Before I start off on any analysis in this segment, even at the cost of a repetitive bore I will put forth this disclaimer. All fund schemes are taken as direct. However, even if you are a direct investor, hire a financial advisor that you trust who can guide with investments. Pay for your advice.

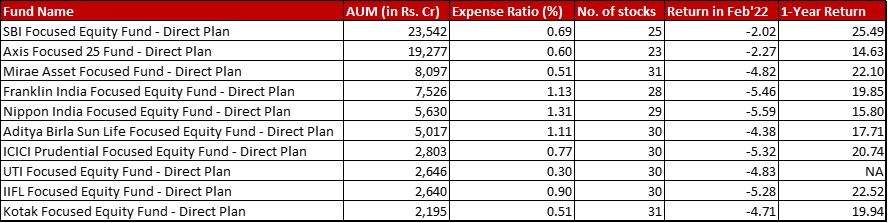

Fund category definition: Funds with maximum 30 stocks in their portfolio

Benchmark: Nifty 500 TRI with change of -3.84{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in January 2022 and a one-year return of 18.77{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}

Data as on: 28th February, 2022

Summary

I have always found focused funds very intriguing. To me, it seems like more giant versions of PMS’s per se since they also end up being concentrated less than 30 stock portfolios.

With the new primary benchmark system, like Flexi Cap, this category also follows Nifty 500 TRI. This time too the category has mostly under performed the benchmark, although last month’s back benchers Axis and SBI are the only two to have fallen lesser.

In terms of AUM ranking ICICI has edged up over UTI with a decent margin.

Mirae sees a 25{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} jump in it’s expense ratio going up from 0.40{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to 0.51{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

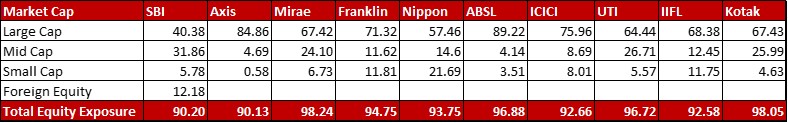

Market Cap Allocation

SBI has further cut it’s mid cap exposure by 1.40{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} leading to an overall reduction in equity exposure. In fact, SBI and Axis are sitting on a high cash pile of almost 10{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} either in anticipation of redemptions or in the hope of good, cheap deals.

Another noticeable change is in Franklin reducing it’s small cap allocation by 1.20{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} and redistributing it within Large cap and Mid Cap.

Top 5 sectors

ICICI has plucked out a hefty 1.89{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} allocation in Divi’s Laboratory leading to a 1.60{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} reduction in the Pharmaceuticals sector and moving out of the top 5.

With minor changes, telecom replaces auto in the top 5 sectors for IIFL.

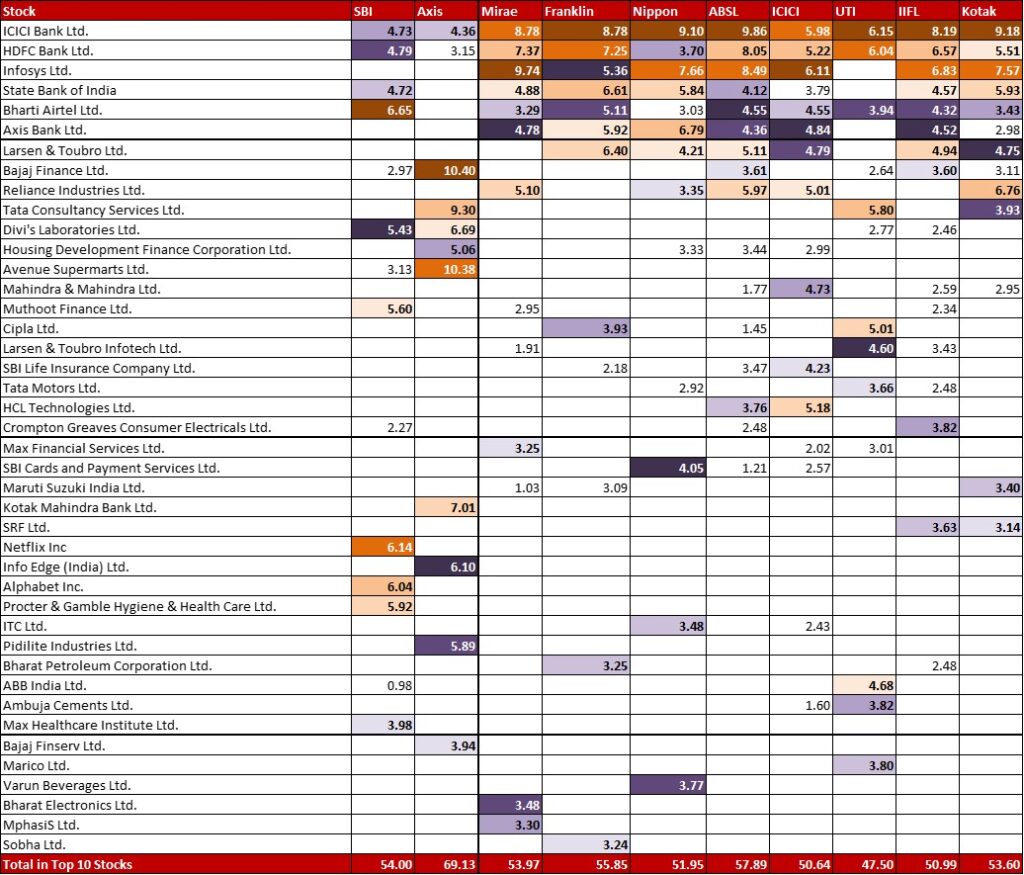

Top 10 stocks & Movements

SBI has increased it’s allocation to SBI bank by 1.24{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. But, the biggest move is the exit of it’s 1.55{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in FSN E-commerce or Nykaa.

Axis has made a complete exit of 0.86{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} from Supreme Industries, which as far as I remember has been a long-term favourite of the AMC.

Mirae, Franklin seem to be in nirvana with their portfolios with not much to report.

Nippon is where the action is this month. A trimming of 1.21{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} from SBI to get it down to 5.84{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. Increase of 1.26{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to get ITC up to 3.48{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. Yup! Apart from increasing Angel Broking allocation by 0.76{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}, they also seemed to have bought HDFC limited on it’s dips to more than double it’s allocation to 2.62{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. Simultaneously, they have completely exited the 2.03{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in Sun Pharma.

UTI has made a complete exit of it’s 1.44{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in Mindtree while beefing up the allocation in Cipla by 0.83{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

Not to be outdone by Nippon, IIFL has some of it’s own queue of changes lined up. ICICI Bank saw a substantial trim of 1.38{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} which was redistributed within the sector along with some extras to increase HDFC Bank by 0.82{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} and a new position in Bank of Baroda with 1.41{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. The attractive dips in the Asian Paints price did not go unnoticed either with an almost doubling of position to 2.58{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. This month also saw a complete exit from Sona BLW Precision Forgings from it’s 0.97{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position (which had already been reduced to lower than half in the previous month).

Apart from the Divi’s Laboratories exit mentioned above, ICICI increased HCL Tech’s exposure by 1{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to go up to 5.18{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. SBI saw a trim of 1.06{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} while HDFC Limited increased by 0.90{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

Two noticeable changes for Kotak – a new 1.90{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in Sun Pharma and a complete out of the remaining 0.70{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in SBI Cards and Payments.

Check out the other categories and what the funds there were up to:

Leave a Reply