I am beginning to make my peace with what a time intensive exercise this is, especially when I choose to dig really deep. So, my target of publishing the analysis by 15th of the month now stands corrected to 19th or like this time early on 20th. Come to think of it, since most AMCs release their portfolios by the 10th of the month, this ain’t too bad, eh?

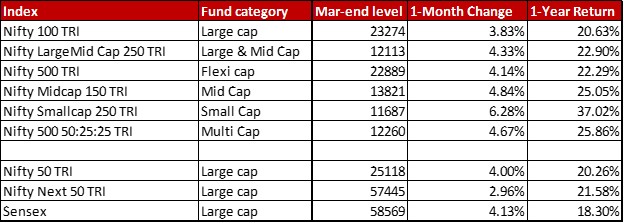

March was a month of recuperation and the market licking it’s wounds of the previous months. Suddenly everyone seemed to think that the markets may not see the kind of upheaval they anticipated from the geopolitical tensions. Sure, inflation is there but meh we knew that was coming anyway with the printing money mode of central banks during the pandemic. Now, writing this as I do in the middle of April, we know things will still remain in pendulum mode. So, my suggestion would be to view the numbers in that light. Even the big positive strides that you see for most indices need to be seen in light of recovery mode rather upward to infinity and beyond. Although it is worth noting that the one year returns have also inched up on all the indices.

Check out how all the major indices moved last month. By the way, while all other indices are in TRI or Total Returns Index mode (meaning stock dividends add to the returns), Sensex is plain jane Sensex.

I have added a new index to the tally above, namely the Nifty 500 50:25:25 to go with the slight change in the analyses going forth. I am swapping Focused funds with Multicap funds in the six categories under the scanner. I am a fan of the Multicap idea and I think it has far more utility in portfolios than the humble Focused category. It’s still nascent and hence many of the funds analysed are new but still provide enough to talk about.

There were four major changes this month that caught my eye.

One, is particularly in Axis Growth Opportunities Fund. There is a humungous 25{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} jump in AUM within a month leading to a jump of two spots in the ranking. It looks to be a case of a close ended fund merging with this existing fund. This has also led to the foreign equity component dropping by about 4{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to wind down to 19.54{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} (from 23.52{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} last month).

Two, Axis AMC is yet again displaying a pattern of sitting heavily on cash. Specifically, equity exposure has been cut down to 80s for Large & Mid Cap, Mid Cap and Small Cap funds. I am deliberately not counting Multi Cap as it’s still a new fund. It’s a strategy that has worked for the AMC in the past. It remains to be seen whether it will work this time as well.

Three, there is a funny pattern in the Nippon equity fund expense ratios. From 23rd March, the direct schemes see a massive cut in the TER which gets reinstated from 11th April onwards. As an example, Nippon Large Cap is consistent at 1.07{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in direct for the first 22 days of March. Then it goes down to 0.40{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} for a day, and then swings between 0.24{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} and 0.23{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} till 10th April. From 11th April, it’s back to 1.07{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. It’s a strange dance visible in multiple funds that I haven’t see in any of the other AMCs.

Four, Indian Hotels was one of the stocks that seemed to be the personification of economic resurgence hope. A lot of mutual funds suddenly are warming up to it. On the other hand, Consumer Non Durables or FMCG are now feeling the heat with trims and slashes especially visible in HUL.

Check out how the portfolios of the top 10-by-AUM funds in different categories stack up against each other.

In case, you are curious what brought about this segment on the blog or how is this analysis even being done, then check out the introduction post where I go into all those details.

You could also check out all the other previous months of analyses – October 2021, November 2021, December 2021, January 2022 and February 2022.

Leave a Reply