Before I start off on any analysis in this segment, even at the cost of a repetitive bore I will put forth this disclaimer. All fund schemes are taken as direct. However, even if you are a direct investor, hire a financial advisor that you trust who can guide with investments. Pay for your advice.

Fund category definition: Funds with maximum 30 stocks in their portfolio

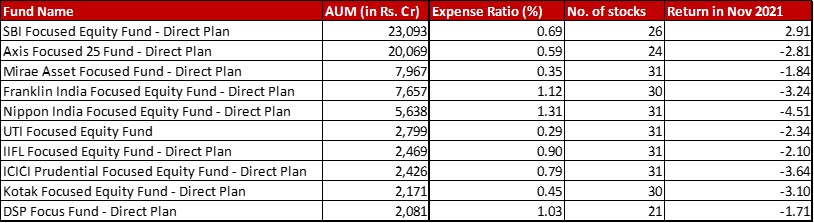

Benchmark: Nifty 500 TRI with return of -2.83{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in November 2021

Data as on: 30th November, 2021

Summary

I have always found focused funds very intriguing. To me, it seems like more giant versions of PMS’s per se since they also end up being concentrated less than 30 stock portfolios.

With the new primary benchmark system, like Flexi Cap, this category also seems to follow Nifty 500 TRI. Despite the biggest AUM, SBI was the only fund under the scanner that had a healthy positive movement.

There is no movement in terms of AUM size or even much of a change in expense ratios. In some funds stocks have increased by 1 or 2 in number. The one thing to note is that although the category has a requirement of limiting stocks to 30, in this table the higher numbers could be due to multiple ISINs of the same stock.

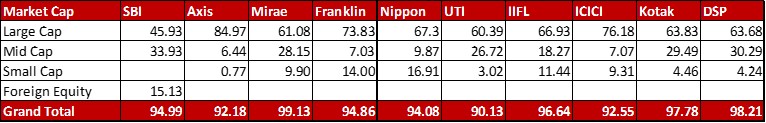

Market Cap Allocation

Most funds have either stayed put or increased their equity exposure with Axis increasing it by about 2.18{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

The funds are on the fence about Small Cap with five of them having less than a 5{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} allocation while 5 choosing to go heavier into that tricky terrain.

Top 5 sectors

While the top 5 sectors remain the same as in the last month for SBI, there is a switch in position with Finance going to second biggest while foreign Internet & Technology are now perched at third largest.

In Nippon, the sector swaps have been Software and Consumer Durables with the former getting to fourth highest sector.

In UTI, while Software and Banking have swapped positions, there has been a fair bit of trimming in the Auto allocation making Consumer Durables now their fifth biggest sector. The same story has played out in IIFL with slight trimming in Auto and increase in Consumer Durables leading to the latter replacing the former as fifth highest sector.

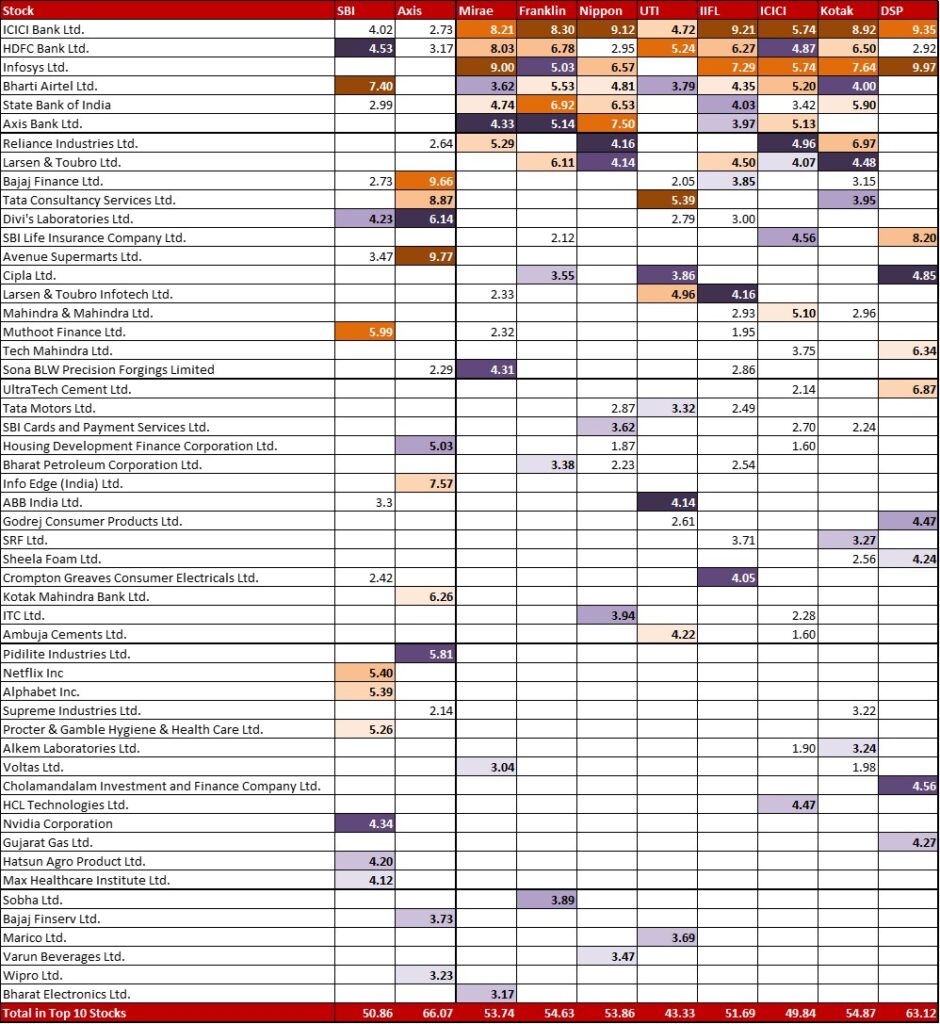

Top 10 stocks

In SBI, allocation to Nvidia has increased a whopping 0.90{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} getting it into the top 10 stocks and edging out Solar India.

Like with the sectors, Axis remains heavily concentrated in the top 10 stocks as well covering almost 20{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} with just it’s top 2 stocks – Bajaj Finance and Avenue Supermarts. Surprisingly, Kotak Mahindra Bank finds favour only with Axis in this category with a 6.26{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} allocation.

When you look at the chart, you see that Mirae, Franklin, Nippon, IIFL, ICICI and Kotak have quite a bit of an overlap in the top 10 stocks with a lot of colour clusters at the top.

Leave a Reply