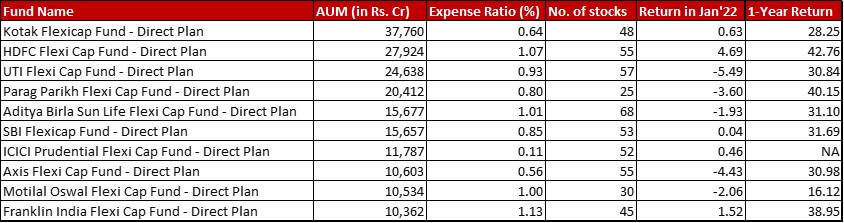

Benchmark: Nifty 500 TRI with a change of -0.48{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in January 2022 and a 1-year return of 33.44{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}

Data as on: January 31, 2022

Summary

There’s not much of a change in the category when it comes to AUM ranking, expense ratio or even the number of stocks.

As usual, there is a wide variation in the performance. Five funds have a much darker shade of red in their performance for the month. Of those, Parag Parikh is the only fund which still has a much higher 1-year performance than benchmark while the other funds have disappointed on that front, too.

As for ICICI, it is one of those funds that rode the euphoria of 2021 very well and mopped up a lot of funds in their NFO period. Hence, they maintain a supremely low expense ratio of 0.11{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} and are yet to have a year in existence.

Market Cap Allocation

There is not much activity to report in this zone since anything less than 2-odd{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} barely counts. ICICI, still being in the portfolio construction phase hiked up it’s overall exposure by about 2.50{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} with most of it going in to Large Cap stocks.

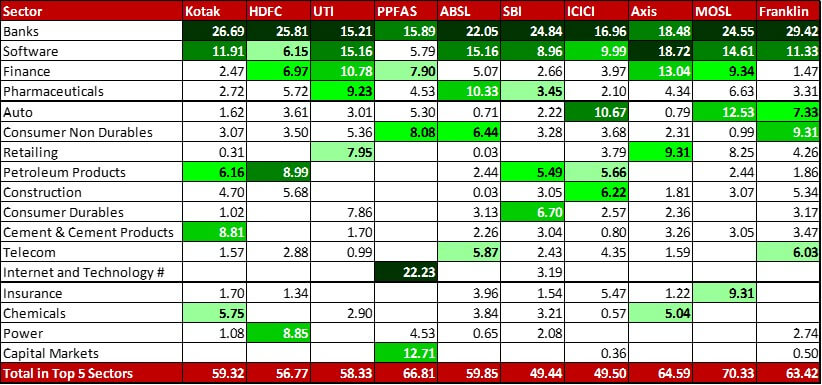

Top 5 sectors

UTI joins the bandwagon with Banks becoming the top sector in this fund as well. Even for Parag Parikh, banks have now become the second highest sector, dethroning Capital Markets although the US tech stocks still remain miles ahead in allocation.

While Software remains the heaviest sector for Axis, it’s fallen to No. 5 for HDFC and out of the Top 5 for Parag Parikh.

Apart from that, there’s not been much action in terms of sector shuffle.

Top 10 stocks

While SBI remains the biggest allocation for HDFC, it’s increased by almost 1{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. That though shouldn’t come as a surprise as the stock gained almost 17{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in the month! In the same fund, allocation to Infosys reduced by 1.18{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to go from 3rd highest to 6th highest stock.

Parag Parikh has increased it’s allocation to HDFC Bank by a whopping 1.90{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} which means the stock goes from Number 14 to entering the highest ten stocks. Not just that, the fund seems to have systematically reduced some of it’s exposure to domestic software companies by completely exiting Mphasis and Persistent Systems where they earlier had about 1{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} allocation in each.

SBI on the other hand has seen quite a bit of activity. They have completely exited from significant exposure of 0.84 in Muthoot and 1.12 in the foreign stock of Cognizant and trimmed by 0.90{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} their position in HCL Tech. They have now taken a fresh position of 1.09{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in Cholamandlam Investment & Finance while increasing the allocation in Alphabet by more than half (despite a 6.5{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} drop in the price which means it was all about buying more stock) and almost tripling their allocation in SBI from 0.81 to 2.41{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}! Yup, some significant changes in this fund.

ICICI has significantly increased their allocation in Mahindra & Mahindra by 0.90{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} and remains the only fund where this stock has the highest allocation.

Axis made one significant move by completely exiting it’s 1.06{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in Zomato.

Check out the other categories and what the funds there were up to:

Leave a Reply