August is when the tables truly turned. First up came the news of India creeping up to become the fifth largest economy in the world, by GDP (yes, we continue to ignore per capita income).

Then, all the talk about India being an outlier in the global era of gloom started to turn more action-oriented. So much so, that it has now sparked debate about whether the Indian markets are decoupling from the Emerging Markets basket. To the uninitiated, global fund managers often consider Emerging Markets as one uniform asset class. However, in the recent past, the Indian economy has shown brighter hope than the other emerging markets leading some market watchers to claim that the correlation is weaker to other Emerging Markets. In my opinion, this could be a bit premature as India remains intensely integrated in the global scheme of things. Plus, beyond all our chest thumping, we are still a middle income economy with a long enough path yet to be traversed.

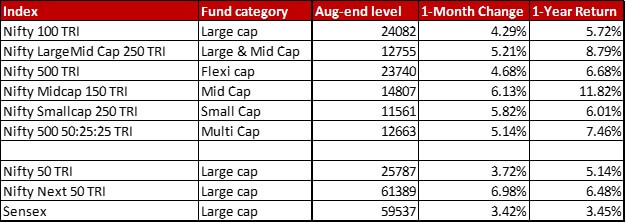

However, be that as it may, August remained a cheery month for all the broad market-cap based indices. Check out their movement last month. While all other indices are in TRI or Total Returns Index mode (meaning stock dividends add to the returns), Sensex is plain jane Sensex.

Some points that popped out as I was working on the analysis.

One, active funds in most of the tracked categories under performed the benchmark. There were substantially more reds than greens in the August performance through this analysis. I am yet to dig deeper into this but it possible that the FPI money has flowed into a few limited, favoured stocks.

Two, the month has been fairly quiet for a lot of the funds in terms of portfolio shuffle. If that’s not your cup of tea, then I suggest jumping right ahead to the Multi Cap category which remained the most action packed. Within that, Quant as usual packed in much more punch than I thought possible within one month. An interesting development to watch out for is how they have suddenly discarded quite a few of the banking stocks and brought down their allocation to the sector.

Three, auto ancilliaries seem to be gaining favour with quite a few funds. Within the sector, Rolex Rings is a name that seems to be on many buy-side equity fund managers. Funnily enough, when I tried to wrap my head around why the sudden interest, the first search result that popped up was Simply Wall Street proclaiming uneasiness about the company’s ROC. Over the next few months, it would be interesting to watch out how this plays out.

Check out how the portfolios of the top 10-by-AUM funds in different categories stack up against each other.

In case, you are curious what brought about this segment on the blog or how is this analysis even being done, then check out the introduction post where I go into all those details.

You could also check out all the other previous months of analyses – July 2022, June 2022, May 2022, April 2022, March 2022, February 2022, January 2022, December 2021, November 2021 and October 2021.

Leave a Reply