Before I start off on any analysis in this segment, even at the cost of a repetitive bore I will put forth this disclaimer. All fund schemes are taken as direct. However, even if you are a direct investor, hire a financial advisor that you trust who can guide with investments. Pay for your advice.

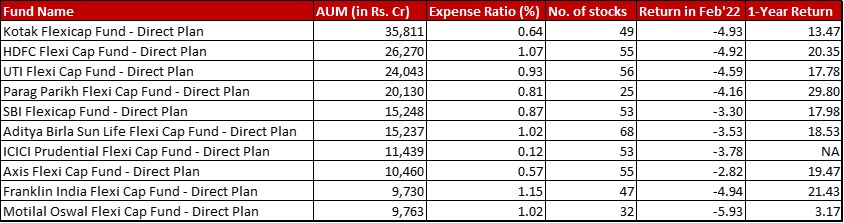

Fund category definition: Funds with no restriction on market cap allocation or number of stocks

Benchmark: Nifty 500 TRI with a change of -3.94{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in February 2022 and a 1-year return of 18.77{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}

Data as on: 28th February, 2022

Summary

The tussle between SBI and Aditya Birla continues for the fifth spot. At the bottom of the rung, Axis seems to have gotten a lead over the other two – Franklin and Motilal Oswal where again it’s one or the other each month.

As for the returns, only SBI, Aditya Birla, ICICI and Axis beat the benchmark slightly.

There’s not much to report in terms of expense ratio or the number of stocks.

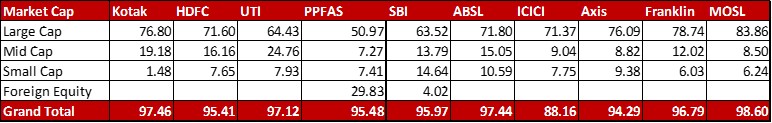

Market Cap Allocation

There is not much activity to report in this zone since anything less than 2-odd{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} barely counts. The one thing I would want to mention here is to remember that the almost 30{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} foreign equity allocation in Parag Parikh Flexi Cap comes from 4 US stocks alone. Plus, while they are opening for fresh inflows it is possible that this allocation may keep going down as they will not be able to invest more in foreign equity.

Top 5 sectors

Most fund managers seemed happy to stay put in this torridly volatile month. Hence, not that much of a change you get to see, apart from some minor juggles.

Within Aditya Birla, metals and mining has edged out Telecom organically thanks largely to higher valuations with the fear of war.

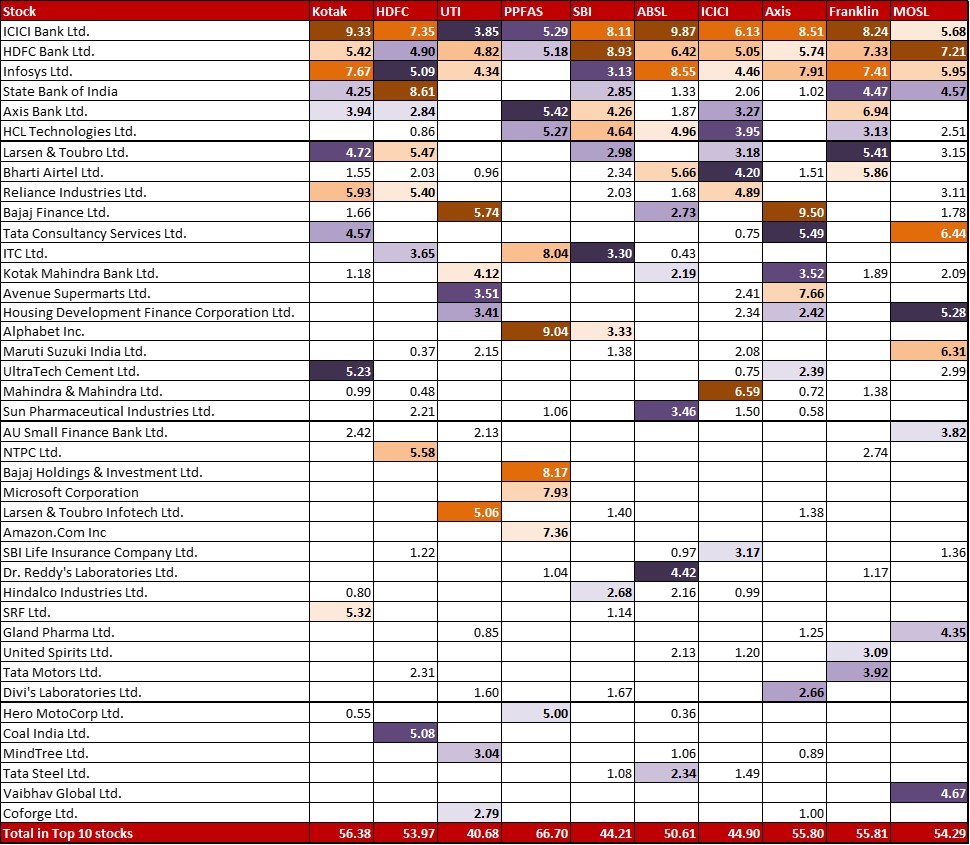

Top 10 stocks & Movements

Even with a 0.88{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} trim, SBI remains the biggest stock for HDFC Flexi Cap.

The Parag Parikh fund manager has been fairly active, although some of those movements could also have been organic. There is a 0.98{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} increase in the allocation to Amazon.com and a big 1.52{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} slash in that of Meta (parent of Facebook). Another development is a new 0.95{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} allocation to Cipla.

Franklin has taken a decent sized 1.13{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} new allocation in ICICI Prudential Life Insurance Company. There’s also a 0.69{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} new allocation to Tata Power.

Check out the other categories and what the funds there were up to:

Leave a Reply